Why defer tax when you can save it altogether?

Why defer tax when you can save it altogether?

With the RRSP contribution deadline past, most Canadians have turned their attention away from tax breaks and saving for the future – and back to everyday budgeting and spending. But there is another valuable tax-assisted tool that isn’t attached to a deadline: the Tax Free Savings Account. And, unlike the RRSP, which provides a long-term tax deferral, the TFSA lets you escape taxes altogether.

The Federal Government introduced the Tax Free Savings Account (TFSA) in its 2008 budget proclaiming it as “the single most important personal savings vehicle since the introduction of the Registered Retirement Savings Plan (RRSP)”. The TFSA, as its name implies, is an innovative vehicle that allows tax-free growth of the investments held within. And when you withdraw money from the account, no tax whatsoever is payable. That’s in contrast to the RRSP, which gives you a tax deduction when you put money in, but fully taxes all withdrawals.

Simply put, a dollar invested within a TFSA can grow faster than one invested in a non-registered account. This flexible, no-catch concept has been catching on with tax-weary investors and is becoming an integral financial planning tool – as an emergency fund, a savings vehicle for major purchases, and a component of their retirement income plan.

TFSA Annual limit

Currently, you can contribute a maximum of $5,500 for each calendar year to a TFSA. As with RRSPs, if you contribute less than that you can bank it for use in future years. As a result, if you were 18 or over when the TFSA was introduced in 2009, and have yet to contribute, as of 2017 you would have $52,000 of contribution room available. The annual limit was $5,000 from 2008 through 2012 and $5,500 thereafter, with the exception of 2015 when the limit rose to $10,000, only to be put back to $5,500 as of the following year.

TFSA has no contribution end date

Unlike the RRSP, there is no final year for TFSA contributions, so you can continue to contribute to your TFSA until the day you die, allowing you to benefit from this tax-free growth throughout your retirement years. And because TFSA withdrawals do not count as taxable income, they will not grind down your Old Age Security, which is subject to a clawback once your net income reaches approximately $74,000. This is an important consideration in determining how and when to fund your retirement income.

TFSA Eligible investments

A common misconception is that the TFSA is a cash account, which may be in part to its name, Tax Free SAVINGS Account, when in fact that’s not the case. The TFSA can hold similar investments to an RRSP, such as cash, GICs, bonds, mutual funds, stocks and exchange-traded funds. Although some investments generally are better held within an RRSP than a TFSA, ideally this decision should be made by reviewing your overall portfolio strategy, including all your registered and non-registered (taxable) accounts. This review should consider your risk tolerance and capacity, as well as the time horizon on when you expect to need to draw on your savings. You can then adjust the risk level and time horizon within each account, according to specific goals. For example, you may want to hold fairly liquid investments in your TFSA if you are saving for a down payment on a house or building an emergency fund, whereas longer-term growth securities may be suited to a retirement fund held within an RRSP.

Weigh tax efficiency against growth potential in your TFSA

Because of the TFSA’s ability to tax shelter income earned within the account, a rule of thumb frequently touted is to hold bonds and other interest-bearing investments that provide a steady stream of income and that would have been taxed at the highest marginal tax rate in a taxable account. The flip side is that your TFSA will miss out on higher yielding investments, such as dividend-paying stocks that can also provide capital appreciation. This is an important consideration, given that bond yields are at historic lows. Again, be sure to align your strategy with your risk tolerance and capacity.

Beware U.S. Stocks held with TFSA

When considering foreign dividend-paying stocks for your TFSA, keep in mind that you will have tax withheld at source by the U.S. Internal Revenue Service on income from U.S. stocks – generally at a 15% rate – whereas this is not the case in an RRSP, which as a pension asset is exempt from withholding tax under the Canada-U.S. Tax Treaty. In regards to other foreign investment income, depending on the country and treaty, the withholding tax can be as much as 30%. What’s more, you cannot claim a foreign tax credit to recover the tax withheld for TFSA investments. Consider holding U.S. dividend-paying stocks within your RRSP instead – or in a non-registered account, which, while taxable, is eligible for a foreign tax credit.

