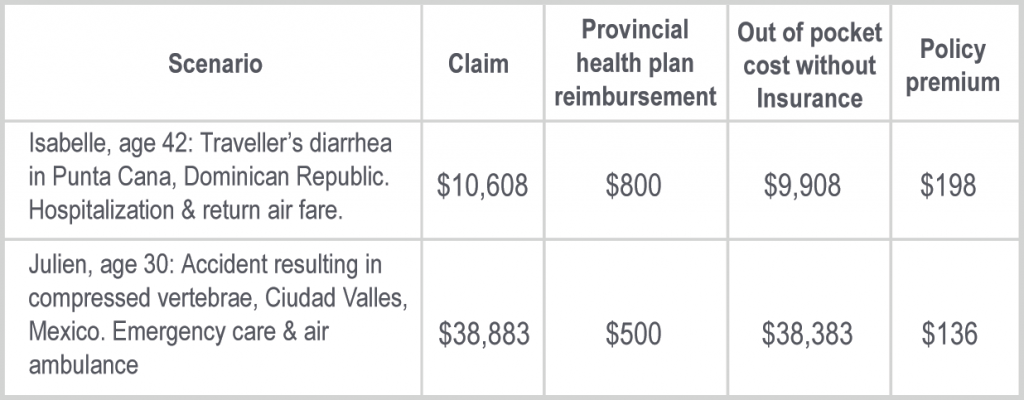

When you hear the words, “summer vacation”, what comes to mind? Where to go, with whom, where to stay, what to pack? But where would travel insurance rank if you were heading out of country? This may change your mind on its importance.

https://on.bluecross.ca/travel-insurance/travel-insurance-101/case-studies

Some employer/retiree plans or credit cards offer out of country insurance, but don’t assume that you are adequately covered, as some plans may only cover shorter stays, such as up to 15 days.

Most offer these common benefits:

• $1 – $5 million coverage for emergency medical care.

• Direct payments to the out of country hospital and health care providers.

• Air ambulance to a hospital in your home province, if medically necessary. This is absolutely essential, as seen above.

• Return of vehicles from vacation destination to Canada.

• Cost of having close family member or relative at your bedside.

• Accommodations and meals.

• Trip cancellation/interruption, lost baggage, flight delays.

Ask these key questions to avoid unpleasant surprises, should you have to make a claim:

• What is NOT covered in the plan, aka “exclusions?

• Are there specific exclusions that pertain to sports or other activities?

• Does the plan deny benefits if your medical emergency arises because of a health problem you already had before stepping on the plane, aka “pre-existing condition.”

• If you have prescribed medications that you regularly take, how will that affect your coverage?

• Will you be fully/partially/not covered if you are unable to call the insurer’s Assistance Centre prior to receiving treatment?

Answering these questions, may help you decide if buying your own private travel insurance plan makes sense, where the insurer will check the information that you provided first. Once your application is assessed and approved you will be covered for any travel related claims, unlike a credit card plan where terms and conditions can be changed without any notice.You should work with an advisor to ensure you understand your coverage and risks.

Some essential travel tips:

1. Carry travel insurance card, policy number, phone numbers of emergency assistance centre and of family & friends.

2. Ensure passports are not expiring within 6 months, and that you have travel Visas, travelers’ cheques and banking cards.

3. Pre-trip medical care – physician, dentist, refill prescriptions, vaccinations.

4. Medical kit – separate regular use vs. emergency use items.

Now, pack your bags and not your stress.