February 01, 2018 – KERR MARKET SUMMARY – Volume 8, Number 3

Global economies and financial markets were off to the races as they rang in the New Year. Continued investor confidence was underpinned by narrowing credit spreads, a stellar start to corporate earnings season, supportive fiscal and monetary policies, persistent productivity levels and advancing oil prices. World economies continued on their path of synchronized expansion, providing a foundation for global profits that fundamentally support the risk-on trade despite the uncertainties that loom on the horizon.

On the economic front, the Bank of Canada raised interest rates in the first month of 2018, taking the overnight rate to 1.25% – no longer an emergency setting however still below the BoC’s definition of neutral (3.0%). The Bank’s accompanying statement and report upgraded Canadian and global economic growth outlooks, acknowledged U.S. tax reform tailwinds, highlighted strengthening core inflation and suggested no real economic slack remains in the Canadian economy. Risks were also discussed in that competitive challenges, household debt and monetary restraint could all impose below-consensus growth on Canada.

South of the border, Donald Trump’s presidency turned a year old last month, and was marked by a government shutdown. The impasse between President Trump, the Republican-controlled Senate and House, and the congressional Democratic minority only lasted three days, with world equity markets largely unfazed, focusing instead on a global economy that is motoring ahead. This week’s U.S. Federal Reserve meeting left interest rates unchanged. Its economic outlook remained upbeat, setting the stage for a hike at its next meeting in March.

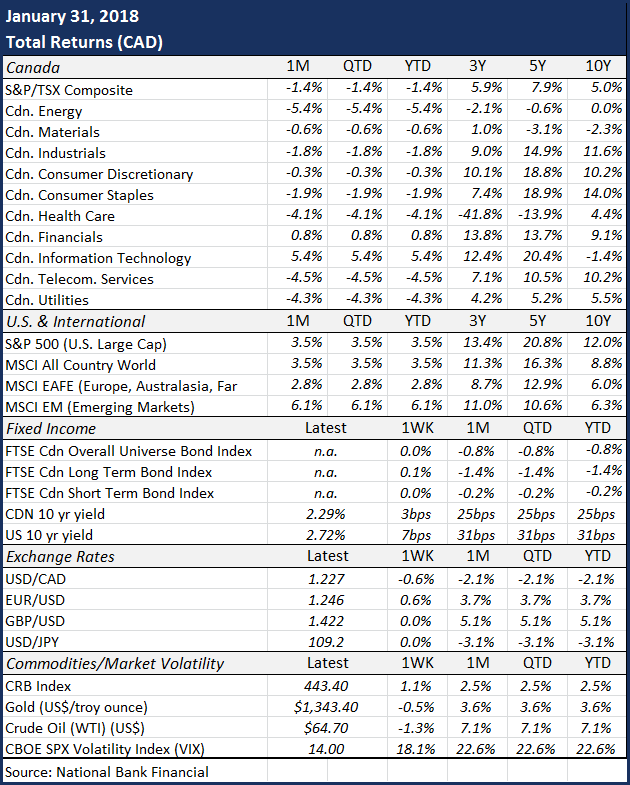

In fixed income markets, the interest rate normalization trend has more recently been seen in longer term yields and is also reflected in global bond markets. These developments are due to the presence of firming inflation, stronger economic growth, climbing deficits and anticipation of tighter monetary policy from central banks. The combination of mounting inflation and rising global bond yields pose a risk to today’s levitating equity markets, the latter offering competition to dividends and planting negative pressures on rate-sensitive sectors. The FTSE Canada Bond Universe Index retreated 0.8% in January.

In fixed income markets, the interest rate normalization trend has more recently been seen in longer term yields and is also reflected in global bond markets. These developments are due to the presence of firming inflation, stronger economic growth, climbing deficits and anticipation of tighter monetary policy from central banks. The combination of mounting inflation and rising global bond yields pose a risk to today’s levitating equity markets, the latter offering competition to dividends and planting negative pressures on rate-sensitive sectors. The FTSE Canada Bond Universe Index retreated 0.8% in January.

The bullish narrative for equity markets continued in January – with a nearly uninterrupted string of positive performance. Superb corporate fundamentals, strong and synchronized global growth, calm inflation levels, accommodative monetary policy, rising deal activity and tax reform tailwinds pushed prices higher. At January’s midpoint, 41% of S&P 500 companies achieved new three-month highs, the most expansive reading of the new-high list since 2013. Historically, such broadening has been associated with persistence of bull markets. Though mounting global bond yields and inflation could dampen the bullishness, they are far from reaching critical levels – having begun their ascent in a slow and orderly manner from historically low levels. The S&P 500 and MSCI World Index each returned 3.5% last month (CAD), and the TSX retreated 1.4%.

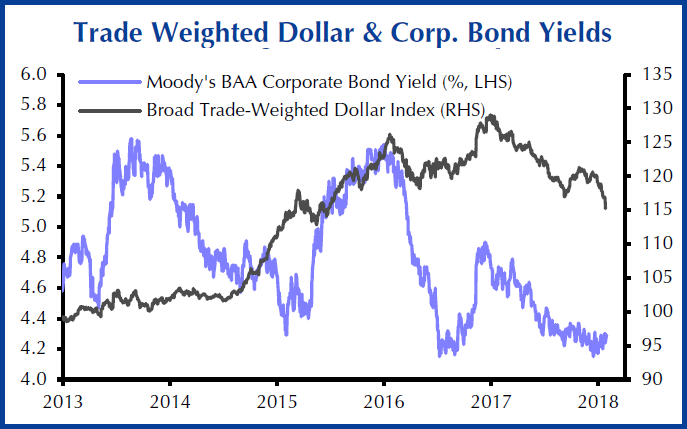

In currency markets, the Canadian dollar enjoyed a strong start to 2018, closing the month trading just above 81 cents USD. Yet where the loonie gained, the greenback faltered. The political dysfunction and uncertainty that delayed the country’s pro-growth policies until the end of 2017 remain. Although rising U.S. bond yields lent some support to the dollar, many investors chose to focus on the euro zone’s strength and began flocking to the euro itself instead of the dollar. Furthermore, the fate of NATFA has kept both the loonie and greenback under pressure as the end of the original timeline approaches.

Oil markets continued their ascent in January, with falling inventories and global economic strength underpinning demand. Prices briefly dipped mid-month due to rising U.S. and Libyan inventories, though the news was quickly eclipsed by top exporter Saudi Arabia’s remarks that OPEC would comply with supply cuts beyond 2018. Crude oil closed the month with its strongest annual start in five years, trading at $64.81 USD per barrel and up 7.3% USD – in line with the broad rise seen in risk assets.

Sources: Capital Economics, Globe Investor, National Bank Financial, Financial Advisor Online