Economic Overview

The final quarter of 2022 offered a much-needed respite from what can only be characterized as a tumultuous year for investors, defined by generationally high inflation, historically aggressive interest rate hikes and an ever-present threat of recession.

Markets began Q4 with a ‘relief rally’ in response to oversold conditions at the end of Q3. Investor optimism continued into November in part due to a growing number of price indicators that implied inflation pressures had finally peaked. October CPI in the US advanced ‘only’ 0.4% month on month and 7.7% from a year ago, both lower than expected. Asset prices finished November higher as investors gained confidence through a statement from Federal Reserve Chairman Powell which noted that interest rates would only need to rise ‘somewhat’ higher than previously projected.

However, true to 2022’s pattern of investors bidding up markets in anticipation of an end to the interest rate hiking cycle followed by disappointment and lower asset prices, central bankers once again acted on cue with 7 out of 10 of the major central banks lifting rates in December. Furthermore, in the face of economic data showing obvious signs of slowing growth in conjunction with several negative corporate earnings announcements, markets finished the month of December broadly negative.

2022 has arguably been the most difficult year for investors since the Great Financial Crisis of 2007-08 from both a return and volatility perspective. Encouragingly, widespread vaccinations and less lethal strains of COVID-19 allowed pandemic-weary populations to move back to a semblance of normalcy. However, supply chain disruptions, lingering excess consumer savings and Russia’s invasion of Ukraine leading to Europe’s major supply of gas moving offline all contributed to inflation surging to the highest levels in 40 years. Central bankers’ early assessment of higher prices being transitory placed them firmly ‘behind the curve’ requiring them to embark on the most aggressive tightening campaigns in decades, effectively triggering sharp selloffs in both fixed income and equity markets on the year.

With each rate hike, the incremental burden brought to bear on consumers and businesses increased, and with that the possibility of recession. To date tight labor markets coupled with a resilient consumer have combined to delay its arrival. However, higher prices eroded pandemic induced consumer savings and the higher cost of debt will reduce margins and put mortgage rates out of reach for the average buyer further depressing housing activity. Thus, as we enter 2023, a recession in the next twelve months seems more likely than not.

Equity Markets

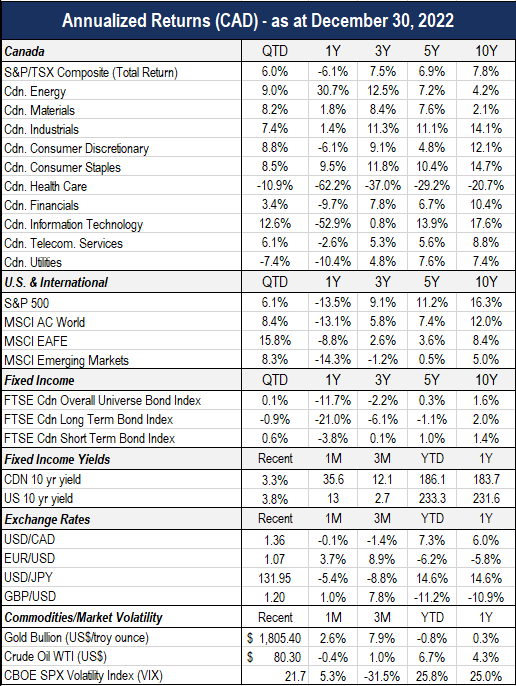

Equity markets benefited from strong performance in the final quarter of the year, with the MSCI AC World and S&P/TSX finishing the quarter up 8.4% (CAD) and 6.0%, respectively. Much of the progress was made in November, as investors balanced ongoing caution from central banks with strong indications that the pace of policy tightening would slow given signs that elevated inflation could be cooling. Except for the Consumer Discretionary sector (read: Tesla’s share price implosion), every sector on the MSCI AC World index was positive on the quarter, with 5 of the 10 sectors finishing up over double digits.

During the quarter, Energy was yet again the standout performer, progressing on account of record profits in Q3 as well as the prospect of Beijing moving away from its ‘Zero-Covid’ policy, increasing energy demand expectations. A falling dollar also provided a tailwind for the broader commodities complex, especially gold. Other strong performers over the quarter were the Industrials and Materials sector, which benefited from the improving outlook on China.

For the year, Energy was by far the best-performing sector as the early-year price surge in oil and natural gas prices due to increased geopolitical risks and reduced Russian supply on account of the Russia’s invasion in Ukraine, helped push energy stocks sharply higher. Defensive sectors specifically Utilities, Consumer Staples, and Health Care were the next best performing sectors as investors rotated towards less economically sensitive segments of the market amidst an increase in the risk of a recession.

