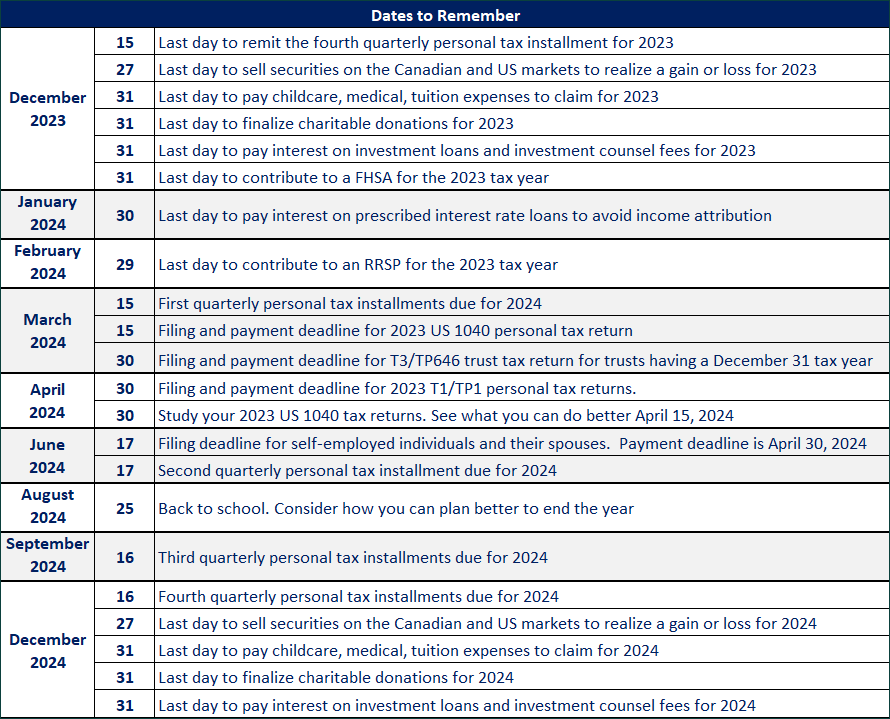

December is on our doorsteps, so now is the perfect time to do some year-end planning. The list of important dates from now until the end of the year and for 2024 will allow you to get a head start on the upcoming year. Being aware of these dates will result in better planning for cash outflows. This exercise may also help one prepare for lead to what can be done before the end of the year to achieve a more optimal result come tax season.

Registered Retirement Savings Plan (RRSP)

RRSPs represent one of the best-known tax vehicles in Canada to save for retirement years. Contributions are tax deductible and income and gains generated in them remain tax-free until funds are withdrawn from the plan.

The annual contribution limit is calculated as a percentage of the previous year’s earned income adjusted for certain pension contributions made by the employer. The maximum contribution for 2023 is $30,780 and that for 2024 is $31,560. Care must be taken when contributing to your RRSP as any overcontribution in excess of $2,000 will be subject to a penalty of 1% per month until the overcontribution is withdrawn or until the contribution room is increased. The deadline to make deductible contributions for the 2023 tax year is February 29, 2024.

Registered Retirement Income Fund (RRIF)

Individuals turning 71 in 2023 have until December 31, 2023 to convert their Registered Retirement Savings Plans (RRSP) into a RRIF. Those still in the work force and still adding RRSP contribution room can consider making one last contribution to their own RRSP accounts in December 2023.

Contributions exceeding the 2023 contribution room will attract a penalty equal to 1% of the overcontribution for one month but will allow for a tax deduction in 2024 or any subsequent year. Taxpayers who can still add to their RRSP contribution room and whose spouses are less than 71 years old may also consider contributing to a spousal RRSP as such contributions continue to be tax deductible.

First Home Savings Account (FHSA)

A first home savings account is a registered plan aimed at first-time home buyers to help them save for a first home. Only a qualifying individual can open a FHSA – the person must be at least 18 years old (or 19 in British Columbia, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut and Yukon), but not older than 71 on December 31 of the year, be a resident of Canada and be a first-time home buyer.

A first-time home buyer for the purposes of opening a FHSA is an individual who has not, at any time in the current calendar year before the account is opened or at any time in the preceding four calendar years, lived in a qualifying home that was a principal residence that the person or his or her spouse or common-law partner owned or jointly owned.

The maximum annual contribution to a FHSA is $8,000 and the lifetime maximum is $40,000. Contributions are tax deductible unless the contribution was done by way of a transfer from an RRSP account. Income earned in the FHSA is tax-free and withdrawals are also tax-free if the funds are used to purchase a first home. The FHSA cannot exist for more than 15 years and if a qualifying home is not purchased, a transfer to a RRSP account is possible with no adverse consequences. A FHSA can be used in conjunction with the Home Buyer’s Plan as long as all conditions are met.

At the time of writing, FHSA accounts can be opened at the following financial institutions, with more to come in the future:

BMO ● National Bank of Canada ● Scotiabank ● EQ Bank ● Questrade ● TD ● Fidelity ● RBC ● Wealthsimple