Economic Overview

The global macroeconomic environment continued to be fairly constructive in the second quarter of 2024. US economic growth came in above expectations despite elevated interest rates and the drawdown of excess consumer savings. Real GDP growth slowed in the first half of 2024 after its strong pace in the second half of 2023 but remained positive with consumer spending holding up based on a healthy labour market and stable spending by business and government sectors.

While the pace of US economic growth has been strong over the last 18 months, we are starting to see signs of softening in recent data – both in terms of consumer spending (with personal consumption expenditure growth slowing to a pace just below 2% in the first half of the year) and labour markets.

Beyond the US, economic growth has been slowing across major economies as anticipated in response to the higher rate environment along with falling inflation pressures. Strong services demand and resilient labour markets have tempered this slowdown and been supportive of a soft landing at least so far.

A series of hotter-than-expected inflation readings in April made investors nervous and markets pared back expectations around interest rate cuts. Through the quarter, however, the outlook for inflation improved with the May core inflation print only 0.16% month over month, the lowest rate so far this cycle, which if maintained, would be consistent with the Federal Reserve’s 2% target.

Specific measures of inflation also moved in the right direction through the quarter. The Bureau of Labor Statistics showed grocery inflation falling from its peak of 13.5% to 1.1% in June 2024. Both housing and core services excluding energy and housing slowed considerably in June 2024. And wage growth shows signs of slowing based on the US Indeed Wage Tracker. These measures should allow inflation to settle into a 2% to 3% range going forward.

While the US Federal Reserve held off on rate cuts in the first half of 2024, other global central banks started to move away from their tightening cycles with the Swiss National Bank, Bank of Canada and the European Centra Bank moving to cut rates. Softening inflation prints make it likely that the Fed will follow suit in the months ahead.

RBC now expects three more cuts from the Bank of Canada this year with the overnight rate expected to end the year at 4% by December. And Goldman Sachs’ Investment Strategy Group expects two 25-basis-point rate cuts from the Fed this year beginning in September. These rate cuts, along with continued government spending, should continue to support economic activity.

In spite of the above relatively positive back drop, we are mindful that risks remain. While the consensus is that the economy is on track for a soft landing, the risk of recession is not zero and we need to keep an eye on the strength of the consumer. Significant geopolitical risks exist with the biggest land war in Europe since WWII still being waged in Ukraine, the regional war in the Middle East and tense relations between the US and China all warranting cautious attention. In addition, the US election this fall adds to uncertainty.

Equity Markets

Stock markets saw mixed results through the quarter and across geographies and sectors. Stubbornly high inflation in April led to worries that central banks would keep rates higher for longer and equity markets started the quarter down. Improving inflation data and strong Q1 earnings reports helped stocks to recover through the quarter, with continued strength from AI stocks.

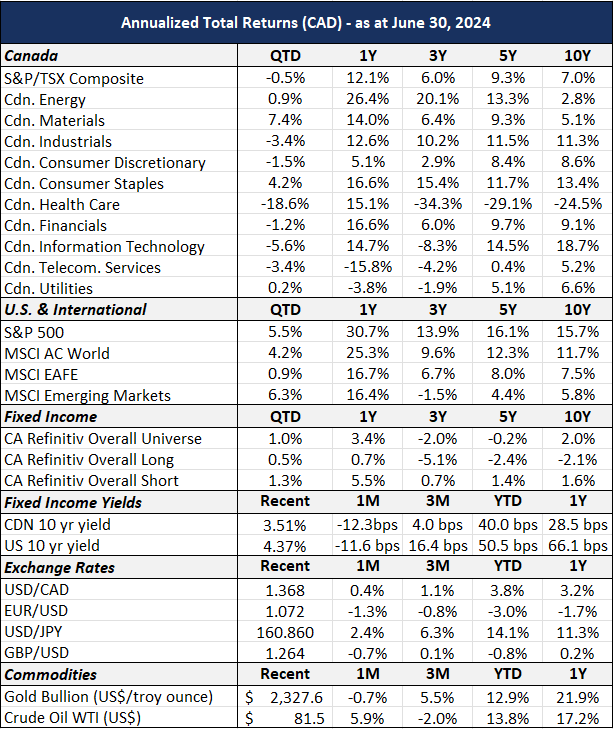

The strongest returns in the quarter came from US equity (+5.5% in CAD) and from Emerging Markets (up +6.3% in CAD). US equity returns were driven largely by the mega cap technology stocks with the strongest sector returns in technology (up 13.8% in USD) and communication services (up 9.4% in USD). Emerging market equity returns were led by returns from Taiwan (on the strength of AI and chips), India (with valuation expansion) and somewhat from China (after policy announcements to support the property sector and stimulate consumption).

Lackluster returns were derived from developed markets ex US (including Canada, Europe and Pan Asia ex Japan). The S&P TSX index in Canada was fairly flat in the quarter, returning -0.5%.

Overall returns were fairly concentrated during the quarter in large cap growth stocks, with value stocks, high dividend companies and small/mid cap companies lagging.

The corporate earnings outlook remains positive with analysts forecasting earnings growth for S&P 500 companies of 10% and14% for this year and next. Though the Magnificent 7 mega cap tech stocks have been driving most of the growth in profits until recently, analysts are expecting this to broaden with the other 493 stocks growing profits in upcoming quarters which should be supportive of valuations.

Fixed Income Markets

Given the April investor nervousness about stickier inflation, bond markets struggled at the start of the quarter with the FTSE Universe bond index down -3.2% in April 2024. More positive inflation numbers in May and June led central banks to begin loosening monetary policy with the Bank of Canada and the European Central Bank each making 25 basis point rate cuts in June. This led to some recovery in bond markets in May and June.

The Canadian bond market return was +0.9% for the quarter with yields under 5 years declining in response to the rate cut by the Bank of Canada while long term bonds slightly lagged as they were more influenced by global interest rates.

Corporate bonds very slightly outperformed government bonds in Canada.

We continue to favor equities over bonds in our portfolio positioning, but with expectations that interest rates will decline from current levels, we believe that high quality bonds can play a role in portfolios to generate some return as well as managing risk by offsetting potential equity volatility.

Looking Forward

Although central banks are in a position to reduce interest rates this year, we believe longer term that structural trends tied to deglobalization, the energy transition and an aging labor force will oblige bankers to keep rates above historical levels as inflation persists. With this view we continue to favor equities to bonds in our portfolio strategic positioning.

While the macroeconomic backdrop and corporate fundamentals continue to be relatively supportive, we are cautious about elevated valuations in select segments of the equity markets and aware of uncertainties and geopolitical risks that remain. For these reasons, we continue to strongly emphasize the importance of diversification and holding quality companies with strong balance sheets.