Economic Overview

The economy continued to grow through the first quarter with the US economy particularly resilient in spite of the higher interest rate backdrop. Overall, while we see regional differences, most global economies experienced slowing but positive growth, inflation trending in the right direction but still higher than target and interest rates ready to come down at some point. These factors have made a soft-landing scenario for the economy more likely.

Real gross domestic product (GDP) in the US in the fourth quarter of 2023 was recently revised upwards to an annual rate of 3.4%. While this reflected a slowdown from the third quarter, this pace is robust and well ahead of the 30-year median growth rate of 2.6%. The most recent Altanta Fed GDPNow estimates first quarter 2024 growth at 2.8%, which is lower but still solid. Economic growth has been supported by a strong US consumer buoyed by positive stock market returns and a strong job market. Survey data from the composite Purchasing Managers’ Index (PMI) remained in expansionary territory, which also boosted investor sentiment.

Some economic signals in the first quarter were mixed. The ISM Manufacturing Index showed a gain in March, but the related Services Index slowed and came in below forecast. While consumer spending was strong (up 0.8% in February), there are some signs of stress in credit cards, auto loans and mortgage defaults that may indicate that household finances will start to tighten.

Inflation has made significant progress, dropping from its peak levels of 8-10% in mid-2022 down to the 2.75% to 3.5% range. While goods inflation has been most cooperative with improved supply chains, services inflation is stickier. Shelter inflation is coming down but slowly. The March US CPI report released on April 10, 2024, showed year-on-year increases of 3.5% in headline CPI and 3.8% in core CPI with both readings exceeding economists’ forecasts. Fed Chair Jerome Powell has noted that they expect the “last mile” back to a 2% target to occur in fits and starts.

While 2023 ended with great optimism that central banks would start to cut rates with the market pricing in as many as six rate cuts through 2024, resilient economic data and stickier inflation have cooled these expectations. Markets now anticipate 2-3 rate cuts in the US in the second half of 2024.

Canada is not showing the same degree of strength as the United States. Canada’s real GDP grew just 0.9% year-over-year in Q4 2023 with the Canadian consumer being more interest rate sensitive given shorter mortgage terms. This greater stress on the Canadian economy may lead the Bank of Canada to diverge from the Federal Reserve in terms of the timing of interest rate cuts. The Bank of Canada still looks on track to cut rates in June with RBC estimating four cuts from the BoC this year at every meeting starting in June.

Equity Markets

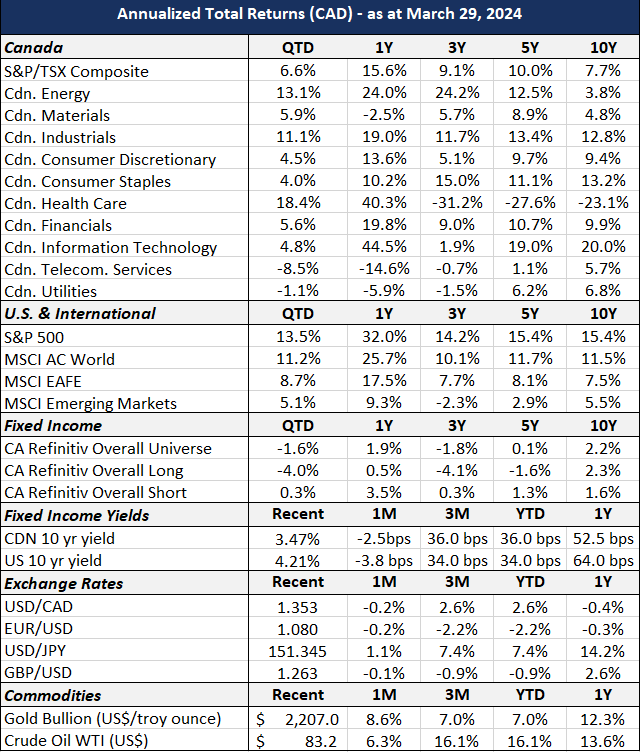

After a strong 2023, global stock markets continued their show of strength in the first quarter of 2024, with the MSCI All Country World index providing a total return of 11.2% in CAD for the period.

