Selling the Nest Egg: Understanding the benefits and how to best proceed?

The global pandemic has unravelled a host of challenges for Canadians young and old. Nonetheless, it is providing families with an opportunity to reflect on what life will be like when we regain some level of normalcy. For Canadians that have or plan to retire, now may be a good time to make a lifestyle change and consider the benefits of selling their home.

What are the motivating factors to sell your home?

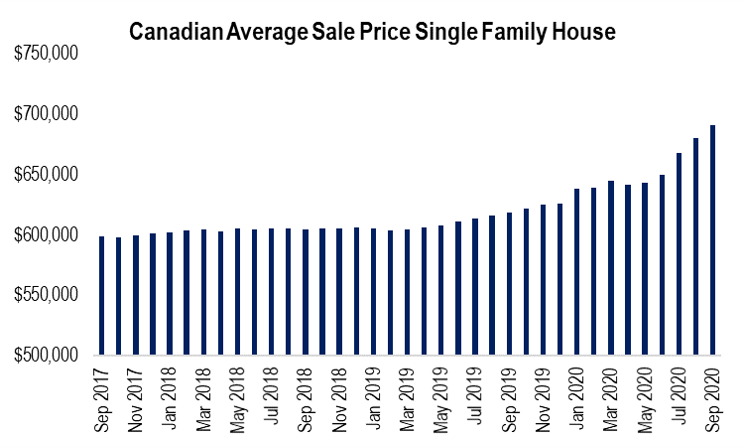

The decision to sell your home is complex given the many factors that come into play. However, the current dynamics of the housing market is making it enticing for Canadians to consider downsizing to a smaller home or even selling to rent. The pandemic has forced young families to work from home and the comforts of single-family homes has caused selling prices to skyrocket. The strong demand has fueled price increases across the country, with the Canadian Real Estate Association reporting an 18% and 13% year over year increase in house prices in Montreal and Toronto respectively to September 2020.

For some families the decision to sell is an easy one

For some families, the decision to sell their home is an easy one. Some have decided to spend the winter months in warmer climates, and the amenities and costs associated with owning home in Canada are no longer attractive. For others owning a smaller property or renting is a far more appealing option as they no longer have an interest or the resources to maintain a family home.

For the undecided – start from a financial perspective

For the undecided, a good way to approach the issue is start from a financial perspective. One needs to calculate the of cash flow required to continue owning your home including mortgage, property taxes, insurance and maintenance costs, compared to the cash flow you would need to either own a smaller home or to rent. In addition, you would need to compare how much you expect your home to appreciate in value in the future, versus the return you expect to generate by investing all or a portion of the proceeds of your house sale.

Gaining access to your home equity

Most Canadians have a significant portion of their net worth tied to their homes. Therefore in selling and transitioning to a small property, individuals gain access to significant equity they have built over the years. This liquidity provides them with the flexibility to finance their lifestyle goals, as well as advancing some estate planning by helping their children that may need some financial support.

There is a disadvantage in downsizing and investing the proceeds in a diversified portfolio, as realized capital gains and income generated from these investments are taxed, whereas holding onto to your principal residence allows for the value of your home equity to appreciate without any tax leakage. In addition, there is the added responsibility of effectively reinvesting the proceeds from the house sale.

Next step: How to best proceed in selling your nest egg?

For families contemplating selling their nest egg, we believe it is worthwhile discussing the options with an advisor who can uncover the pros and cons of various scenarios and highlight how these will impact your financial and estate planning objectives. We also believe that having an investment plan in place is important since simply investing in guaranteed investment certificates or other savings products will generate minuscule returns in the current environment.

The decision to sell you family home can be an overwhelming experience as it is another step toward the next phase of your life. However, with the support of your family and friends the transition provides an excellent opportunity to benefit from the wealth accumulated in your home and support the ones you love.

Related Articles

Estate Settlement & Administration, Investment Management, Kerr Family Office

Accounting Services, Kerr Family Office, Kerr Fundamentals, Kerr Integrated, Personal Financial Planning

Accounting Services, Investment Management, Personal Financial Planning, Personal Tax Services