Economic Overview

Over a year has passed since the pandemic-induced volatility that led financial markets to their low point. And just as the season has turned to summer, it appears as if the world has turned over a new leaf as well. Numerous cities across the globe have begun to reopen their economies, vaccine administration levels are reaching new heights each day, global GDP expectations are being revised higher, inflationary fears have abated, and equity markets have enjoyed their fifth consecutive quarter of positive gains. We find ourselves wondering what would have been easier to predict – the calamitous COVID-19 pandemic itself, or the fierce V-shaped economic recovery that has since ensued.

A combination of fiscal stimulus efforts and vaccine rollouts continued to drive economic output in the second quarter of 2021. Within the developed world, the United States remained on track to stage the strongest rebound. The country’s economic activity benefitted from an accelerated pace of inoculation and, as a result, removal of restrictions. Vaccination progress in Canada sped up as well, with numerous provinces currently in, or about to move into, Stage 3 of the reopening process.

Meanwhile, vaccination rates in Asia, South America and emerging Europe were slower due to vaccine hesitancy and/or access. The apparent success of vaccines at preventing severe illness or death from the Delta variant should mean that it does not pose a major threat to recoveries in advanced economies. However, the variant does pose a greater threat to recoveries in the emerging world. This decoupling will continue into the second half of the year, thereby exposing certain geographies to varying degrees of economic and health risks.

As the global economy continued to recover from the shackles of pandemic restrictions, concerns over rising inflation weighed on investors earlier in the year. However, in Q2 a growing acceptance began to emerge that a degree of price pressure was tolerable, given strong reopening demands. We believe currently elevated prices reflect short-term drivers and temporary supply constraints, some of which began to ease in Q2. While these transient factors should moderate by 2022, we remain watchful of indicators that could signal the end of the low inflation era we have witnessed for over 30 years, such as accelerating wage growth or unwieldy price appreciation.

Fixed Income Markets

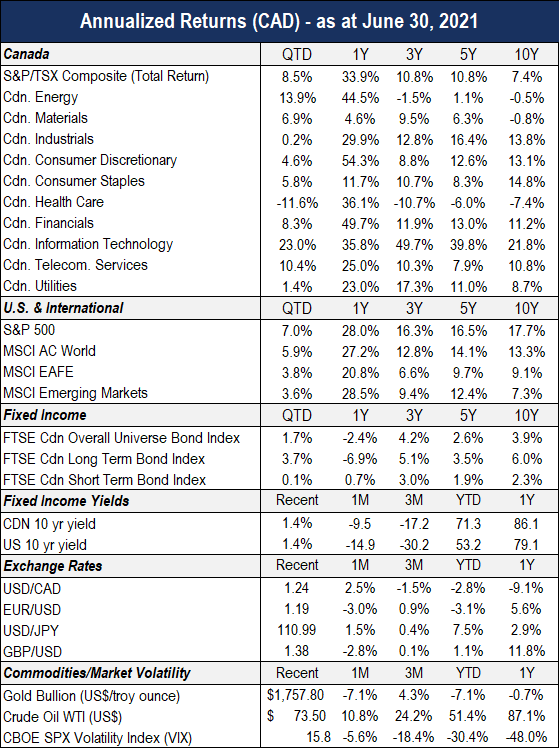

Bond markets experienced modest gains in the second quarter, which helped offset the turbulence witnessed in the first three months of the year. The FTSE Overall Bond Universe advanced 1.7% in Q2, bringing its year-to-date return to -3.5%. Corporate bonds fared slightly better than their government counterparts, returning 1.6% over the period while the federal bond universe gained 0.9%.

With regard to duration, longer maturity bond yields declined over the quarter while short bond yields increased, establishing a flattening effect across the yield curve. Since higher bond yields correspond to lower bond prices, fixed income portfolios with relatively longer durations outperformed their short-term equivalents over the quarter.

