May 02, 2017 – KERR MARKET SUMMARY – Volume 7, Number 9

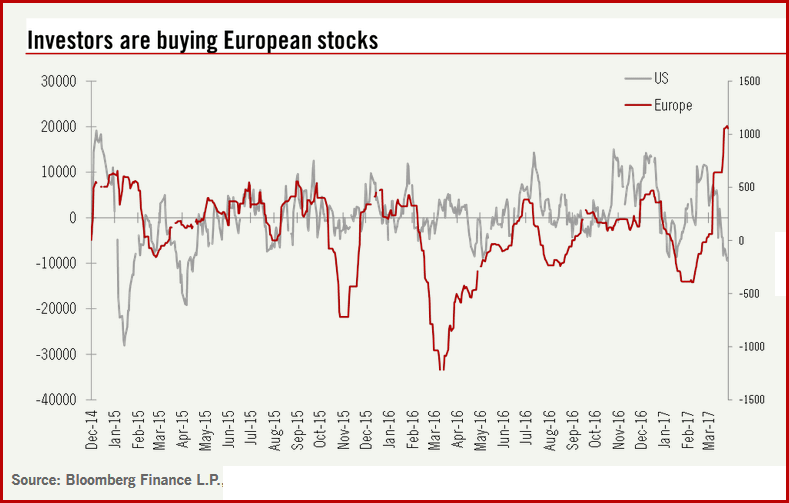

Higher-risk areas of U.S. financial markets have outperformed since early 2016, especially after the U.S. election. That rally, for the first part of the month, saw an interruption as equity prices traded sideways until the prospect of a decisive pro-Europe French candidate emerged. U.S. equities have essentially lagged their European peers over the last two quarters following a strong post-Trump election rally. At the same time, bond yields have retreated, commodity prices have stagnated and inflation expectations have been tempered. For now, after several years, market leadership has switched to Europe on the fading prospects for Trump’s promise of fiscal stimulus and tax cuts.

The month’s first half saw broad-based market declines as many analysts mused whether markets had returned to more sluggish conditions. Equities initially moved into a consolidation phase, awaiting more clarity about economic growth trends and the French election – investors catching their breath (and taking profits) while waiting for justification of the current valuation levels. U.S. stocks had a false start – initially rallying on strong wage data but quickly reversing on March’s paltry addition of 90,000 new jobs – the worst showing since last May. Adding to the doubtful demeanor was House leader Paul Ryan’s acknowledgement of differences between legislators and the White House on tax reform. Treasury yields also waivered, the 10-year Treasury yield touching 2.27% – a five month low. Yields rebounded on the release of the Fed’s meeting notes indicating they may temporarily halt rate increases when it starts to trim its bond portfolio. The broad move away from equities gathered steam as investors focused on escalating geopolitical risks in Syria, Afghanistan and North Korea. The conflict in Syria especially added to the uneasiness – affecting American-Russian relations. In Europe, a rise in the polls by a French leftist candidate rattled investors who are already worried about the fate of the E.U. For the first half of April the S&P 500 Index fell 1.2%, marking the first back-to-back weekly decline since January. Canada’s TSX finished down 0.4% while European stocks slid 2%.

During the month’s second half, politics presented more headline risk. The Turkish referendum result initially unsettled markets and was followed by the announcement of a snap election in the U.K. Notably, the UK’s FTSE 100 Index experienced its worst weekly performance in five months. Other markets proved resilient. European markets perked up, as pollsters were redeemed for their accurate predictions about the outcome of the first round of French elections: a comfortable lead for pro-EU Macron over nationalist Marine Le Pen. Bank stocks surged and the euro rose to five-month highs on the news. European companies earnings reports added to the levity as they delivered a positive average earnings surprise of 9.5% and an average sales surprise of 2%. Investors responded by adding $2.4 billion into European equity funds in one week – the highest since December 2015. Encouraging news from China also helped bolster sentiment as GDP rose a better-than-expected 6.9%, lifted by credit, fiscal spending, and a hot housing market. After Q4-2016’s 6.8% pace, this marks China’s first multiple-quarter growth increase in six years. The loonie came under pressure as Donald Trump initially mused to terminate NAFTA. The U.S. also imposed a 20% tariff on Canadian softwood lumber imports and put the Canadian dairy trade on its hit list. The Canadian dollar slumped on concerns that the trade dispute would mean a more aggressive stance in NAFTA trade renegotiations. For the last two trading weeks of the month, Canadian equities were up 0.2% while U.S. and European equities advanced 0.8% and 0.2% respectively.

