Holistic Planning for Your Lifetime and Across Generations

Holistic Planning for Your Lifetime and Across Generations

Helping you understand and maximize the full value of your family by aligning financial, human, and legacy goals, while honoring your family’s unique values.

Meeting Your Family’s Needs with Established Solutions

Wealthy families like the Rothschilds and the Rockefellers realized long ago that their affairs were complex and they needed more than casual help from their accountants or lawyers. As a result, they established permanent “family offices” and hired professionals to manage their finances.

These families needed professionals who knew tax planning, investment management, budgeting, accounting, estate planning, bookkeeping, and more, and the same need exists today.

Kerr Family Office provides a comprehensive suite of in-depth, personalized financial services to our most successful Canadian families. We take ownership of all your family priorities and deadlines with you, maintain all of your records, and take care of all your family members’ needs so you feel confident in meeting your current and long-term financial goals.

Full Service Family Office Wealth Management

The objective of our Full Service Family Office Wealth Management is to help you understand and maximize the true value of your family, which is the sum of its human, social, and intellectual capital facilitated by your financial capital.

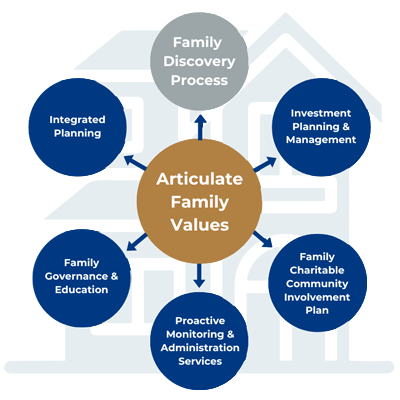

The team at Kerr Family Office does this by maximizing your financial resources through integrated planning, providing peace of mind that financial opportunities and priorities are being taken care of, and helping you articulate your family values to create the best financial and non-financial legacy for the next generation.

Your family can rely on a dedicated, multidisciplinary team of professionals led by a Family Office Partner to promote continuity of service. We follow our proprietary Kerr Family Office Process, which, at its core, is guided by a detailed understanding and articulation of your family’s goals and values.

Family Governance and Engagement

Family Meetings • Family Governance Structures • Financial Literacy Programs • Succession Planning • Philanthropy and Social Impact • Family Communication Plans • Generational Transition Coaching • Wealth Education for Younger Generations

To grow and preserve family wealth for multiple generations, families should develop effective ways to make decisions together while preparing the next generation to manage the family wealth. Depending on the family’s situation and objectives, we can develop a program of family meetings to share information and decisions. We can also help assess and address the educational needs of younger members of the family so they have the financial literacy necessary to act as financial stewards.

Investment Planning & Management

Investment design & Asset Allocation • Investment Manager Selection • Tax Effective Portfolio Construction • Custodial Arrangement • Merged Accounting Verification • Performance Calculation and Comparison • Ongoing Monitoring & Review

Through Kerr Financial Advisors Inc (KFA) our Family Office Investment Planning & Management process starts with developing a strategic Investment Policy for your family’s assets. From there, we:

In your strategic framework, adjustments are made as needed or as opportunities arise based on changes in market conditions, goals, and needs. We also focus on effectively managing the overall portfolio through wise asset location choices and carefully considering when and where taxable income is generated.

Family Discovery Process

Articulate Family Goals • Clarify Family Resources • Align on objectives

The Family Office service starts with getting to know you and your family. We begin our discovery process by:

From this in-depth learning and analysis, we articulate your family goals, clarify your family resources, and align on your objectives, allowing us to advise you in the most meaningful and personal way.

Articulate Family Values

Facilitate Family Discussions on Core Values • Identify Shared Values Across Generations • Create a Family Values Statement • Align Values with Business and Investment Goals • Integrate Values into Philanthropic Planning • Communicate Values Across Generations • Embed Values into Governance and Decision-Making Processes

From the wealth creators to the wealth inheritors, each generation grew up under different circumstances, which shaped family members’ perspectives on life and values. Articulating the values most important to your family is what brings your family together across generations, as it provides a framework for each family member to act in any given situation. Plus, a system of shared values often drives the success of family businesses and offices.

Without commonality in values, succession planning, budgeting, investing, and family direction are difficult. Kerr Family Office can guide you through this process and help you confirm your family’s values, instilling them in the work we do and helping you to communicate them across generations. This is a particularly valuable process in the work we do with families around their philanthropic planning.

Integrated Planning

Family Risk Management • Succession & Estate Planning • Tax Planning • Strategic Family Philanthropy • Optimal Tax & Income Structure • Education Funding • Action Plans

With our deep level of technical expertise through our diversified, professionally designated team, we can integrate our services to help ensure that your strategies combine to complement and enhance each other’s effectiveness. We have extensive experience advising clients on advanced strategies, including the use of holding companies, trusts, and business succession. Our comprehensive integrated planning includes family risk management, succession and estate planning, tax planning, education funding, strategic family philanthropy and considering optimal ownership, tax and income structures.

Proactive Monitoring & Administration Services

Corporate & Trust Tax Services • Tax Estimates & Instalments • Annual Optimization of Taxable Income by Entity • Financial Statement Preparation • Cash Flow & Budgeting • Bill Payment & Banking • Maintenance of Family Records • Tax Return Preparation (Canadian & US) • Implementation of Planning Strategies • Proactive Advice & Consultation

An important part of our service is ensuring that your family stays on top of all priorities, that deadlines are met and that you take advantage of all new opportunities as they arise. To do this, we develop an Annual Calendar for your family that tracks all of your deadlines and builds in regular meetings. At the outset of each year, we review your family’s strategic objectives for the year and risk areas to be addressed, and we keep these top of mind in our regular meetings. Additionally, we take care of all your ongoing tax filing and administration needs from our internal teams, allowing us to monitor the effectiveness of all strategies on an ongoing basis.

Family Philanthropy

Develop a Charitable Giving Strategy • Establish a Family Foundation • Align Philanthropy with Family Values • Create a Planned Giving Program • Facilitate Family Discussions on Community Involvement • Engage the Next Generation in Philanthropy • Optimize Giving for Tax Efficiency

Two of the most important assets for a family are your relationships and experiences with each other and your connection with your community (sometimes referred to as Human Capital and Social Capital). When families have been fortunate to build wealth, they often find it rewarding to focus on the purpose of the wealth, including how they can give back to their communities, and enrich their own experiences by doing so. Our experience with families in this regard, and with our own charitable giving and community involvement, allows us to help your family make informed decisions when it comes to giving. Depending on your goals and objectives, we can work with you to set up a charitable foundation or a planned giving strategy that aligns with your family’s values and is tax effective.