Following the surprising rebound from Brexit drama and ensuing volatility, investors were initially in “risk off” mode, but later lackluster trading volumes would suggest that traders presumably headed off on holiday to enjoy what remained of the summer. The global economy and financial markets have weathered the storm following the surprising “leave” result in June’s U.K. referendum vote. Investors have been emboldened by the continuing gains in the U.S. labour market as well as decisive central banks in overseas markets. The Bank of England and European Central Bank increased stimulus, while Fed and Chinese leaders have delayed further tightening, and Japan has doubled-down on its fiscal stimulus. As such, investor confidence is high and the market trends, while subdued, have remained intact with the exception of the U.K.

Investors were heartened at the U.S. jobs report which revealed 255,000 new jobs last month – well above expectations. Moreover, the JOLTS data indicated that jobless claims and layoff announcements remain near the lows of the expansion that began seven years ago. July’s job gains were accompanied by a strong increase in labour income, a sign of good things to come with respect to consumer spending. Reduced slack in the labour market should put upward pressure on inflation, bringing it closer to the Fed’s 2% target. Investors eagerly awaited bold measures from the Bank of England (BoE) announcement in the UK. Markets initially traded with a negative bias attributed to the Brexit uncertainty. However, the BoE rose to the occasion and delivered an aggressive stimulus plan by cutting its key policy rate to 0.25% (a historic low) and announcing at a £100bn new Term Funding Scheme to reinforce the low policy rate. Oil also seemed to help propel equities as it clawed its way back above $50 per barrel – up more than 22% from its recent bear market low of July. In addition to speculative momentum, a downward trend in the U.S. dollar likely contributed to the increase in oil. For the first-half of the month, Canadian and U.S. equities were up 1.3% and 0.6% respectively. European markets were also up 0.8% along with Japanese equities at 1.4% due to weakening Yen and central bank purchases of domestic ETFs.

Investors were heartened at the U.S. jobs report which revealed 255,000 new jobs last month – well above expectations. Moreover, the JOLTS data indicated that jobless claims and layoff announcements remain near the lows of the expansion that began seven years ago. July’s job gains were accompanied by a strong increase in labour income, a sign of good things to come with respect to consumer spending. Reduced slack in the labour market should put upward pressure on inflation, bringing it closer to the Fed’s 2% target. Investors eagerly awaited bold measures from the Bank of England (BoE) announcement in the UK. Markets initially traded with a negative bias attributed to the Brexit uncertainty. However, the BoE rose to the occasion and delivered an aggressive stimulus plan by cutting its key policy rate to 0.25% (a historic low) and announcing at a £100bn new Term Funding Scheme to reinforce the low policy rate. Oil also seemed to help propel equities as it clawed its way back above $50 per barrel – up more than 22% from its recent bear market low of July. In addition to speculative momentum, a downward trend in the U.S. dollar likely contributed to the increase in oil. For the first-half of the month, Canadian and U.S. equities were up 1.3% and 0.6% respectively. European markets were also up 0.8% along with Japanese equities at 1.4% due to weakening Yen and central bank purchases of domestic ETFs.

Momentum in the first-half of the month fizzled out due to worries over an imminent Federal Reserve rate increase. Stocks weakened in reaction to Fed Chair Janet Yellen’s speech at the annual Jackson Hole conference. While the market should be encouraged by Yellen’s favourable assessment of the U.S. labour market and inflation trend, the strengthened case for a rate increase still raises questions about its impact on the wider economy. Given recent upward revisions to Q2 GDP growth, which showed an even higher rate of consumer spending and modestly upgraded inflation, it is now more likely that at least one rate hike will occur in 2016. Nevertheless, the changes in rates over the short to mid-term are expected to be slow and modest. And if recent history is a guide, any additional taper tantrums by the markets would give Yellen reason for pause. For the second half of the month, with light trading volume, North American markets were in the red with a 0.5% fall to the S&P 500 and a 1.2% decline to the TSX. European markets appreciated a modest 1.2% and Japanese equities gained a further 0.8%. Oil had a partial reversal of fortune, falling 12%, as the greenback strengthened on the greater likelihood of a rate hike.