During the month’s second half, politics presented more headline risk. The Turkish referendum result initially unsettled markets and was followed by the announcement of a snap election in the U.K. Notably, the UK’s FTSE 100 Index experienced its worst weekly performance in five months. Other markets proved resilient. European markets perked up, as pollsters were redeemed for their accurate predictions about the outcome of the first round of French elections: a comfortable lead for pro-EU Macron over nationalist Marine Le Pen. Bank stocks surged and the euro rose to five-month highs on the news. European companies earnings reports added to the levity as they delivered a positive average earnings surprise of 9.5% and an average sales surprise of 2%. Investors responded by adding $2.4 billion into European equity funds in one week – the highest since December 2015. Encouraging news from China also helped bolster sentiment as GDP rose a better-than-expected 6.9%, lifted by credit, fiscal spending, and a hot housing market. After Q4-2016’s 6.8% pace, this marks China’s first multiple-quarter growth increase in six years. The loonie came under pressure as Donald Trump initially mused to terminate NAFTA. The U.S. also imposed a 20% tariff on Canadian softwood lumber imports and put the Canadian dairy trade on its hit list. The Canadian dollar slumped on concerns that the trade dispute would mean a more aggressive stance in NAFTA trade renegotiations. For the last two trading weeks of the month, Canadian equities were up 0.2% while U.S. and European equities advanced 0.8% and 0.2% respectively.

At the end of the month, Canada’s TSX eked out a gain of 0.5% – greatly helped by Consumer Discretionary (+3.9%), Consumer Staples (+5.4%), and Telcoms. at (+5.7%). The S&P 500 was up 1% while European indices surged for the second consecutive month at +3.6%. Foreign equities were helped immensely by the tailwind from a 2.5% drop to the loonie, bringing U.S. and European indices to +3.7% and +6.3% respectively. The U.S broad-based bond index rallied 0.6% for the month, suggesting some investor doubt over valuations and the prospects for the Trump administration.

NEWS FOR THE SECOND HALF OF APRIL 2017

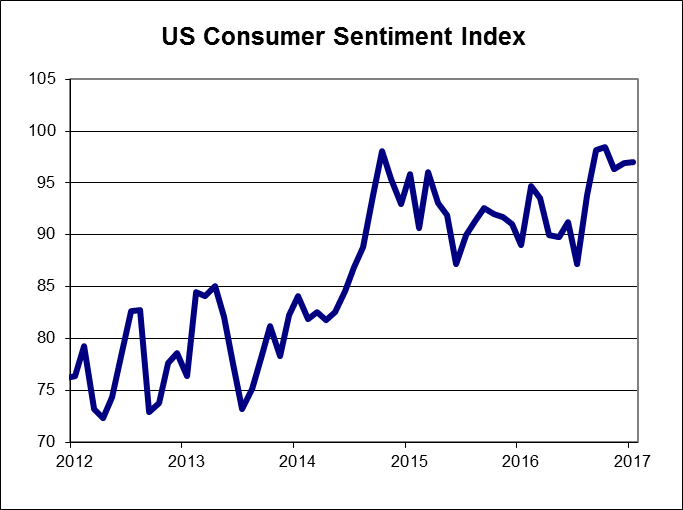

The Thomson Reuters/University of Michigan consumer sentiment index rose to 97.0 in April from 96.9 in March. The index of future economic expectations is widely divided among party lines with Republicans being optimistic, while Democrats are largely pessimistic.

Personal income rose by 0.2% in March, below the forecast for a 0.3% gain, while personal spending was flat.