Reduce your family’s overall income tax bill

You can use the TFSA as an income-splitting tool. Because tax is calculated according to a system of graduated tax rates, the more income you make, the higher the tax rate on those greater amounts. By splitting income between your spouse and adult children, you can reduce your family’s overall tax burden. If you have personally maxed out your TFSA and RRSP contribution room, and other family members have minimal assets, you can gift money to them so that they may contribute to their own TFSAs. This allows you to multiply the benefit of the tax-sheltered income without any income attribution back to you. A TFSA might be a complementary strategy to consider with your adult children as a way to fund their university education where the RESP savings is not sufficient.

Withdraw one year, recontribute the next

You don’t sacrifice TFSA contribution room when you make a withdrawal. Unlike an RRSP, you can take money out of your TFSA and replace it later as part of the same contribution room. However, that room is only restored in the year following the withdrawal. So if you remove a sum of money from your TFSA this year, you must wait until next Jan. 1 to put the same amount back in. Assuming you don’t have additional contribution room, you would face the 1%-per-month overcontribution tax until the new year. As with the RRSP, the tax kicks in even if you are in an overcontribution position only briefly during the month.

Is a Spousal rollover available?

A TFSA can be an important estate-planning asset because the assets, where so designated, can be transferred tax free to your spouse’s TFSA account when you die. You must designate this in your will, or name him or her as the successor holder in the financial institution’s account documentation. This will not impact their own TFSA contribution room and allows your spouse to end up with additional assets that will be tax sheltered throughout their life.

When should you contribute to a TFSA versus an RRSP?

There may be times when you may not have sufficient cash available to make maximum contributions to both your RRSP and TFSA, particularly during your earlier income-earning years. This will bring a difficult choice – and the decision will depend on your specific situation. Consider the following key questions to ask when deciding between these two tax-assisted vehicles:

• Are you saving for a long-term goal or your retirement? If you are saving for a long-term goal such as retirement – particularly if you are currently paying tax at a higher rate than you expect to be paying during retirement – it probably will make more sense to contribute to the RRSP. You’ll get the benefit of an immediate tax deduction as well as the tax deferral on the income earned within the plan. However, should you expect to need the funds within a shorter timeframe, the TFSA may make more sense. The money within will earn income tax-free, and you’ll be able to recontribute back to your TFSA later, once you can afford to do so. Another option may be contributing the maximum amount to your RRSP and then use the tax refund that results from the deduction for the TFSA.

• Can you benefit from income splitting? If you already have amassed significant funds in your own RRSP, consider contributing to a spousal RRSP and to your own TFSA, as well as gifting money to your spouse to contribute to their TFSA, without worrying about income being attributed back to you. This allows you to benefit from the RRSP deduction and the tax-deferral on that money, as well as the tax-free growth within the TFSA.

• Are you a member of an employer pension plan? If you are a member of a company pension plan, not only will your ability to contribute to your RRSP be limited, but you’ll likely be looking forward to an above-average income in retirement in particular when it is added to your Old Age Security benefits, Canada (or Quebec) Pension Plan income, as well as the minimum required withdrawals from your registered retirement income find (RRIF). But without careful planning, you may inadvertently be put into a situation where some or all of your OAS benefits may be clawed back. Contributing to a TFSA instead of an RRSP may be the right option because amounts withdrawn from the former will not be included in income and as a result won’t impact the OAS clawback calculation.

Work with your advisor

A TFSA has become a crucial financial-planning component. You must consider your investment choices in concert with tax and estate-planning factors. It’s not an easy process, so you should work with a financial advisor who has a solid understanding of investment options as well as the tax and estate-planning rules. Doing so will help you make the most out of your retirement savings – and at the same time allow you to address any unusual cash needs along the way.

