Economic Overview

Markets picked up where 2022 left off, as the broad rally that started at the end of October continued into January. Investors (once again) anticipated an imminent end to the global monetary tightening cycle as inflation in the US cooled for the sixth successive month, with CPI at 6.5% in December, down from 7.1% the prior year. With China’s economy reopening and the EU avoiding economic catastrophe thanks to an unseasonably warm winter, investors not only embraced the prospect of a ‘soft landing’ scenario (read: mild recession) but began contemplating a ‘no landing’ scenario (read: no recession).

In February, optimism gave way to doubt in the context that ‘good news is bad news’, as the prospect of a rate hike fell into question and economic data proved more resilient than expected. The US and Canada added a greater than projected 517,000 and 150,000 jobs during January, respectively, with the unemployment rate ticking down by 0.1% to 3.4% in the US and holding steady in Canada at 5.0%. The PMI index also showed improvement with the survey rising above 50 (into expansion territory) in both the US and UK.

The European Central Bank, Bank of England, and Federal Reserve moved forward with expected rate hikes. The broad message that emerged from their accompanying statements: despite recent declines inflation remained too high and their job was not done. Inflation in January confirmed this as CPI in the US increased 6.4% year-on-year, with only a marginal change from the month prior, while hitting 8.6% in the EU.

With March, investor doubt turned to dread as higher interest rates manifested themselves in the collapse of two US regional banks: Silicon Valley Bank and Signature Bank. While neither were amongst the largest banks in the country, both ranked in the US’s top 25 in size with assets over $100B. To make matters worse, the crisis seemed to metastasize to Europe by way of Credit Suisse, making the problem appear systemic.

While the role of regional banks in the US should not be understated as they account for approximately 70% of loans to the commercial real estate sector, comparisons to the Great Financial Crisis (GFC) are misplaced as the two situations bear little resemblance.

Banks are both better capitalized and regulated than before the GFC. Similarly, with the benefit of hindsight, regulators have developed effective playbooks to navigate such crises. Through various “alphabet programs,” such as the recently conceived Bank Term Funding Program (BTFP), they could very well have contained the present issue. And Credit Suisse’s problems were longstanding mismanagement issues which had been affecting the bank’s performance for some time; all they really needed was a “push”.

The failure of several regional banks in the US and Credit Suisse in Europe contributed to new bouts of volatility, raising concerns about the broader banking system and the potential for wider fallout and increasing the risk of recession. Central banks seem to be at the end of their tightening cycle, but tighter financial conditions and the banking crisis have narrowed the window for a soft landing.

Equity Markets

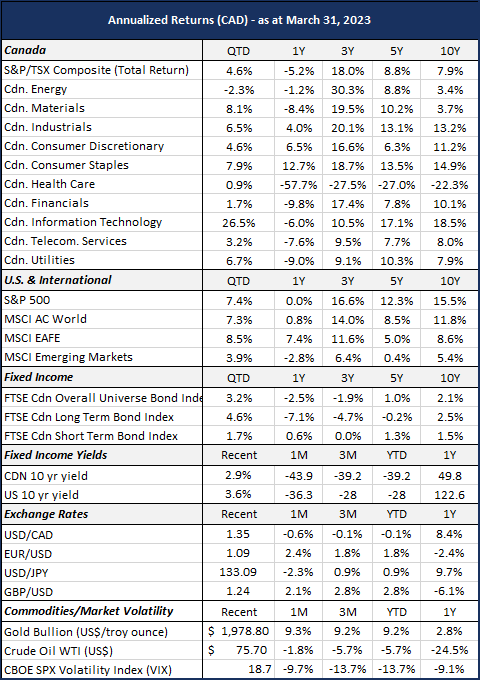

Despite the biggest bank failure since the Great Financial Crisis and fluctuating economic data, global equities finished the quarter broadly higher, with the MSCI All Country World Index up 7.3% in CAD.

While value outperformed growth during 2022, the trend so far reversed in 2023, with the S&P 500 Growth Index up 9.2% compared to the S&P 500 Value Index’s 4.6% (all in USD). The initial driver seemed to be a combination of attractive valuations on the back of 2022 poor performance and the early decline in bond yields that made the valuation of long duration assets like tech and tech-oriented consumer discretionary and communication services companies more attractive.

As markets began to falter in February, followed by the regional banking crisis in March, mega-cap tech companies continued to outperform as safe havens given their essential role in our modern society, their well-capitalized balance sheets, and strong cash flows. Information Technology and Communication Services were the best performing sectors in the S&P 500 for the quarter, finishing up 21.5% and 20.2% (all in USD), respectively.

On the S&P 500, the financial sector was understandably the worst performer in the first quarter, finishing down -6.1% (USD) as the regional banking crisis weighed on bank stocks and financials more broadly. Energy also lagged the market, on concerns about global economic growth and subsequent weakness in consumer demand. As the worst performer on the S&P TSX, the energy sector finished down -3.6% (CAD).

Internationally, foreign markets were stronger than those in North America. The MSCI EAFE increased 8.5% (CAD) compared to the S&P TSX and S&P 500’s 4.6% and 7.4% (all in CAD) respectively, as economic data in Europe was better than expected and European banks were viewed as mostly insulated from the US regional banking crisis. Real estate was the major laggard on account of credit and high financing concerns coupled with weaker occupancy rates as the MSCI Europe Real Estate Index finished the quarter down -5.6% (USD).

