Economic Overview

After experiencing one of the sharpest and deepest economic recessions in modern history in 2020, the global economy entered a period of recovery in 2021.

Availability of vaccinations in conjunction with population age, healthcare infrastructure and capacity, and economic policies helped dictate the robustness of each country’s recovery. Naturally, there were divergences. US, Canada, and Europe, along with various other regions, were able to successfully vaccinate large proportions of their population and reopen more broadly, leading to a sharper pickup in activity. Conversely, Japan, Australia and China imposed restrictions, and emerging countries had less access to vaccinations and in both cases, experienced a lag.

Through the year, central banks continued to favor accommodative measures to continue to offer backing to business activity and improve consumer sentiment with the primary goal of returning the labor rates to pre-pandemic levels. Governments remained supportive as well, extending crisis response programs like that of income support in the US and Canada or furlough measures in the UK, before paring them back in the fall as labor markets improved.

At the beginning of Q4, the debate about the ‘transitory’ nature of inflation took another turn as the Consumer Price Index (CPI) for November in the US jumped to 6.8%, its highest reading in almost 40 years, while Canada’s CPI reached 4.7% for the same period. Higher prices, in conjunction with a rapidly tightening labor market, forced the Fed and Bank of Canada to shift to a more hawkish stance. Both central banks have signaled several rate hikes over the course of 2022. The Bank of England surprised markets by raising its main rate 15 basis points to 0.25%. The EU Central Bank has expressed a similar sentiment but sees rate hikes as a 2023 story. Curiously, China moved the opposite way, showing more of an easing bias to exercise caution on account of excesses of financial leverage and support for financial and regulatory reforms.

Economic momentum, although generally positive, became more muted as the end of the year approached as cases of the new Omicron variant surged coupled with continued supply and labor constraints, and a slowing China due to previously noted reforms.

Fixed Income Markets

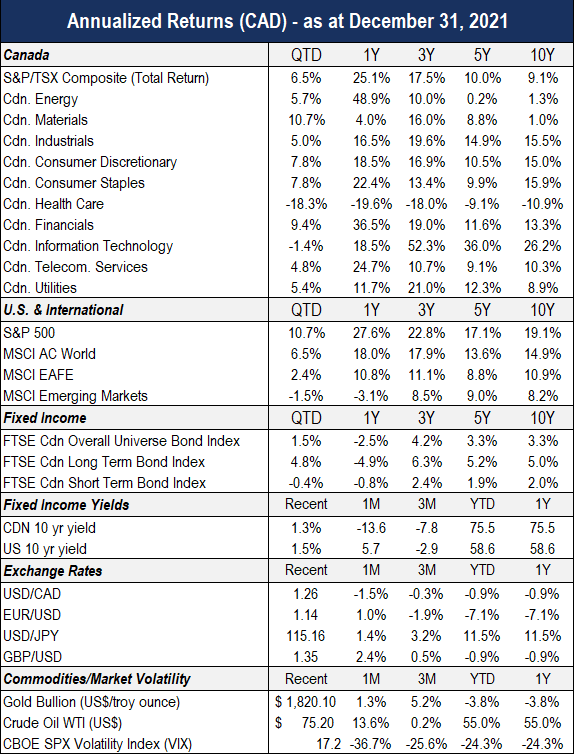

Bond markets had a lot to contend with over the course of 2021, given the prospect of rising inflation, remerging variants, and an imminent interest rate tightening cycle. The result was a sub-par year of returns for an asset class from which investors have come to expect consistently positive returns, with the FTSE Canadian Overall Universe Bond Index down -2.5% for 2021.

Yields generally trended higher (and bond prices lower) at the start of the year in anticipation of the economy reopening. However, as the Delta variant presented itself as a real threat to the economy, rates responded by drifting lower. Finally, as inflation fears were realized with multidecade high CPI numbers, yields rose once again.

Performance across the fixed income spectrum was mixed as corporate bonds generally outperformed government counterparts. After credit spreads widened on account of the onset of the pandemic, spreads ended 2021 narrower than pre-pandemic levels as investors came to appreciate highly accommodative central banks, generally improving corporate earnings and economic outlook as well as demand for riskier debt amidst low rates. For 2021, the FTSE Canada All Corporate Index finished with a return of -1.3%, compared to -3.0% for the FTSE Canada All Government Index.