While the strong performance during Q4 took the major indexes off their lows of the year, most finished the year down heavily scathed, with markets having their worst performance since 2008 with the MSCI All Country World index declining by -13.1% (CAD). The tech sector or those sectors with significant exposure to high-growth companies were the biggest losers on the year with the NASDAQ 100 finishing down -33.4% (CAD). The S&P/TSX was relatively spared due to its commodity tilt, finishing the year down ‘only’ -6.1% (CAD).

This divergence between defensive sectors or ‘Value’ stocks relative to ‘Growth’ stocks was perhaps the defining theme for equity markets during 2022, with Value significantly outperforming. This was due to both the ‘frothy’ state of growth stocks at the outset of the year on account of their pandemic related runup leaving them with further to fall as interest rates increased and future cash flows were subjected to higher discount (interest) rates. The S&P 500 Growth Index traded at 25.6 times earnings at the beginning of 2022 and dropped to 18.0 times by end of year. Conversely, the S&P 500 Value Index dropped only from 16.6 times to 15.6 times by year end

Fixed Income Markets

Compared to the first three quarters of the year, the Canadian fixed income market in Q4 was uneventful, with the FTSE Canadian Bond Universe finishing up 0.1%. This was in stark contrast to the index’s performance for the entire year, which featured the worst return on record. This poor performance can be attributed to central bankers hiking rates more aggressively than expected to combat high inflation, which caused the yield curve to surge. Over the course of 2022 the FTSE Canadian Bond Universe finished the year down -11.7%, while in the US, the Bloomberg US Aggregate Bond Index declined -13.0% (USD).

For Q4, government bond yields in both the US and Canada edged slightly up, reflecting some investor disappointment at the hawkish action from central banks as both the Federal Reserve and Bank of Canada lifted policy rates twice during the quarter. Conversely, corporate bond spreads tightened across the curve on improved risk sentiment, causing investment grade and high yield bonds to outperform government bonds over the quarter with the FTSE Canadian Corporate Bond Index up 1.0% compared to the FTSE Canadian All Government Bond Index down -1.9%.

A highly restrictive monetary policy setting over the year coupled with a lack of foresight in the nature of the policy shift caused nearly every segment of the fixed income market to experience declines, especially those with long durations as investors reevaluated the implications of an end to the easy money regime. As a result, the FTSE Canadian Long Term Bond Index declined -21.0% over the year, compared to the FTSE Canadian Short Term Bond Index, which was down -3.8% over the same period.

Relative bond duration performance continued to deepen into year end, shifting the yield curve into an inverted position. The yield spread on the 2-to-10-year bond in the Canada and the US moved from 0.48bps and 0.77bps at the beginning of the year to -0.76bps and -0.57bps twelve months on, respectively. As the current curve sits at the steepest inversion since the early 1980s, we are reminded of the tendency for such a curve to precede recessions.

Outlook & Portfolio Positioning

After a turbulent 2022 (to say the least), markets still face an uncertain 2023. Investors can take some solace that, given lower equity valuations and more attractive bond yields, the associated risks have diminished, and opportunities have begun to present themselves.

The major factors contributing to uncertainty are well established, but their potential outcomes are less so.

Inflation remains worryingly high, and while it seems to be past the peak, its path and timeline to more manageable levels is less obvious.

While central bankers were clear and resolute in their mandate to reduce inflation in 2022, one only needs to refer to 2021 when they considered high prices ‘transient’, which arguably put them ‘behind the curve’, to see that their actions have consequences, which may be unintended or poorly executed.

The risk of recession is increasing and if so, how severe will it be? Services and manufacturing data point to a broader economic slowing. With wages remaining firm and the cost of debt now higher, firms will inevitably need to navigate added pressure on margins. Markets are forward looking machines, but if a recession is unknown, to what extent has it been priced in?

Ongoing geopolitical uncertainty includes but is not limited to China’s stop-start COVID-19 policy, war in Ukraine and resulting energy prices in Europe, political divisiveness in the US, climate change, climate change policy, and so on… Endogenous variables are always present and difficult to completely discount, but 2023 seems particularly fraught.

So how do we position portfolios to navigate the current environment?

Firstly, maintain a high-quality bias. With slowing growth likely and as the debate between hard and soft landing continues, quality brings both confidence and maintains value over the long term. Second, continue to embrace diversification, which is the dominant factor for risk-adjusted returns.

While there stands to be a few more twist and turns ahead, with inflation trending down and central bankers speaking of final rate cuts, we can take comfort that we are most likely past the point of peak volatility.