Economic Overview

Where do we begin? 2020 will go down in history as a year we will never forget, yet in several ways wish we could. A once-in-a-century pandemic abruptly altered nearly every way in which we live our lives. The human and economic scars of COVID-19 will take a long time to heal. Nevertheless, for financial markets, 2020 ended up being a remarkably robust year. During the fourth quarter, the fog of uncertainty surrounding the pandemic began clearing. Investors looked beyond resurging infection rates and political unrest, instead focusing expectations on a vaccine-led economic rebound in 2021.

The monetary and fiscal response to COVID-19 has been extraordinary, with numerous policy lifelines keeping household incomes afloat and limiting corporate bankruptcies. These rescue efforts continued to provide the largest source of support to the global economy in the fourth quarter. We anticipate policymakers will remain accommodative in 2021 to nurture the recovery. In turn, this means that global debt loads will remain elevated for quite some time.

At what level does a government’s debt begin hurting an economy? The pandemic has incited a debate among economists to answer this question, and the truth is that no one knows for certain. However, as long as interest rates remain near zero, governments can handle much heftier debt burdens than were once thought possible. Policymakers expect their injections of aid to drive GDP growth in 2021 and assist with the unprecedented accumulation of global debt.

We do recognize that the historic magnitude of government spending in 2020 will remain in sharp focus for years to come. Countries will have to pay for their responses to COVID-19, which is likely to manifest in the form of increased taxation measures for consumers and businesses alike.

While near-term momentum will be challenged due the resurgence of the virus and new lock down measures, we are cautiously optimistic about a global economic recovery in 2021. We particularly think an expansion in service sector activity will ensue once the virus is relatively tamed. We believe the vaccine rollout obstacles witnessed in Q4 will prove temporary as countries overcome the complexities and bottlenecks surrounding mass inoculation.

Fixed Income Markets

Corporate and government bond yields continued to narrow last quarter as the risk‐on environment persisted. With yields at record lows, the cost of borrowing has dropped significantly, however this has also resulted in lower investment income earned on interest‐generating assets. Although all bond sectors appreciated in value last quarter, with yields as low as they are, very few fixed income investments managed to compete with equities.

Bolstered by an accommodative fiscal and monetary landscape, the investor optimism on display in Q4 caused corporate bonds to produce the strongest returns and once again outperform their government equivalents by a wide margin. This took place despite markets taking a breather from their stunning rally at the end of the third quarter.

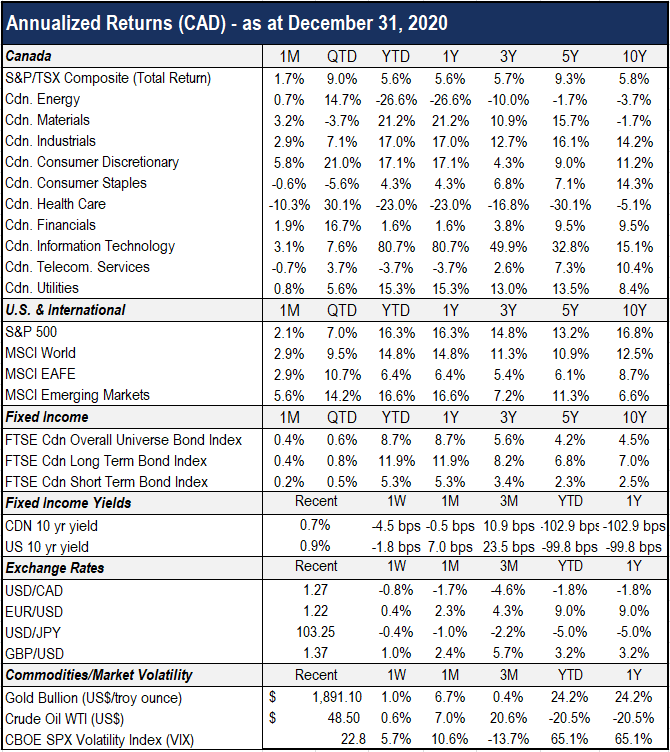

Over the last three months of 2020, long‐term bonds slightly outperformed their shorter‐term counterparts, with the Canadian long‐term and short‐term bond indices advancing 0.8% and 0.5%, respectively. In particular, long‐term corporate bonds drove performance in Q4, with the FTSE Corporate Long Index gaining 2.7%. Nevertheless, on a one‐year basis, long term government bonds were the most additive to fixed income returns, as yields collapsed during the pandemic and caused this sector to generate the largest gains. The FTSE Government Long Index advanced 12.7% in 2020.

