Economic Overview

The global economy has shown itself to be resilient with the OECD marginally raising its global growth outlook for the year to 3.2% in early October. A key factor behind the strength has been declining inflation, which has boosted household spending and helped to offset the negative impacts of relatively tight financial conditions and geopolitical uncertainties.

Business surveys indicate strong services activity, with the Services Purchasing Managers Index in the US and EU in expansionary territory since the start of the year. However, manufacturing has struggled due to the shift in post-pandemic demand preferences and high inventory-to-sales ratios. September’s Purchasing Managers’ Index for the US and EU indicated contraction at 47.2 and 48.9, respectively.

China’s economy faces challenges, including weak domestic demand, excessive real estate debt and overbuilding. Second quarter growth was 4.7% down 0.8% from the prior quarter. Chinese officials have introduced a range of measures to support the economy, housing market, and stock market. These include cuts to policy rate and the reserve requirement ratio, the injection of billions of yuan into the stock market, and housing reforms. Despite these efforts, it is still unclear if China will reach its 5% annual growth target for 2024.

After a bumpy start to the year, recent inflation data indicates that more countries are nearing or meeting their central bank targets on account of declines in the price of food, energy and durable goods. In the U.S., the Consumer Price Index for August came in at 2.5%, down from 2.9% a year earlier. However, core inflation remained higher at 3.2%, increasing by 0.3% month-over-month, raising concerns about the future direction of prices.

A key contributor to slower price growth has been the cooling labor markets. In the U.S., the unemployment rate rose from a low of 3.4% in April 2023 to 4.2% this past August. In Canada, the unemployment rate jumped from 5% in January 2023 to 6.6% in August 2024, suggesting the economy might already be in recession However others saw less concern pointing to the fact that the higher unemployment rate stems more from new entrants to the market not layoffs.

As inflation subsides and labor markets cool, central banks are shifting their focus to supporting economic growth and employment. In September, the Federal Reserve implemented its first interest rate cut since the pandemic, lowering the benchmark rate by 50 basis points to a range of 4.75% – 5%. Chair Powell described the cut as a “recalibration” to manage economic risks, with future decisions based on incoming data.

Other central banks have also eased rates with the Bank of Canada (BoC) cutting rates three times since June, and the European Central Bank delivering a second cut in September, taking rates to 3.5%. The Bank of England followed suit, initiating its own easing cycle with a 25-basis point cut in August.

The BoC’s recent rate cuts underscore potential instability in the Canadian economy. Despite inflation reaching the BoC’s 2% target, ongoing economic challenges may lead to more aggressive rate cuts, especially if unemployment continues to climb.

Equity Markets

Global equities experienced increased volatility in the third quarter, however, due to various policy measures introduced in the quarter’s final weeks, ended positively.

The sell off in August was driven by soft manufacturing and job data in the U.S., concerns that the Federal Reserve may have waited too long to cut rates and increasing fears of recession along with concerns about valuation levels of big tech companies. The tipping point, however, seemed to be the surprise rate hike from the Bank of Japan (BoJ) which caused the Yen to surge by approximately 13% in value (compared to the USD) during the month of July. As the preferred currency for leveraged trades, the Yen’s sharp appreciation combined with high borrowing costs exacerbated losses, forced traders to abruptly unwind positions, ultimately triggering a broad sell-off in risk assets.

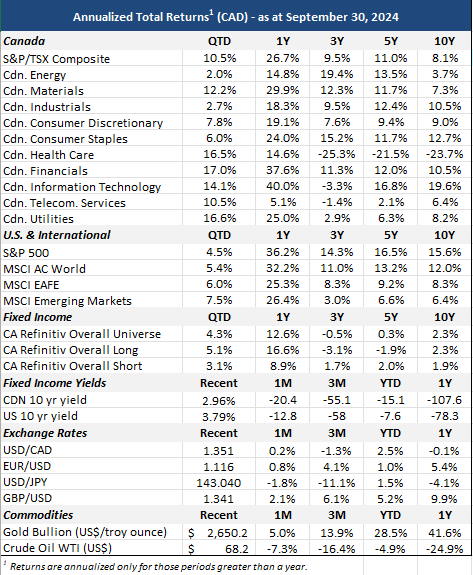

Soon after the sell off began, corporate earning reports posted their fastest growth since 2021 causing stocks to reverse course and lifting markets to their strongest week of the year. Market optimism was further elevated by Federal Reserve Chair Powell’s speech at the Jackson Hole symposium telegraphing the much-anticipated interest rate cut at the September meeting. U.S. equities regained momentum with the S&P 500 finishing the quarter up 5.9% in USD.

