Economic Overview

In spite of widespread concern about declining growth and expectations of recession at the outset of 2023, the economy proved to be quite resilient. The global economy remained solid despite facing the largest increase in interest rates in decades, multiple international conflicts, an ongoing energy crisis in the EU, a regional banking crisis in the U.S., early signs of recession in parts of the EU, and initial indications of credit and consumer deterioration in the U.S. Key factors that contributed to stabilizing growth included significant fiscal stimulus in the U.S. and Europe and the strength of the U.S. consumer. As a result, the widely anticipated global recession failed to materialize and risk markets finished the year broadly positively.

The absence of a recession helps support the notion that policymakers have so far adeptly managed to strike the near impossible balance of taming inflation and supporting economic growth, or what is commonly termed a ‘soft landing’. After reaching a 50-year high in 2022, U.S. headline Consumer Price Index (CPI) eased to 3.1% year-on-year in November, well below the 9.1% peak in 2022. While still above the target rate of 2%, the trend of the underlying components implies that barring a supply shock or an unexpected surge in demand inflation should continue to moderate.

Corporate investment trended down over the course of the year, likely due to tighter lending standards, but fared better than expected largely on account of the surge in research and development and the building and integrating of artificial intelligence capabilities. Consumers, particularly in the U.S., were a major support to the broader economy, based on their elevated savings, a tight labor market and rising real wages. That said, while credit as a share of income is well within ‘normal’ levels, delinquencies were trending higher in Q4, particularly in the auto loan space.

Corporate earnings though modest surprised to the upside this past year, as consumer strength and pricing power allowed companies to boost sales. Margins failed to keep pace in the first half of the year as companies grappled with higher input and labor costs but as the year progressed, management cut costs by adopting more efficient digital capabilities, helping margins in the U.S. and Canada expand in Q3.

While the unemployment rate remained at all-time lows in developed economies, the labor market continued to show signs of cooling in the most recent quarter, including slower employment growth, declining quit rates, and fewer vacancies. Wage growth in the U.S. has started to moderate towards the long-term average.

Overall, a combination of moderating job growth, decelerating wage increases and softer inflation prints reinforced central bankers’ belief that inflation is moving in the right direction, indicating an end to the interest rate hiking cycle. At the December meetings, Fed Chairman Powell did not push back against the idea of easing financial conditions or rate cuts, while the ECB and Bank of Canada reduced their hawkish outlook continuing to hold rates steady. As a result of these changes in sentiment, investors became convinced that central banks will be able to cut interest rates in 2024

Equity Markets

Despite the widespread predictions of a continued bear market in 2023 and impending recession, it was a remarkably strong year for equities. Much of this strength (about half of annual returns) occurred in the last two months of Q4.

Throughout 2023, the market narrative was in flux as inflation and economic growth vacillated within a charged geopolitical landscape. Central banks attempted to fine tune monetary policy resulting in multiple sell offs and rallies. In the latter half of October, as interest rates continued to grind higher, markets sold off aggressively. Investor sentiment quickly turned positive as the U.S. and Europe saw softer inflation prints, complemented by positive economic data. This boost in confidence prompted investors to anticipate rate cuts from central banks sooner, leading to an equity market rally into the year-end, with markets finishing at new or close to new all-time highs.

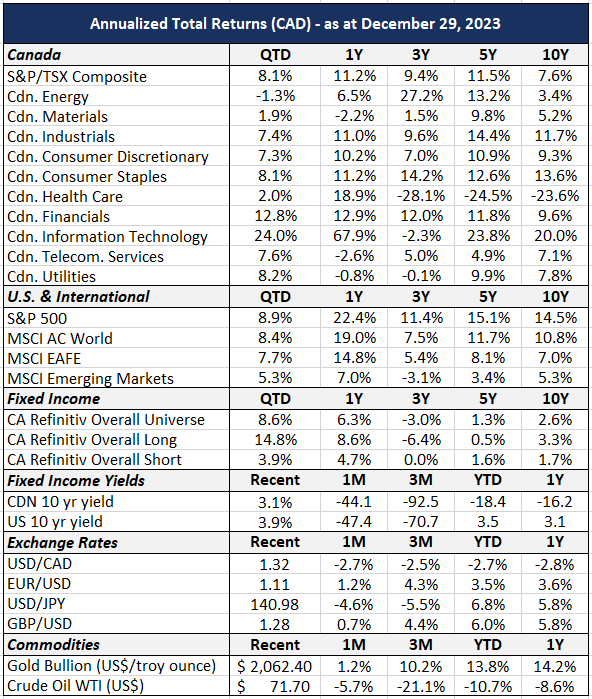

In Q4, the S&P 500 was the best performing major equity index, posting an 11.2% gain (in local currency). Every sector, except for Energy, was positive, marking it as the index’s best quarterly performance in three years. The S&P 500 was up an even more impressive 24.2% for the year. However, it is important to note that this was primarily driven by the ‘magnificent seven’ tech companies, which logged an extraordinary 111% return collectively in 2023, contributing to around 80% of the index’s returns.