Overall, the Canadian bond universe posted a return of 0.6% for Q4 and 8.7% for the year. Numerous fixed income indices reached double‐digit return territory over the last 12 months, an unusual feat for an asset class that is primarily meant to provide downside protection.

Going forward, our bond return expectations are muted, as we believe the asset class will resume its typically defensive role in portfolios. Nevertheless, we think fixed income instruments remain a critical component of portfolio construction despite their diminished attractiveness. We are confident that high quality fixed income securities will continue to offer a bedrock of stability during periods of market turbulence and/or weakness going forward. Furthermore, while we realize that an economic recovery will probably place upward pressure on interest rates, we are not battening down the hatches for a resurgence in inflation in the short‐term. The large amount of slack present in the economy represents too mighty a headwind.

Equity Markets

Investors who stayed the course last year managed to achieve double-digit returns from most major stock markets. While the economy remained constrained by COVID-19 containment measures, massive injections of stimulus along with medical breakthroughs to treat the virus manifested into a bullish outlook for stock market investors, with expectations for profit and economic growth in 2021 on the back of a vaccine-powered recovery.

Emerging markets led the charge last quarter, with the MSCI EM Index returning 14.2% over the period and 16.6% for the year. U.S. stocks were not far behind, with the S&P 500 advancing 7.0% and 16.3% over the same timeframes, respectively. International markets, represented by the MSCI EAFE Index, were a star performer in the fourth quarter (+10.7%) yet lagged on an annual basis (+6.4%).

Closer to home, the S&P TSX gained a relatively robust 9.0% last quarter yet trailed its peers on a one-year basis (+5.6%). For most of 2020, Canadian stock market returns were almost exclusively generated by gold companies and technology giant Shopify. In fact, the e-commerce solutions provider was singularly responsible for more than three quarters of Canada’s stock market performance last year. Canadian equity portfolios with underweight allocations to these segments of the market were therefore materially impacted. Similar patterns transpired south of the border, with the majority of U.S. equity returns in 2020 powered by technology behemoths Tesla, Amazon, Alphabet, Netflix and Facebook.

However, as equities continued on their upward march last quarter, the market leadership rotation that began in Q3 remained present throughout the final three months of the year. The mega-cap tech businesses and growth/momentum stocks that pushed markets higher for much of 2020 continued to lag, as the value factor stayed in the limelight and a much wider group of companies participated in the rally. This reversal in style leadership allowed the majority of our portfolios to outperform in Q4. Going forward, we believe this rotation towards value-oriented, cyclical and smaller-cap companies is poised to persist in 2021. While patience has certainly been tested for value investors over the past decade, we believe they will be rewarded as the global economy and corporate earnings recover from the external shocks experienced in 2020.

Outlook & Portfolio Positioning

We enter 2021 with investor confidence running high and markets already pricing in numerous positive developments. This makes us question if 2020 has eaten up some of 2021’s gains. Compared to consensus views, our outlook is relatively cautious. While we are optimistic that in due time efforts to contain the virus will engender an economic recovery, we recognize the underlying short- to medium-term risks that could unravel returns earned in recent months. Though these are challenges associated with an uneven economic recovery and elevated valuations, we are mindful that both monetary and fiscal accommodation remain a meaningful tailwind. Overall, the current market backdrop reinforces our conviction that client portfolios must maintain balance and diversity. Given our cautious outlook, we expect risk assets to deliver mid-single-digit annualized returns going forward.

We believe that our client portfolios with long-term investment horizons should continue to favour equities over cash and fixed income. For our clients with shorter-term horizons and/or cash needs, we will continue to maintain sufficient liquidity and cash reserves. Our underlying investment managers remain invested in proven, defensively-positioned businesses with strong quality and value characteristics.