March 15, 2017 – KERR MARKET SUMMARY – Volume 7, Number 6

Global financial markets and GDP growth have been surprising on the upside over the last year. Capital Economics’ index of world GDP, which represents three quarters of the global economy, rallied from 2% annualized in late 2015 to 3.5% in the second half of 2016. The global manufacturing PMI is approaching a three-year high and consumer confidence is at a level consistent with the sharp spending pick-up in the developed world. Several world trade measures have also experienced uptick in recent months (see Chart 1). What’s more, the rally has extended into 2017. Some pundits postulate that post-U.S. election optimism in the global economic outlook triggered the rally. Implicit in this sentiment are expectations that fiscal policy will enhance economic activity, with governments around the world loosening their purse strings after years of fiscal consolidation. Nevertheless, the surge cannot only be attributed to a prospective Trump stimulus, given that it pre-dates the U.S. election. According to Capital Economics, several factors are at play.

global economy, rallied from 2% annualized in late 2015 to 3.5% in the second half of 2016. The global manufacturing PMI is approaching a three-year high and consumer confidence is at a level consistent with the sharp spending pick-up in the developed world. Several world trade measures have also experienced uptick in recent months (see Chart 1). What’s more, the rally has extended into 2017. Some pundits postulate that post-U.S. election optimism in the global economic outlook triggered the rally. Implicit in this sentiment are expectations that fiscal policy will enhance economic activity, with governments around the world loosening their purse strings after years of fiscal consolidation. Nevertheless, the surge cannot only be attributed to a prospective Trump stimulus, given that it pre-dates the U.S. election. According to Capital Economics, several factors are at play.

Firstly, a policy-driven rebound has surfaced in China. Quicker bank lending and infrastructure spending have lifted China’s growth rate from 4% annualized in early 2016 to 6.5% by December. Furthermore, Chinese export and import figures have recently reached multi-year highs on improving commodity prices and global economic momentum. China will remain the most important economy for which fiscal stimulus will lend support to both domestic and world GDP profiles.

A second factor is oil price stabilization. 2014’s price plunge impaired investment in the U.S. and engendered recession in some emerging economies. Yet oil prices have settled down since last March – between $40 and $60 per barrel of Brent crude – and the industry has subsequently recovered. Last quarter, U.S. mining investment grew 23% annualized.

More fundamentally, the broad-based boost supports the notion that any lingering austerity and/or headwind from the global financial crisis has finally subsided. Households in the developed world are no longer trimming their debt ratios, nor are governments withdrawing fiscal policy. Barring some exceptions, the financial sector has also recuperated. Bank lending to non-financial corporations is now growing in advanced economies in year-on-year terms.

However, Capital Economics does not expect the economic expansion to continue on its tear. For one, China’s rebound could slow down as policy support tightens, with policymakers shifting their attention from stimulus back to structural reform. Eurozone activity could lose momentum if political uncertainty escalates – buoyed by fears of Russian aggression, terrorism, and the need to integrate hundreds of thousands of refugees. Furthermore, reduced population growth and trend productivity growth render it difficult for global GDP to revisit its pre-financial crisis average of 4%. Finally, a key component working against a more constructive fiscal boost is the economy’s firming itself. Fiscal authorities may no longer deem stimulus measures urgent should they begin fearing the impact of new spending and tax cuts on already elevated debt-to-GDP levels.

Yet in a market dominated by bullish sentiment, the bears are not necessarily about to govern the playing field. The world economy’s outlook is still reasonably bright. Capital Economics forecasts a global GDP growth of 2.3% in 2017 and 2.5% in 2018. Oil prices are anticipated to persist at current levels, creating an ideal “Goldilocks Scenario” where moderate economic growth is sustained while inflation is also quelled. Any Chinese slowdown is presumed to be gradual, as well as offset by recovering economies such as Brazil and Russia, both of which Capital Economics recently revised growth forecasts for on the upside. Furthermore, in the event that a Trump stimulus is delayed until next year (or even shelved), the U.S. economy is expected to remain robust. While growth is unlikely to accelerate further, one needn’t believe it will slow down sharply either.

NEWS FOR THE FIRST HALF OF MARCH 2017

The NFIB Small Business Confidence Index for February dipped by 0.6 points to 105.3. Three out of ten sub- indicators rose, one was unchanged and the rest fell.