Under the surface, a shift in leadership was observed as falling interest rates boosted interest-rate sensitive sectors and previously neglected sectors like Utilities and Real Estate surged 18.5% and 16.1%, respectively. In contrast, market leaders from the first half of the year, such as Information Technology and Communication Services lagged, each of which ended the quarter up a modest 1.4%. Industrials and Financials also posted impressive gains, climbing 11.2% and 10.2% respectively (all in USD).

Eurozone equities followed suit, with the MSCI EAFE index increasing 7.3% in USD. Similar to the U.S., Real Estate, Utilities, and Healthcare drove performance as lower interest rates once again led investors to reconsider previously overlooked sectors. Energy and Information Technology, were the weakest performers in Europe, delivering negative returns.

Emerging market equities generally outperformed as Chinese and Hong Kong shares surged late in the quarter. MSCI Hong Kong and MSCI China rose 24.4% and 23.6% in USD, respectively, after the Chinese government announced a range of monetary and fiscal stimulus aimed at reversing an economic slowdown.

Canadian equities outpaced U.S. equities, finishing the quarter up an impressive 10.5%. Again, falling yields provided strong support to banks and rate-sensitive sectors, such as Real Estate and Utilities which posted gains of 21.9% and 15.3%, respectively.

Fixed Income Markets

In Q3, global monetary policy experienced a significant shift as many major economies initiated their interest rate cutting cycle. The prospect of lower rates spurred gains in global fixed income markets, with the Bloomberg US Aggregate Bond Index – a broad measure of U.S bond performance – returning 5.2% for the quarter, reflecting sold gains across both government and corporate bonds.

The Federal Reserve’s decision to cut the policy rate in September was undoubtedly the most noteworthy market event of the quarter. The decision followed a series of disappointing data, including weaker-than-expected July non-farm payroll data, a rising unemployment rate, and larger-than-anticipated drop in August inflation. In response, the Fed implemented an impressive 50 basis point rate cut, while setting the stage for additional cuts in the near term.

The size of the rate cut led to a broad decline in yields with the 2-year Treasure yield falling by 107 basis points, and the 10-year yield dropping by 58 basis points by quarter end, effectively normalizing the previously inverted yield curve. A steepening yield curve, where long-term yields are rising faster than short-term yields, generally indicates expectations of a prolonged low-interest rate environment.

In response to declining prices and rising unemployment, the Bank of Canada (BoC) followed its initial rate cut in Q2 with two additional cuts of 25 basis points in Q3. This led to a decline in yields and thus an increase in bond prices. The FTSE Canada Bond Universe returned 4.7% for the quarter. The Canadian corporate bond put in an almost identical performance, signaling no significant shift in sentiment toward corporate debt despite a change in the policy rate.

Although Canada’s headline CPI reached the BoC target of 2% in August, the central bank remains concerned with inflation in the service sector. However, the BoC’s primary focus is likely the steady increase in unemployment, which has been climbing since February. In August, the unemployment rate rose to 6.6%, up 0.2% from July and 1.1% higher than the same period last year. This troubling trend may prompt more aggressive rate cuts in the future.

Looking Forward

Globally, economic conditions continue to be mixed, with sluggish manufacturing activity but strong services activity in the US and EU, increasing unemployment rate in Canada, and weak demand in China dampening growth prospects. However, as inflation moderates and labour market pressures ease, policy rate reductions should continue which will help to stimulate activity. And, more positively, corporate fundamentals remain strong, which should help with weakness in the labour market. Profits improved in the second quarter, while earnings estimates for the third quarter suggest continued resilience.

There are some risks to watch. The timing and scope of interest rate reductions will remain data-dependent and carefully calibrated to ensure that underlying inflation pressures are durably contained. And any surprises in the pace of economic growth or inflation could lead to disruptive corrections in financial markets. These risks are particularly acute in high-debt environments, be it within corporate, household, or government sectors, especially as significant debt refinancing looms and rates remain higher than normal levels and as debt-to-GDP ratios are much higher than in the 2010s.

Additional risks include ongoing geopolitical conflicts and the upcoming U.S. election. Asset markets, which are inherently averse to uncertainty, could react sharply to any serious escalations in the conflicts in the Middle East and Ukraine. As we enter the home stretch of the U.S. election of both the presidency and Congress, the race remains extremely close and thus yet fully priced by the markets..

In addition, valuations in the U.S. seem to be stretched or at the very least ‘priced to perfection’, which not only raises the question of future returns, but also risk of a material drawdown if the economy stumbles.

Overall, our portfolio positioning remains unchanged. In recognizing the growing concentration and valuation risks in certain parts of the market, we continue to favor a geographically diverse equity portfolio. We believe in the importance of diversification to manage risks and take advantage of opportunities in parts of the market that are not overvalued and continue to focus on quality companies with strong balance sheets and earnings visibility. Fixed income allocations are conservatively positioned with a preference for shorter duration investment grade bonds.