June 01, 2018 – KERR MARKET SUMMARY – Volume 8, Number 7

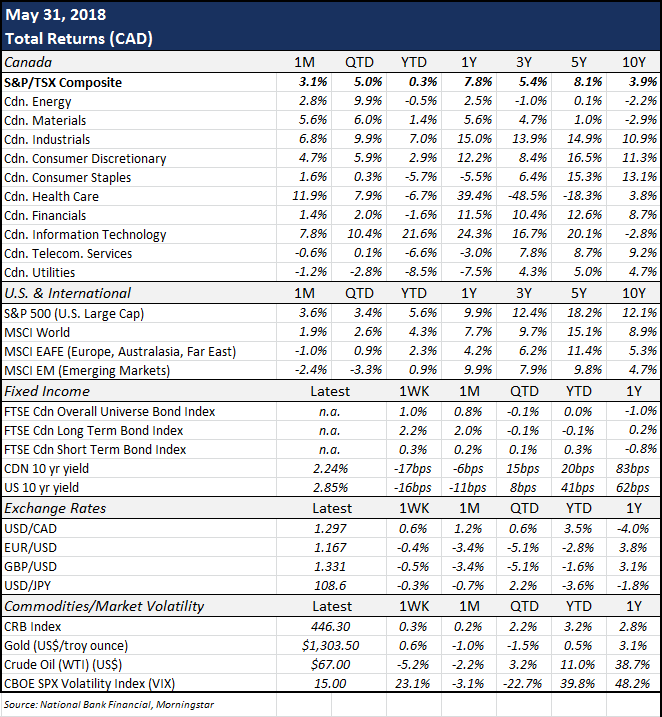

While the various risks facing the global economy have not disappeared, including uncertainties regarding trade policies, the behaviour of North American equity markets in May would suggest otherwise when looking at volatility as measured by the CBOE Volatility Index (VIX), which was reasonably low overall during the month. However, the behaviour of equity markets outside North America and the U.S. & Canadian bond market would suggest that volatility is alive and well.

On the economic front, various key data releases during the month continued to point to softening economic growth in Canada but nothing suggests that we are moving towards a recession. The housing market continued to adjust to new mortgage guidelines and higher borrowing rates, with housing starts declining in April and house prices remaining flat over the February-April period. The slowdown in residential investment was one of the primary contributors to the softer 1.3% real GDP growth in Q1, while the weaker growth in consumer spending also had an impact. In Europe, economic data has also demonstrated weakness with Q1 GDP growth coming in at 1.7%, the softest level since 2016Q3. South of the border, however, economic growth is showing few signs of a slowdown, providing support for the Federal Reserve to resume raising interest rates at their June meeting.

As expected, the Bank of Canada once again left the overnight rate unchanged at 1.25% at its meeting on May 30. They stated, however, that “Overall, developments since April further reinforce Governing Council’s view that higher interest rates will be warranted to keep inflation near target”. Despite the softer overall economic data and only modestly rising inflation reported in May, the Canadian bond market experienced a significant sell off during the first half of the month, with both short- and long-term interest rates moving sharply higher in tandem with U.S. rates (despite the Fed leaving interest rates unchanged at its May 2 meeting). All of this was reversed during the second half of May, with long-term rates ending the month lower and short-term rates ending only slightly higher. What looked like a potentially significant negative return for the bond market at mid-month turned into a positive contributor to investment portfolios by month-end, with the FTSE Canada Overall Universe and the FTSE Canada All Corporate returning 0.80% and 0.56%, respectively.

While equity market volatility in North America was much more subdued in May as measured by the VIX, volatility wasn’t entirely absent. Equity markets reacted throughout the month to the possibility and then actual announcement of the U.S. pulling out of the Iran nuclear deal, numerous comments from the U.S. regarding North Korea, U.S.-China trade talks, trade tariffs announcements, political uncertainty in Italy, as well as positive economic data out of the U.S. and continued favourable corporate earnings reports. Despite the geopolitical wrangling in May, both Canadian and U.S. equity markets posted solid returns with the S&P TSX Composite up 3.1% and the S&P 500 returning 3.6% in May. Sadly, the same cannot be said for the rest of the world’s equity markets. May was a difficult month for several European equity markets including Italy, Spain and Austria, while many emerging equity markets (Brazil, Greece, Mexico, and Malaysia to name a few) experienced material negative returns ranging from -8.0% to -17.3% in local currency terms. Overall, the MSCI EAFE returned -1.0% in CAD, while the MSCI EM was down 2.4% in CAD. As the numbers illustrate, in any one month (or one year), equity returns can very significantly from one region to the next, highlighting the importance of being diversified geographically to reduce portfolio volatility and generate higher returns over the long term.

Following a strong April, the loonie lost some ground in May against the USD to close the month at 77.1 cents USD. The level of interest rates in Canada vs. the U.S has been impacting the loonie more significantly than in the past when commodity prices, especially the price of oil, was one of the key drivers of movements in the currency. The loonie declined in value during most of the month as investors started to question whether the Bank of Canada would raise interest rates in July given some of the softer economic data. However, the wording in the Bank of Canada’s statement on May 30 hinted at a July hike and sent the loonie up a full cent. Going forward it remains to be seen what the impact of recently announced trade tariffs will be on capital flows, economic growth, inflation and, consequently, the impact on the Bank of Canada’s decision in July and the loonie. The USD also had an eventful month driven by strong economic data, the release of dovish Fed minutes and geopolitical concerns. For the month, the USD closed higher against the EUR and GBP, but slightly lower against the JPY.

Sources: Capital Economics, National Bank Financial