February’s market performance continued to reflect the negative sentiment that has been on display since the beginning of the year. Skittish investors have been in a “risk-off” mode over worries of slowing growth in China spilling over into a global recession. Oil’s continuing decline and price pressures in commodities are adding credence to the slowing global growth thesis in addition to negatively impacting the efforts of central banks to reach their inflation targets. Widening credit spreads in the energy sector have spilled over into other sectors, a situation that could hold back economic growth. Another source of angst rests in the future pace and magnitude of Fed tightening – a byproduct of a reasonably strong U.S. economic recovery. Starting at the mid-point of the month, equities rallied. The causes for this hint at what markets will need to see before the current level of volatility subsides: stable and recovering oil prices, continued loose monetary policy, and some signs of stabilization in China’s declining growth trajectory.

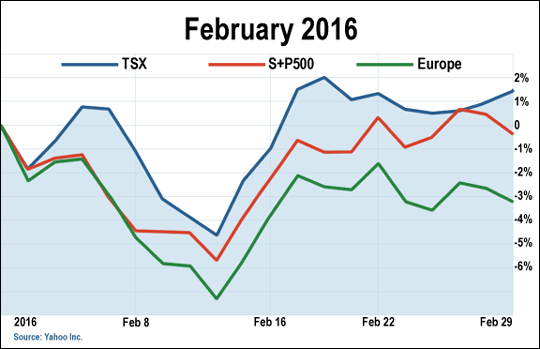

The month’s first half saw equity markets continue their downward spiral since January’s sell-off. Strong U.S. labour gains – 151,000 new jobs in January and the unemployment rate falling to 4.9% – did little to offset the economic risk to the U.S. economy caused by weakening global growth and the strong greenback’s detracting from exports’ GDP contribution along with its dampening effect on inflation. Disappointing Eurozone corporate earnings forecasts alongside the remote-but-growing possibility of a UK “Brexit” also continued to sour investor sentiment. Oil prices staged a temporary rally on expectations that Russia and OPEC countries would coordinate production cuts. In the Far East, Japan’s central banker re-iterated their commitment to a 2% inflation target and stated that there is “no limit to measures for monetary easing.” China’s currency continued to buck its weakening trend by posting its fourth straight week of gains – drawing down its foreign reserves by $0.5 trillion dollars in a concerted effort to ward off hedge fund speculators who have repeatedly shorted the yuan in expectation that it will weaken in tandem with China’s economy. Investor attention is also still nervously focused on the U.S. FED as labour gains, coupled with a 2.5% increase in wage gains over the past year suggest further rate hikes this year. Some solace was taken from the recent FOMC meeting notes that outlined the FED’s concerns over China’s slowdown and the current environment of tightening credit conditions caused by falling equities, a rising dollar and widening credit spreads. These comments would suggest that rates may remain accommodative for the rest of the year. For the first half of the month, Canadian and U.S. equities slipped 2.2% and 3.8% respectively. EAFE markets were also down 7.4%.

During the month’s second half, risk assets finally became back in vogue – investors taking the opportunity to buy on the recently excessive negative sentiment. Stability in the price of oil along with some positive economic data from China aided the rebound. Oil prices recovered as Russia and several of the OPEC majors agreed to freeze oil output. In China, government agencies announced further infrastructure projects while the PBOC committed to increased lending in order to help its struggling industrial sector while promoting more mergers and acquisitions. In the U.S., equities rebounded strongly on an upward Q4-GDP revision (now 1% vs. 0.7%.) Interim growth appears to be robust with personal spending, income, durable goods orders and residential investment all trending positively. The U.S. consumer, who is benefiting from job and wage gains along with savings at the gas pump, has also started to spend – evidenced by the PCE deflator accelerating 0.2% to 1.75. For the last two trading weeks of the year, Canadian, U.S. and EAFE equities rallied 2.4%, 4.5% and 4.7% respectively.

During the month’s second half, risk assets finally became back in vogue – investors taking the opportunity to buy on the recently excessive negative sentiment. Stability in the price of oil along with some positive economic data from China aided the rebound. Oil prices recovered as Russia and several of the OPEC majors agreed to freeze oil output. In China, government agencies announced further infrastructure projects while the PBOC committed to increased lending in order to help its struggling industrial sector while promoting more mergers and acquisitions. In the U.S., equities rebounded strongly on an upward Q4-GDP revision (now 1% vs. 0.7%.) Interim growth appears to be robust with personal spending, income, durable goods orders and residential investment all trending positively. The U.S. consumer, who is benefiting from job and wage gains along with savings at the gas pump, has also started to spend – evidenced by the PCE deflator accelerating 0.2% to 1.75. For the last two trading weeks of the year, Canadian, U.S. and EAFE equities rallied 2.4%, 4.5% and 4.7% respectively.

At the end of the month, Canada’s TSX was the only major index in the green at 0.4% with once-downtrodden sectors such as Materials (+18%) and Metals/Mining (+28%) supporting the gain. In local currency terms, the S&P 500 skidded sideways at 0.1% while the EAFE index declined 1.8% – both of which were further sullied from a 4% gain to the loonie – bringing them down to -4% and -6% respectively. Despite the late-month rally in equities, the U.S broad-based bond index continued with its “risk-on” stance – finishing up 1% for the month while Canadian bond investors gained 0.2% their index. Oil stabilized this month – finishing up 7.4% to $33.75 bbl.