The latest foreclosure report is not available. The 2016 U.S. “home flipping” report was released. A “home flip” is the sale of the same property twice within a 12-month period. 193,009 single family homes and condos were flipped in 2016, up 3.1% from 2015, to the highest level since 2006.

US retail sales rose by 0.1% in February, with January’s number being revised from a 0.4% to a 0.6% increase.

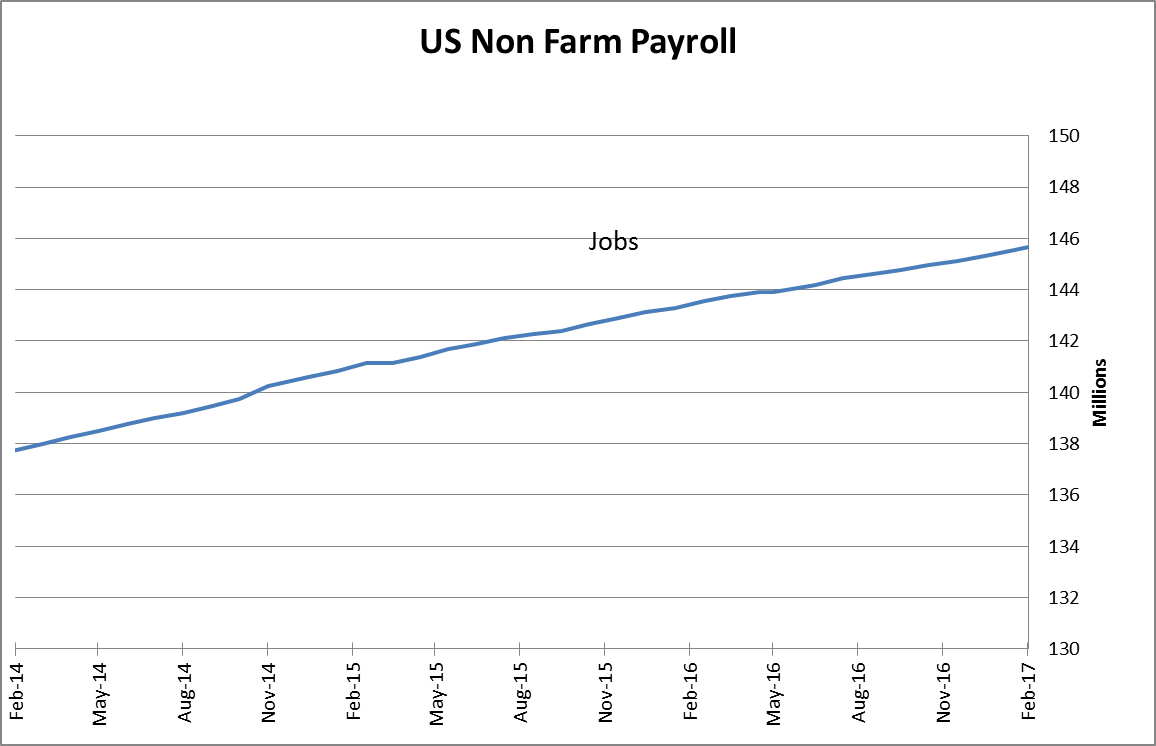

US non-farm payrolls rose by 235,000 in February, exceeding expectations of 200,000. The unemployment rate dipped to 4.7% from 4.8%.

OTHER ECONOMIC NEWS

The ISM non-manufacturing index for February rose by 1.1 to 57.6, beating expectations. The new orders, business activity and employment sub-indices all rose. The US trade deficit for January widened to US$48.5 billion from US$44.3 billion in December. Exports rose by 0.3%, while imports rose by 2.5%. The US annual inflation rate for February was 2.7%, up from 2.5% in January.

CANADIAN ECONOMIC NEWS

Canadian employment grew by 15,000 jobs in February, with the unemployment rate dipping by 0.2% to 6.6%. A surprising 105,000 full-time jobs were created, while there was a drop of 90,000 part-time jobs. Canada’s trade surplus for January widened to C$807 million from a C$447 million surplus in December. Exports rose by 0.5%, while imports declined by 0.3%. It was the third consecutive monthly surplus. Canadian GDP rose by 2.6% for the fourth quarter of 2016. Canadian housing starts were relatively stable in February at a seasonally-adjusted annual rate of 210,000. The Teranet/National Bank home price index rose by 1.0% in February. Home prices in the markets surveyed were 13.4% higher compared to the same time a year ago.