March 03, 2020 – KERR MARKET SUMMARY

The final days of February provided investors with an unpleasant wake-up call. Rising concerns on the outbreak of the COVID-19 virus dominated headlines. The news of people infected with the virus outside of China in latter part of February raised concerns, and elicited responses from health officals globally. The development rattled global equity markets as investors reacted to the potential negative impact the COVID-19 outbreak has on economic growth. Although we anticipate that managing this crisis will have a short-term impact on global growth as supply chains are disrupted and there is a change in consumer behavior, the duration and degree of the downturn is unknown.

On the economic front, the immediate effects of managing the risks associated with COVID-19 have led to disruptions to international trade and manufacturing. The slowdown in activity levels are being felt the most in China where the temporary shutdown of many factories caused the February Caixin/Markit Manufacturing Purchasing Managers’ Index to fall to 40.3-the lowest reading since 2004. Certain businesses in the west who rely on goods from the far east have been compelled to source their supply-chain items elsewhere or brace through the halt. Authorities aim to help economically; Chinese and Italian authorities are offering loans and subsidies to companies that have been negatively impacted. Similarly, the International Monetary Fund and the World Bank have declared that they are ready to provide emergency financing to countries severely affected by the outbreak.

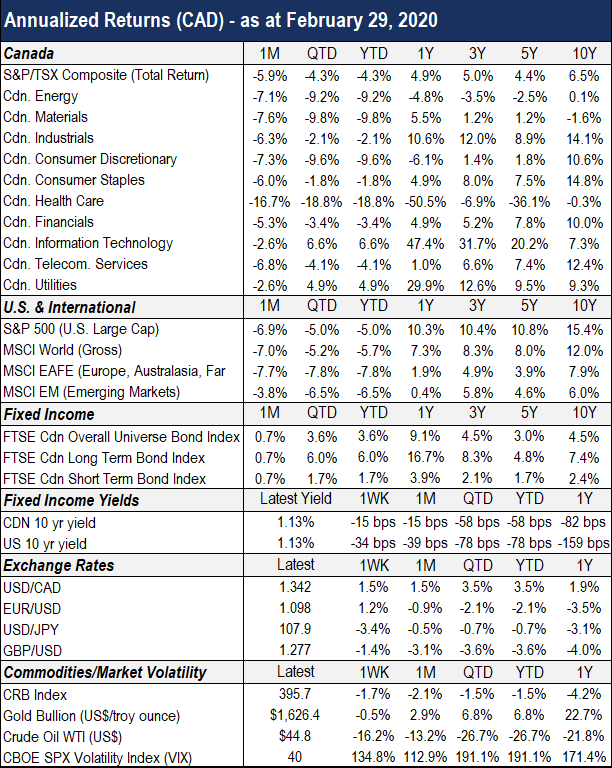

In response to concerns about economic growth and corporate profits, fixed income markets rallied as investors retreated to safe-haven assets. The shift to capital preservation assets raised bond prices and pushed the U.S. treasury yield to an all-time low. To appease investors, the Federal Reserve released a statement on February 28th affirming that they would use tools at their disposal and act appropriately to support the economy. Stating that fundamentals remain strong and that they are closely monitoring the developing situations, they did not commit to any immediate action of a rate change. Though there was no commitment to timing, it is possible that the Federal Reserve decides a rate cut is necessary prior to their upcoming March 17th-18th meeting. On our side of the border, the Bank of Canada will be meeting on March 4th and announce their rate policy decision. The latest Canadian economic figures point to GDP slowing to the lowest level in nearly 4 years, mainly driven by strikes, weather and shutdowns. The recent challenges related to the COVID-19 and rail blockades increases the probability of a rate cut, which hasn’t happened since October 2018. Both long-term and short-term bonds returned 0.7% in February.

The equity world was correspondingly shaken in February, as we witnessed the worst week since the financial crisis of 2008-2009. Safe-haven assets such as gold, and utilities absorbed the shock relatively well, while economically sensitive areas such as commodities, consumer discretionary and cyclical businesses falling in value, as expected. The S&P 500 closed the month at -6.9%, and the S&P/TSX closed at -5.9%.

The past experiences related to medical emergencies provide us some perspective that through a coordinated effort and with advances in healthcare technology there will be solutions that will contain the virus, and limit its impact on the long-term prospect on businesess and the global economy. Following conversations with investment managers we remain confident that the portfolios they manage for our clients are well-diversified, and emphasize owning businesses managed by conservative management teams capable of adapting to a more challenging economic environment. Although we recognize that the drop in equity prices is never a pleasant experience, we are encouraged that investment managers remain in direct contact with companies to evaluate the current situation and are focused the long-term impact of COVID-19. We continue to prioritize long term quality investing over short term speculation.

As always, we are happy to discuss any question you may have about your portfolio.

Sources: Morningstar Direct, Capital Economics, Globe Investor, National Bank Financial Markets