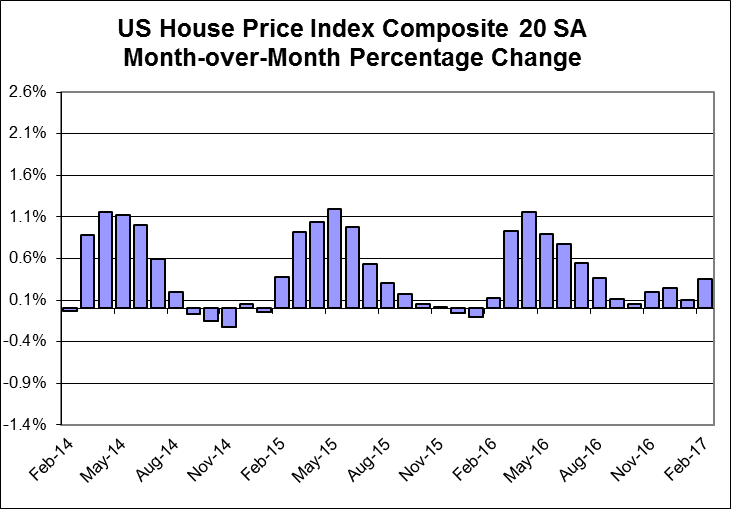

Home prices, as measured by the S&P Case Shiller home price index, rose by 0.7% in February and were up by 5.9%, year-over-year, compared to a 5.7% rise in January.

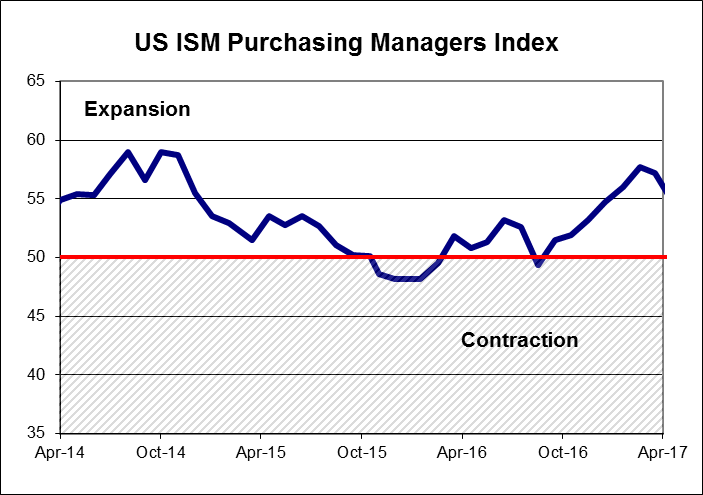

The ISM Manufacturing index for April fell from 57.2 to 54.8, led by declines in new orders and employment.

OTHER ECONOMIC NEWS

US housing starts lost momentum in March after two solid months to start the year. Housing starts fell to 1.215 million units in March from an upwardly revised 1.303 million units in February. Building permits rose, but the increase was due to the volatile multi-family segment. Existing home sales in the US rose by 4.4% for March, beating expectations. US new home sales rose to a eight-month high in March, rising to 621,000 units, on an annualized basis. Orders for US durable goods for March increased by 0.7%. Orders for non-defence capital goods, excluding aircraft, a close proxy for business investment, rose by 0.2% and have risen for six consecutive months. US consumer prices fell by 0.3% in March, lowering the annual inflation rate from 2.7% to 2.4%. The advance estimate of US first quarter GDP came in at 0.7%, annualized, down from 2.1% reported for the fourth quarter of 2016 and falling short of a consensus estimate of 1.0%.

CANADIAN ECONOMIC NEWS

Canadian retail sales declined by 0.6% in February, following a strong month of January. The drop was driven largely by lower gasoline prices as a number of industries posted gains during the month. The Canadian inflation rate fell to 1.6% in March from 2.0% in February. Canadian GDP was flat in February, as gains in the service sector were offset by declines among goods-producers. Canadian manufacturing sales declined by 0.2% in February.