At the end of August, most major markets were modestly positive led by Japan at 2.2%. Canada’s TSX eked out a 0.3% return. The S&P 500 was also up 0.8% while European indices gained 1%. Oil finished off the month at $43/bbl – just 7% higher for the month. While this month’s returns were in the doldrums, market sentiment has changed significantly since the beginning of the year. In January there was talk of deflation that would result from the collapse in oil prices. Oil has made a comeback, albeit while still looking for an equilibrium. The Brexit fall appears contained to the U.K, and the U.S. is displaying positive economic momentum. While there are concerns over the Fed’s next move, the market seemed to take the Jackson Hole news in stride. In other developed world economies, central bankers are still in easing mode – a factor that should support higher equity valuations.

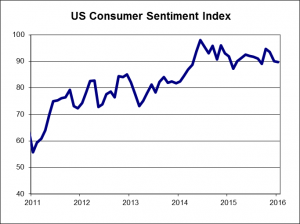

The Thomson Reuters/University of Michigan consumer sentiment index decreased to 89.8 in August from 90.0 in July, due to less favourable current economic conditions, while future expectations for the economy rose slightly.

Personal income and personal spending kept growing at a steady pace in July, up by 0.4% and 0.3%, respectively. The June numbers were revised upwards.

The S&P/Case-Shiller home price index for June dipped slightly with the year-over-year increase at 5.1% compared to May’s 5.3% revised increase.

The ISM Manufacturing index for August slipped into contractionary territory, with a reading of 49.4 down from 52.6 in July. New orders and employment were key factors in the lower reading.

US housing starts for July rose modestly to 1.211 million units annualized, beating expectations for a slight pullback. Building permits declined slightly marking the first decrease following three monthly increases. Existing home sales in the US retreated by 3.2% in July, falling to 5.39 million units, after reaching a post-recession high of 5.57 million units in June. New home sales in the US unexpectedly jumped in July to the highest level in almost nine years, surging by 12.4% to 654,000, on an annualized basis. Orders for durable goods in the US for July rose by 4.4%, the largest jump since last October. Orders for non-defence capital goods, excluding aircraft, a close proxy for business investment, rose by 1.6%, the second straight monthly increase. US consumer prices were unchanged for July with the annual inflation rate easing to 0.8%. The second estimate of US second quarter GDP came in a notch below last month’s preliminary estimate, dipping to 1.1% from 1.2%. Higher consumer spending and business investment were offset by lower government spending and net exports.

Canadian manufacturing sales for June rose by 0.8%, after dropping by 1.0% the prior month. Canadian retail sales for June fell below expectations, declining by 0.1%. The Canadian inflation rate fell to 1.3% in July from 1.5% in June. Canadian second quarter GDP declined by 1.2% on an annualized basis, impacted negatively by the Alberta wildfires. However, June’s 0.6% month-over-month increase is expected to carry over to the summer months, with expectations for a third quarter rebound.

Sources: TD Securities, Case Shiller, Reuters, Institute for Supply Management, Thomson Reuters/University of Michigan, Commerce Department, National Association of Realtors, Statistics Canada.

| August 31, 2016

Total Returns in CDN$ |

1M | 3M | 1Y | 3Y | 5Y | 10Y | |||||

| Canada | |||||||||||

| S&P/TSX Composite | 0.27% | 4.54% | 8.69% | 8.06% | 5.86% | 4.92% | |||||

| S&P/TSX 60 | 0.61% | 4.47% | 7.75% | 8.61% | 6.35% | 5.13% | |||||

| Cdn. Energy | 3.95% | 3.60% | 10.18% | -6.00% | -4.35% | -2.51% | |||||

| Cdn. Materials | -9.87% | 8.94% | 37.66% | 1.69% | -9.21% | 1.64% | |||||

| Cdn. Industrials | 3.18% | 10.12% | 17.27% | 14.72% | 15.28% | 10.36% | |||||

| Cdn. Consumer Discretionary | 1.91% | 2.64% | 2.46% | 15.19% | 18.55% | 7.96% | |||||