Given the dominance of tech stocks through the year, the S&P Growth Index outperformed value in 2023 (up 28.1% vs 19.5%). Over the quarter, however, the Q4 rally broadened out with about a third of the index reaching new 52-week highs in December and the S&P 500 Value index returning 13.0% compared to S&P 500 Growth index’s 9.8%.

Developed international markets also displayed resilience, with the MSCI EAFE Index up 9.0% for the quarter and 19.5% for the year. The MSCI Emerging Market Index finished the quarter up 5.2% and the year up 7.1% – despite the MSCI China, approximately 20% of the index, finishing the quarter down -5.0% and year off -12.8%. The primary source of emerging market’s strong performance was the Indian equity market, which matched the S&P 500’s Q4 return of 11.9% and finished the year up an impressive 20.3%.

In Canada, the S&P/TSX finished the quarter up 7.3%, with all sectors except for Energy coming in positive. Over the year, Canada’s index lagged other major indices, finishing up ‘only’ 8.1% for the year. This underperformance can be attributed to lackluster performance from commodity sectors, both for materials and energy, a lower weighting in tech, and a poor showing from the banks, of which the S&P/TSX is significantly overweight compared to most major indices.

Fixed Income Markets

Fixed income staged an impressive comeback in Q4. Through to late October, the Global Aggregate Bond Index, a proxy for the global fixed-income market, was on pace for its third-consecutive year of losses. However, as expectations of forthcoming rate cuts arose, bond yields sharply declined and credit markets rallied, outperforming government bonds and tightening spreads. By the end of Q4, the Global Aggregate Bond Index had delivered a quarterly return of 8.1%, marking its best quarterly performance in decades.

During the quarter the U.S. Federal Reserve (Fed) maintained policy rates but moved towards a more dovish stance in December. The revised dot plot, which displays the Federal Open Market Committee (FOMC) projections for the federal funds rate, indicated an anticipation of three rate cuts for 2024. An enthusiastic market has since responded by pricing in 6 rate cuts beginning as soon as March. While the Fed appeared more comfortable with the progress made towards its 2% inflation target, the European Central Bank and Bank of Canada exhibited more caution.

In anticipation of more accommodative conditions, government bond yields declined across the board. Having peaked at 5.0% in mid-October, the U.S. 10-year Treasury dropped to 3.87% by the end of Q4. In Canada, the 10-year government bond dropped from a high of 4.3% at the beginning of October to 3.11%. The short end of the curve also saw a significant move with the yield on the Canada 2-year government bond and U.S. 2-year bond shifting down 90bps and 80bps respectively, finishing the year at 3.89% and 4.25%.

While the inverted yield curve favored shorter duration for the first three quarters of the year, the broad decline in yields favored longer duration bonds, which outperformed for Q4 and the year. By year end, the FTSE Canada Long Duration Bond Index was up 8.6% (after being -5.1% year to date as at the end of Q3), while the FTSE Canada Short Duration Bond Index finished the year up 4.7% (vs only +0.9% year to date as at the end of Q3).

The corporate bond market also staged an impressive rally, with the FTSE Canada Corporate Bond Index returning 7.6% on the quarter, to finish the year up 8.0%. The strength at the macro level was driven by optimism that a severe recession could be avoided. On the corporate level, lower yields will help reduce interest rate costs, further supporting margins and reinforcing balance sheets.

Outlook & Portfolio Positioning

As the new year starts, prominent financial institutions are sharing their outlook for the economy and capital market performance for 2024. Crafting a reliable forecast is always a formidable undertaking. What makes the 2024 crop unique is the notable absence of consensus. Goldman Sachs anticipates robust growth in the U.S., whereas Bank of America and UBS foresee a significant slowdown. Fidelity predicts inflation will be sticky in the upcoming year, while Vanguard envisions inflation declining towards the banks’ targets in 2024. Additionally, expectations regarding the actions of the major central banks span the spectrum, ranging from maintaining the status quo to implementing multiple interest rate cuts beginning early in the year.

On a constructive note, we anticipate positive (though slowing) economic growth, further deceleration in inflationary pressures and lower interest rates over the course of the year which will be supportive of a recovery in corporate earnings. However, we also note that the market rally at the end of 2023 reflects that a good share of optimism is already priced into asset prices. There could be also headwinds for further price gains if central banks are slower than anticipated in reducing interest rates or there is a reemergence of inflationary pressures combined with slower economic growth. And we are cognizant of continued geopolitical threats.

Given this backdrop, we want to remain diversified in portfolios from an asset class, sector and geographic perspective. Cash remains helpful for portfolios with short-term liquidity requirements, but with the anticipation of rate cuts, it is also healthy to have bonds in the portfolio to take advantage of rates and to provide a hedge against headwinds. And we anticipate that 2024 may see a further broadening of market returns (with less concentration in the mega cap tech names) so we favor a multi factor approach to equities with a preference for quality.