Last quarter, the U.S. Federal Reserve continued to stick to its view that mounting inflation rates largely represented transitory factors. Chair Powell also reinforced that the Fed was not considering tapering asset purchases this year. Median projections now reveal two interest rate hikes in 2023. The market’s reaction to the Fed’s announcement was modest, as pundits had already been pricing in rate hike expectations for 2023. The Bank of Canada reiterated similar commitments to easy money policies during the quarter, given the likelihood that inflation in Canada will drop back below 2% next year.

As economic indicators and vaccination rates improved over the quarter, central banks upgraded their forecasts for the economic recovery. As a result of these encouraging trends,

the Bank of Canada began tapering the pace of its monthly bond purchases. Pundits also believe that the Fed may be considering the timing of such an announcement, despite having reiterated this is not on the near-term horizon.

Going forward, our return expectations for fixed income portfolios remain relatively muted, particularly after the double-digit gains experienced last year. We envision low single-digit returns for 2021, and for bonds to continue recovering from losses experienced earlier this year. Nevertheless, we continue to believe fixed income instruments remain a critical component of portfolio construction. We are confident that a high-quality bond portfolio will provide a bedrock of stability during periods of market turbulence and/or weakness going forward.

Equity Markets

Investors who stayed the course in 2020 continued to earn positive gains from their equity portfolios in the first half of 2021. Predicated on fiscal stimulus efforts and a vaccine-powered reopening, the pro-cyclical trade remained in favour throughout April and May, with once-laggard sectors such as energy and financials being top performers over the quarter. The richly valued information technology sector lagged in April and May, but came back strongly in June, posting double-digit gains over the quarter.

The Canadian stock market (S&P/TSX) continued reaching new highs last quarter and remained the top performing geography, returning 8.5% in Q2 and 33.9% over the past year. Tech, energy, telecom and financials were the strongest sectors. The IT sector was particularly buttressed by the performance of Shopify, which returned more than 30% over the period.

South of the border, the U.S. stock market (S&P 500) gained 7.0% last quarter and 28.0% over the past twelve months. Markets were bolstered by macro tailwinds including President Biden’s bipartisan $1.2 trillion infrastructure plan and accelerating vaccine distribution trends.

International and emerging equity markets trailed their North American peers last quarter but were still in positive territory. The MSCI EAFE and EM indices returned 3.8% and 3.6% over the period. On an annual basis, these markets posted gains of 20.8% and 28.5%, respectively. Furthermore, corporate earnings results pushed all equity markets higher over the period, on the back of numerous upward revisions.

Going forward, we believe the rotation towards value-oriented, cyclical companies is poised to persist in the second half of 2021. While patience has certainly been tested for value investors over the past decade, they are being rewarded as the global economy and corporate earnings continue to recover from the external shocks of COVID-19. That being said, we also believe in the importance of balancing this exposure with high-quality growth stocks in order to achieve style diversification. Overall, we believe that stronger economic and earnings growth, as well as broad participation across sectors, continue to support modest equity upside in the near-term.

Outlook & Portfolio Positioning

Barring a severe return of COVID-19 infections on a global scale, we believe that stocks will deliver attractive returns during this economic expansion as they have done in previous cycles. We realize this scenario may still involve volatility and periodic pullbacks, which are normal and inevitable characteristics even in rising markets. The likelihood of market swings is not enough of a rationale for us to underweight equities at this juncture.

While our bias towards equities persists, we continue to respect the risk profiles of our clients. We have tactically positioned equity exposure at the upper end of target ranges for our clients with long investment horizons. Our clients with shorter-term horizons and/or liquidity needs continue to maintain sufficient liquidity and cash-equivalent reserves.

Our fixed income portfolios continue to overweight investment-grade corporate bonds with above-average income yields backed by strong businesses. Our equity portfolios are invested in a global mix of resilient, proven business franchises. Furthermore, we retain our conviction that all client portfolios must possess balance and diversity in order to manage risk.