| Cdn. Consumer Staples | 4.05% | 6.29% | 18.05% | 25.65% | 24.56% | 13.18% | |||||

| Cdn. Health Care | -1.68% | -10.36% | -39.07% | 2.25% | 12.76% | 8.82% | |||||

| Cdn. Financials | 2.39% | 2.76% | 11.88% | 10.92% | 11.69% | 6.81% | |||||

| Cdn. Information Technology | 1.62% | 2.85% | 10.94% | 20.31% | 14.35% | 8.30% | |||||

| Cdn. Telecom. Services | -1.84% | 5.55% | 23.60% | 17.28% | 14.33% | 11.09% | |||||

| Cdn. Utilities | -2.80% | 4.27% | 16.55% | 11.48% | 5.80% | 6.60% | |||||

| U.S. & International ($CDN) | 1M | 3M | 1Y | 3Y | 5Y | 10Y | |||||

| S&P 500 (LargeCap) | 0.8% | 4.3% | 11.7% | 20.8% | 21.6% | 9.4% | |||||

| Russell 2000 | 2.4% | 8.0% | 7.8% | 16.7% | 19.7% | 8.9% | |||||

| World | 0.8% | 3.5% | 6.5% | 16.1% | 16.8% | 6.9% | |||||

| Europe | 0.9% | 0.1% | -3.3% | 9.7% | 11.8% | 3.9% | |||||

| Japan | 1.0% | 4.5% | 2.4% | 13.8% | 13.4% | 2.6% | |||||

| Pacific ex-Japan | -0.8% | 6.5% | 12.0% | 9.6% | 9.5% | 7.7% | |||||

| EAFE (Europe, Aus, Far East) | 0.7% | 1.9% | -0.4% | 10.7% | 11.9% | 3.9% | |||||

| EM (Emerging Markets) | 3.2% | 12.4% | 11.4% | 9.1% | 6.0% | 6.0% | |||||

| Total Returns in CDN$ | 1M | 3M | 1Y | 3Y | 5Y |

10Y |

|||||

| Fixed Income | Latest Price | Week | Month | YTD | 1-Year |

| iShares Cdn Universe Bond ETF | $32.49 | 0.15% | -0.2% | 2.8% | 2.4% |

| iShares Cdn Long Term Bond ETF | $25.57 | 0.20% | 0.0% | 8.1% | 7.6% |

| iShares Cdn Short Term Bond | $28.41 | 0.11% | -0.2% | -0.3% | -1.1% |

| CDN 30 yr yield | $1.63 | -1.39% | -0.9% | -24.3% | -25.4% |

| US 30 yr yield | $2.23 | -0.40% | 2.2% | -25.9% | -23.9% |

| Exchange Rates | Latest Price | Week | Month | YTD | 1-Year |

| Canadian Dollar ($US) | $0.76 | -1.42% | -0.5% | 5.5% | 0.8% |

| Canadian Dollar (Euro) | $0.68 | -0.45% | -0.2% | 2.7% | 2.1% |

| Canadian Dollar/British Pound | $0.57 | -0.65% | 0.2% | 18.9% | 17.7% |

| Canadian Dollar (Yen) | $79.06 | 1.49% | 0.9% | -9.2% | -12.9% |

| Commodities | Latest Price | Week | Month | YTD | 1-Year |

| RJ/CRB Index | 180.21 | -2.98% | -0.4% | 1.7% | -8.1% |

| Bloomberg Livestock | $27.67 | 0.51% | -0.1% | -10.2% | -16.4% |

| Gold | $1,311.40 | -1.38% | -2.8% | 23.7% | 15.1% |

| Natural Gas | $2.89 | 3.25% | 0.4% | 30.4% | 6.8% |

| Light Sweet Crude Oil | $44.73 | -4.43% | 7.5% | 20.7% | -1.6% |

| CBOE Volatility Index | 13.50 | -0.22% | 13.1% | -26.3% | -57.3% |