Emerging markets posted positive returns, with the MSCI EM finishing the quarter up 3.9% (CAD). The start of the year brought renewed optimism, given the reopening of China’s economy. However, February and March saw US-China tensions re-escalate through the spy balloon affair. The widespread loss of confidence in the US and European banks also weighed on performance.

Although equities have recovered from their lows from last year, they remain well below their all-time highs observed at the beginning of 2022. Valuations in certain sectors and geographies of the market remain reasonable. The greatest risk to markets, separate from a resumption of the banking crisis, is weaker than expected corporate earnings. Margins continued to be pressured as inflation remains doggedly high in certain sections of the economy, labor markets tight, and borrowing costs high. A potential recession could deteriorate margins more than expected, which would be negative for valuations.

Fixed Income Markets

Following the worst ever calendar year for fixed income returns, yield volatility continued into the new quarter, culminating in an unprecedented move in rates on account of the regional banking crisis. However, aided by both attractive yield opportunities and the anticipation of an end to the rate hiking cycle due to the increasing likelihood of a recession, investors embraced less risk causing the FTSE Canada Bond Universe to return an impressive 3.2% for the quarter.

At the beginning of January, the yield curve initially shifted lower as markets revised their outlook for rate hikes lower due to news of weaker inflation and China re-opening. While both the Bank of Canada (BoC) and the Fed raised policy rates 25bps, the BoC was notably less ‘hawkish’, with Governor MacKlem signaling a pause in hikes. Compared to last year, when the question was “how much”, the BoC signaled a drastic shift in policy towards “if” rates would be increased, which reverberated throughout markets.

In February, the downward trend in yields (once again) reversed with stronger than expected economic and inflation data, sending yields back higher erasing most of the gains from the month prior.

The collapse of Silicon Valley Bank and Signature Bank in mid-March dwarfed concerns over reaccelerating inflation prompting a sharp rally in government bonds. From March 10 through to March 12, the 2 Year US Treasury yield suffered its steepest decline since October of 1987, sliding 85bps. As markets reacted to fears of contagion, government bond markets went from pricing in rate hikes to discounting sizeable rate cuts. Against this backdrop credit spreads widened, with banking and financial related bonds most affected.

With the shock of the banking crisis and the rate tightening cycle seemingly closer to its conclusion, the inverted yield curve began to reverse again, with the 2/10s Treasury curve ending the quarter approximately 50bps off its peak inversion. Longer dated bonds outperformed shorter dated, as investors welcomed further declines in inflation, reaching for long-term yield amidst an uncertain outlook for future growth. The FTSE Canada Long Overall Bond Index was up 4.6% in the quarter compared to the FTSE Canada Short Overall Bond Index, which finished up 1.7%.

If economic activity has indeed downshifted and the likelihood of recession increased, the curve could be past the point of maximum inversion, which has been historically favorable for fixed income investors. While steps have been taken to shore up the banking system, uncertainties remain, further highlighting that a high-quality approach is as important as ever.

Outlook & Portfolio Positioning

Over the past year, central banks in developed economies have aggressively raised interest rates more than any time since 1981, simultaneously creating the steepest inverted yield curve in decades. At some point the consequences of such aggressive rate hikes were bound to take hold.

The failures of Silicon Valley Bank, Signature Bank and Credit Suisse are clear indications that stresses in the financial system have been building. Regulators in both the US and EU moved swiftly to enact measures to prevent this regional banking crisis from evolving into a broader financial crisis, but it is important to consider whether this was a harbinger of things to come.

By quarter-end, anxious depositors responded by pulling out $185 billion of deposits from (just) the US regional banking system. When considering that these banks maintain leverage ratios in the range of 7% to 10%, those withdrawals represent between $1.85 to $2.65 trillion in potential loans.

A potential credit crunch is only the latest in a score of ongoing risks facing capital markets. Inflation remains mixed. Encouragingly, the main drivers initially responsible for the inflation surge have been reversing with commodity prices calmed, inventories high, supply-chain problems resolved, and excessive monetary and fiscal stimulus ratcheted down.

In contrast, policy rates in both the US and EU continue to remain below core inflation, casting doubt on whether central banks have done enough. A credit crunch might help central banks with their objectives; if lending standards tighten then less action on their part will be required to bring about a slowdown in activity to reduce inflation. The market seems to agree as yields have broadly shifted down and the yield curve is less inverted.

Tightening credit has also increased the prospect of a recession. Higher than expected inflation and rising costs have negatively impacted both current and expected profit margins, as has slowing economic growth. Given that margins are coming off record levels, a reversion to the mean should be expected. However, if the recession is more severe than expected, further downside is possible.

Central banks have been performing a balancing act between reducing inflation and avoiding recession, and now with the added complexity of financial instability. If inflation remains high and they need to continue increasing rates to bring it under control, will this worsen financial instability? On the other hand, if they keep rates on hold could this cause investors to question their determination and/or lead to speculation that central banks foresee some cataclysmic event, leading to investor panic?

Up to now, policy makers seem to have this situation well in hand, setting rates according to macroeconomic conditions, while looking to encourage financial stability through measures the Fed has deployed (i.e. The Bank Term Funding Program). A banking crisis has been averted (for now), but given the overall uncertainty, additional caution is clearly warranted. This uncertain backdrop argues against extreme positioning between or within asset classes. Valuations still look attractive historically, and investors should embrace the higher yields in both fixed income and equity, while maintaining focus on quality within both equity and bond allocations.