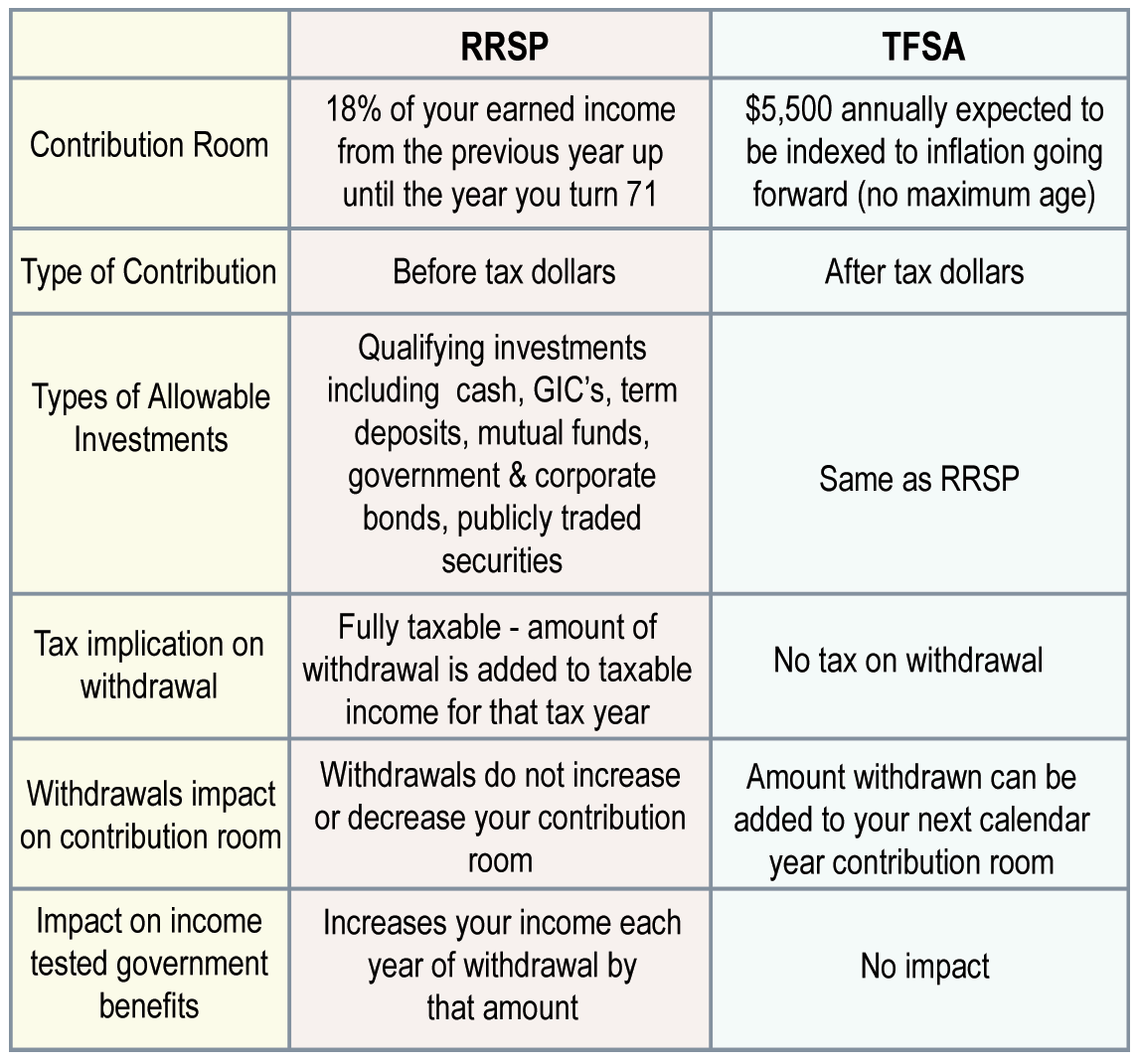

How a TFSA compares to an RRSP

RETURN TO HOME PAGE

RETURN TO HOME PAGE

Related Articles

Accounting Services, Kerr Family Office, Kerr Fundamentals, Kerr Integrated, Personal Financial Planning

Accounting Services, Investment Management, Personal Financial Planning, Personal Tax Services