December 03, 2019 – KERR MARKET SUMMARY

Investors focused on a series of positives in November, including stronger-than-expected corporate earnings, decent economic data points, cautious optimism over a Sino-U.S. trade agreement, and a sense that the global economy is stabilizing. Receding recession fears continued stoking demand for risky assets, which pushed valuations to record highs. Yet in an environment where returns attract inflows and inflows drive returns – essentially, where momentum powers performance – have asset valuations decoupled from fundamentals? Are markets pricing in a better macro environment than is justified?

In global economic news, fading recession risks have coincided with the loosening of financial conditions, the yield curve un-inverting, and economic data remaining comfortably above recessionary levels. Manufacturing PMIs for November suggested that industrial activity strengthened in several regions. Perhaps the clearest manifestation of the recent bullishness was last month’s outburst of M&A activity. Luxury goods group LVMH bought jeweller Tiffany & Co. for over $22B, the same week that rival brokers Charles Schwab and TD Ameritrade announced a merger. Catalyst Capital Group bid $2B for a stake in Hudson’s Bay, while Quebec’s Alimentation Couche-Tard revealed a $7.7B proposal to acquire Caltex Australia. Meanwhile, ticket exchange Viagogo and healthcare company Novartis were busy purchasing StubHub and Medicines Co., respectively. The flurry of M&A activity points to a rise in corporate confidence as chief executives become optimistic on the outlook for global demand. Nevertheless, we question whether investors are getting ahead of themselves, as the bullish wave has not been matched with an equally positive upturn in economic growth.

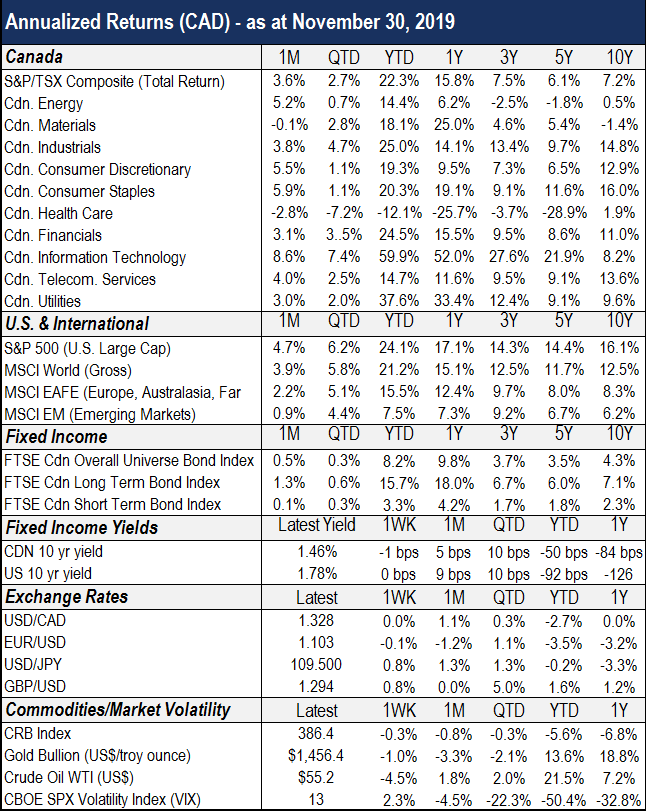

In fixed income markets, the steepening of the yield curve provided further support that recessionary risks are retreating. When it inverted this summer, investors feared that a downturn was looming, choosing to focus on its bearish prognostication powers instead of embracing easy monetary policy. Now, with the spread between the three-month and 10-year segments of the curve at a 12-month high, investors appear to be placing a great deal of faith in central bankers’ capacity to keep the good times rolling. At its October policy meeting, the Bank of Canada opened the door to a rate cut in December. The U.S. Federal Reserve will likely cut rates again in December if economic growth surprises on the downside. The Canadian bond market advanced 0.5% in November. Long-term bonds continued outperforming their short-term counterparts, with each market gaining 1.3% and 0.1%, respectively.

Stock markets around the world continued on their upward ascent last month. The market-wide climb was fueled by none other than discounted recessionary fears and a global shift towards lower interest rates. At this point, stocks appear priced for strong economic and earnings growth, as well as positive developments on the trade front. We support the market’s assessment that recession risks are small, and that corporate earnings as well as economic activity could expand modestly over the coming months. However we struggle to envision prospects improving to the degree implied by current stock prices. For all the confidence that emerged last month, and despite record-setting North American valuations, it is not entirely apparent that economic fundamentals have improved by that much. For the month of November, Canadian and U.S. stock markets advanced a respective 3.6% and 4.7%, and are up 22.3% and 24.1% year-to-date. International and emerging markets returned 2.2% and 0.9%, and have gained 21.2% and 7.5% year-to-date.

Going forward, the dichotomy between near-term optimism and long-term risks could continue disconnecting valuations from fundamentals. This does not imply that we are calling for a sharp correction, pullback, or even the end of the bull market. However it does suggest that markets appear vulnerable to a consolidation over the next year. When it comes to client portfolios, we continue to favour a diversified yet selective set of fundamentally higher-quality investments and companies. We believe this philosophy will serve us well over the coming year, and we remain vigilant of the downside risks. Should the harmonized market updraft come to a sudden halt, we will be especially grateful for our defensive stance.

Sources: Morningstar Direct, Capital Economics, Globe Investor, National Bank Financial Markets