Approaching the end of the year, the yield curve began to flatten, reflecting higher than expected inflation and the increased potential for rate hikes from both the Fed and Bank of Canada in 2022. Longer duration bonds went on to outperform shorter duration bonds in Q4, with the FTSE Canada Long Term Bond Index returning 4.8% while the FTSE Canada Short Term Bond Index returned -0.4% over the same period.

For the better part of the year, markets and central bankers concluded that as the labor market returned to normal, so would inflation. However, labor force participation has yet to move materially after a modest recovery in 2020. The initial assumption from economists and policy makers was that as vaccinations progressed and enhanced unemployment benefits were phased out, workers would return to the fold. This has proven incorrect, with labor market dynamics proving more complex, which is perhaps understandable given the lack of precedents coupled with the notable digital and technological structural shifts. Regardless, it is has become impossible to ignore that the pandemic related hit to labor participation is probably more structural in nature and will take more time to normalize. Thus, the case for normalizing policy by way of increasing the pace of tapering and hiking rates is likely.

Equity Markets

2021 proved to be another historic year for equity markets with the MSCI World Index returning 21.3% (CAD). Throughout the year developed markets experienced a relatively steady rise; the S&P 500 registering 70 record highs during the year, finishing the year with a return of 27.6% (CAD). Canadian stocks, while underperforming the US market, closed out their best year since 2009, with the S&P/TSX composite returning 25.1% on the year.

Emerging Markets and China were the worst performing major cohorts. MSCI Emerging Market index returned -3.1% for the year, reflecting the pandemic’s disproportionate impact on those nations, as well as the disconcerting trend of deteriorating political stability (perhaps not unrelated). Chinese equities also continued to face headwinds, with MSCI China ending down -22.7% on the year, on account of regulatory changes and imbalances in the property market, coupled with COVID-19 lockdown measures and an appreciating US dollar.

In developed economies, access to vaccinations, as well as fiscal and monetary accommodation supported an improving economic backdrop resulting in strong corporate earnings. While markets moved steadily higher over the course of the year, the looming fear of new variants, as well as a policy response from central banks due to inflation pressures kept investors on edge or as the old investor adage goes, ‘climbing the wall of worry’.

The year was also marked by a notable transition and/or asset rotation within investors’ portfolios. The first few months saw a ‘reflation’ environment where low-duration assets performed better than high-duration assets. Resource and other cyclical stocks like that of financials rose quickly after it was made known in November 2020 that vaccines were effective. Amid concerns of Delta, this trend reversed, until markets deemed Omicron less of concern, where it reversed back.

Energy was by far the best-performing sector in both US and Canadian markets due to a surge in oil and natural gas prices on account of supply being unable to meet unanticipated demand. Real estate and information technology were also strong performers as investors sought protection from inflation via real estate and financials, while information technology benefited from continued strong earnings and the familiar defensive rotation following the Delta and Omicron waves.

More hawkish central banks gave rise to some uncertainty towards year end. However, signs that global supply constraints may be fading and a belief that inflationary pressures are close to a peak has helped limit the negative impact from tighter monetary policy stances.

Outlook & Portfolio Positioning

While the pace of economic growth in the coming year will undoubtedly moderate it will most likely remain positive, barring the emergence of a more virulent strain of COVID-19. Households possess a historically high amount of savings, while corporate balance sheets are very healthy, putting them both in a position to boost spending. Second, businesses need to rebuild inventories, as well as increase capital expenditure to both increase capacity and ease supply chain bottlenecks. The greatest risks to that broadly benign outlook include central bank policy and the potential for policy mistakes in addressing rate tightening, inflation and the extent to which it proves more persistent, and of course the evolution of the pandemic.

We expect volatility will persist as the market readjusts to a higher interest rate regime. Higher rates generally imply muted bond returns. We remain confident in the long-term prospect of our positioning which favors holding equities relative to fixed income securities. In recognition of valuation and inflation risks, our sub-advisors have been selectively raising exposure to higher quality bonds and continue to invest in growth companies that are trading at reasonable valuations.