The appeal of investing in unconventional assets

Just before Christmas, countless middle-aged men across Canada likely spent hours scouring shoeboxes containing their childhood mementos. Why? Our guess would be that news that a Wayne Gretzky O-Pee-Chee rookie card sold at auction for $1.29M probably had a lot to do with. The value of sports cards and a whole host of unconventional assets have risen in value in recent years. Rising disposable income and strong capital markets have likely helped steer individuals to consider investing in cryptocurrencies, fine art, and classic sports cars.

The Ultra-wealthy have been supporting collectibles as an asset class for centuries

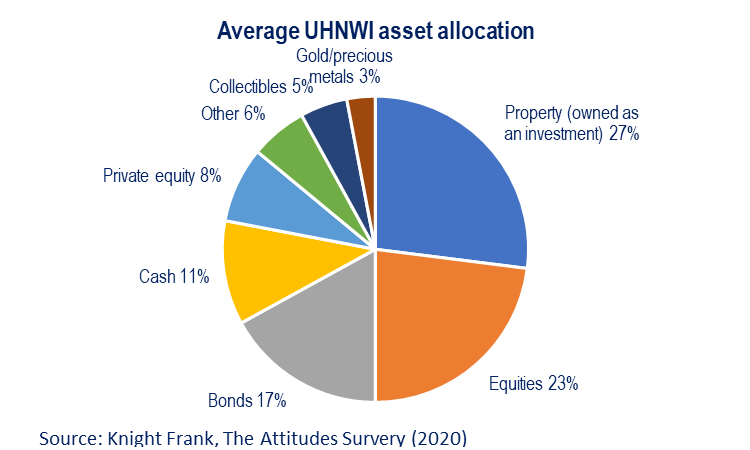

The growing interest in unconventional alternative assets may be new to some investors, but the ultra-wealthy have been financially supporting the asset class for centuries. In fact, the Medici family were patrons of great Renaissance artists such as Michelangelo, Raphael, and Donatello. That interest has persisted to this day, and two recent surveys from Frank Knight and Credit Suisse highlighted that collectibles represent from 5-10% of a wealthy individual’s total net worth. While the collectibles markets had been strengthening prior to the COVID-19 pandemic, the period of isolation perhaps triggered more interest from investors as auction houses reported record sales in 2020.

Three factors driving the appeal in collectibles

The appeal of investing in collectibles is usually driven by three factors. First and foremost, investors have a deep passion for what they are collecting. For some a lifelong passion for art causes them to want to acquire paintings of established or aspiring artists. Second, is the desire to own a rare object. A collector of timepieces would want to own one of only 200 Rolex watches produced in the 1960s. Lastly, collectible investments have proven to a good store of value for future generations. A 2020 Credit Suisse report highlights that although returns for a wide range of collectibles over the last two decades have fallen short of traditional asset classes, returns have easily outpaced the rate of inflation.

While collectibles represent a small fraction of an investors’ net worth, it is highly unlikely to be an allocation initiated by a financial advisor. There are two primary reasons for this: First, financial advisors may not have the knowledge or expertise to advise clients on assets such as fine wines or paintings. Advisors can calculate the estimated future cash flows of a stock, bond, or a real estate property but it is a little more complicated when the asset does not produce a revenue stream. Second, while trading markets exist for investors to buy or sell both traditional assets like stocks and bonds, the market for collectibles is far less structured and does not provide investors with the same level of liquidity and transparency.

Platforms such as Masterworks allows investors to buy and sell shares in works of art

The growing interest in the collectibles and the emergence of technology platforms has led to the creation of new formats for the less affluent investors to invest in the space. Platforms such as Masterworks allows investors to buy and sell shares in works of art. The process begins with the team at Masterworks acquiring artwork that it registers with security regulators. The different pieces are then offered to investors, who purchase shares in a painting at a set price. Investors can choose to hold or sell their shares on a secondary market maintained by Masterworks. The “tokenization” of the asset class has broadened, and investors can now invest in art, sport collectibles and vintage automobiles.

Four steps to consider when investing in collectibles

For investors keen on investing in the unconventional asset class we would encourage that they consider four items. First, make sure that the assets you are buying are authentic. Unfortunately, the collectibles market is not free of hucksters trying to profit by selling everything from fake paintings to phony jewelry. Second, do not overpay for an asset. This is critical for any investment, but some investors can get caught up in the emotional desire to own a very rare asset, raising the risk of making a poor investment decision. Third, given below average liquidity investors should not invest funds that may be needed in the short-term. Lastly, be conscious of the transaction and management costs. Finder fees and auction premiums can add up quite significantly when investing in the assets.

Related Articles

Accounting Services, Kerr Family Office, Kerr Fundamentals, Kerr Integrated, Personal Financial Planning

Accounting Services, Investment Management, Personal Financial Planning, Personal Tax Services