US stocks continued to lead the way with the S&P 500 up 10.2% in USD terms, or 13.5% in CAD in the quarter. The first two months of 2024 were reminiscent of earlier in 2023 with returns once again driven by strong performance of the ‘magnificent seven’ technology stocks, which collectively rose 13% in Q1 in spite of share price weakness from Tesla and Apple. This growth rate was double that of the other 493 stocks in the S&P 500 index, which rose just 6%. This mid-single digit return was more in line with the S&P/TSX Composite, which returned 6.6% in the quarter. Overall, both are solidly positive returns and both indices saw new highs by quarter end.

The strongest performing sectors in Canada were energy, industrials and health care with telecom services being weakest with a return of -8.5%. The US index saw positive contributions from technology and communications companies (driven by the M7) as well as energy, financials and industrials. Interest rate sensitive asset classes such as real estate suffered on the back of continued higher interest rates.

International developed markets lagged the US with the MSCI EAFE up 8.7% in CAD terms in Q1. Japanese equities capped another strong quarter with the Topix up 18.1% in Q1, that was offset by modest returns in Europe. Emerging market equities underperformed their developed market peers with the MSCI EM Index up 5.1% in CAD for the quarter. This reflects some continued investor concern about China’s growth prospects in the absence of meaningful fiscal stimulus.

Overall, it has been a good start to the year for equity investors. It is important to be mindful though that markets have been quite optimistic and are increasingly priced for perfection, which will lead to some volatility as data develops. We have seen this play out early in April with some pull back to prices after hotter inflation reports raised doubts about the timing of interest rate cuts.

Fixed Income Markets

Bond markets were volatile during the first quarter. By the end of 2023, markets had gotten ahead of themselves pricing in six rate cuts of 25 bps each by the US Federal Reserve and five cuts in total by the Bank of Canada for 2024. A combination of resilient economic data and central banks providing guidance that they may tolerate ‘higher for longer’ rates, led to a revision in market expectations by the end of Q1 that 2024 might see only three rate cuts. This led to the US Treasury 10-year yield rising from 3.9% to 4.2% and the Canadian Government 10-year yield rising from 3.1% to 3.5% by the end of March. With higher bond yields leading to lower bond prices, the broad bond indices were down in the quarter.

Long government bonds are the most interest rate sensitive therefore short duration bonds outperformed long duration and corporate bonds outperformed government bonds. Corporate bond outperformance also reflected the market’s current confidence in the economy and in corporate balance sheets.

In Canada, the FTSE Universe Bond Index was -1.22% for Q1, with the Universe All Government Bond index -1.66% and the All Corporate Bond index +0.07%. In US fixed income markets, the Bloomberg Global Aggregate Index fell -2.1% in USD as yields increased.

The higher US March CPI reports released in early April also led to a negative response by bond markets with 10-year yields topping 4.5% and Fed swaps showing bets on only two rate cuts for 2024.

Outlook & Portfolio Positioning

A resilient economy, a rebound in corporate profits and a strong job market provide a positive economic backdrop.

With inflation moving in the right direction from its peak in 2022, central banks will eventually start to cut interest rates – though the timing of this may be delayed versus market expectations. For these reasons, we continue to favour the long- term prospects of holding equities relative to bonds.

We recognize that markets will likely be volatile as new economic data is digested and incorporated into market expectations of the timing of interest rate cuts, and we are keeping an eye on earnings reports and consumer sentiment. We are also aware of continued geopolitical uncertainties. This gives us more reason to maintain well diversified portfolios.

With the anticipation that interest rates will start to decline, the return prospects in holding short-duration bonds are becoming increasingly attractive to meet liquidity requirements. While equity markets have been reaching new highs, valuations are not uniformly high across sectors and geographies, leading to opportunities to selectively add to positions at attractive price levels and our conviction that maintaining exposure to a multi-factor equity portfolio is the prudent approach given the current market dynamic.