Economic Overview

The first quarter of 2018 was particularly eventful across the global economy. Financial markets rang in the New Year with a euphoric start, investor confidence underpinned by a nearly uninterrupted string of positive January data. Yet it eventually all became too much, with investor attention shifting to the risks pertaining to economic overheating. Concerns over growing inflationary and employment pressures triggered an abrupt market regime shift, with equity sell-offs ensuing. And a lot has been thrown at investors since, from cracks in the mighty tech sector edifice, to global trade rhetoric potentially becoming reality, to firming inflation and the end of easy money policy. Perhaps the defining characteristic of Q1, which will shape the rest of the year, was the return of market volatility.

Domestically, the Bank of Canada lifted interest rates by 0.25% in January yet left them unchanged in March, asserting the need for monetary policy accommodation in the face of housing market risks, potentially easing economic growth, global trade tensions and uncertainty over NAFTA’s going concern. South of the border, the Powell era began on a hawkish note. Encouraged by mounting core inflation, economic growth and consumer confidence readings, the Fed increased interest rates by 0.25% in March. Continued inflationary and employment pressures, combined with trickle-down effects from recent tax reform, bolster the likelihood of further U.S. monetary policy normalization this year. What remains to be seen is whether the Fed can arrive at a soft landing, where rates are raised just enough to prevent economic overheating without triggering derailment. Across the pond, below-target Eurozone inflation readings should keep rate hikes off the agenda this year.

President Trump’s announcement to impose trade tariffs on China was his first major step towards fulfilling the protectionist agenda he championed during his election campaign. Firstly, if the U.S. and China do pull up the drawbridge on each other, the direct impact of these tariffs is projected to be small. Secondly, Trump’s track record suggests that his actions may fall short of the rhetoric, with negotiations likely to win out over a full-blown trade war. Yet fears that the remainder of his presidency will be punctuated by protectionist announcements could continue weighing on business confidence and investor sentiment, with the potential to impact global growth. Nevertheless, market bulls will remind us that world GDP is the strongest it’s been in years, corporate earnings continue to expand at a healthy clip, and global liquidity remains plentiful despite gradual monetary policy normalization.

Fixed Income Markets

Similar to last quarter, the Canadian bond market experienced a volatile first three months of 2018. Yet it finished in slightly positive territory, with the short-term bond universe outperforming the long bond universe and corporate bonds outperforming government bonds. Short-term and corporate bond outperformance is entirely attributable to weakness displayed by long-term provincial bonds, as long provincials did not fully recover from poor performance early in the quarter.

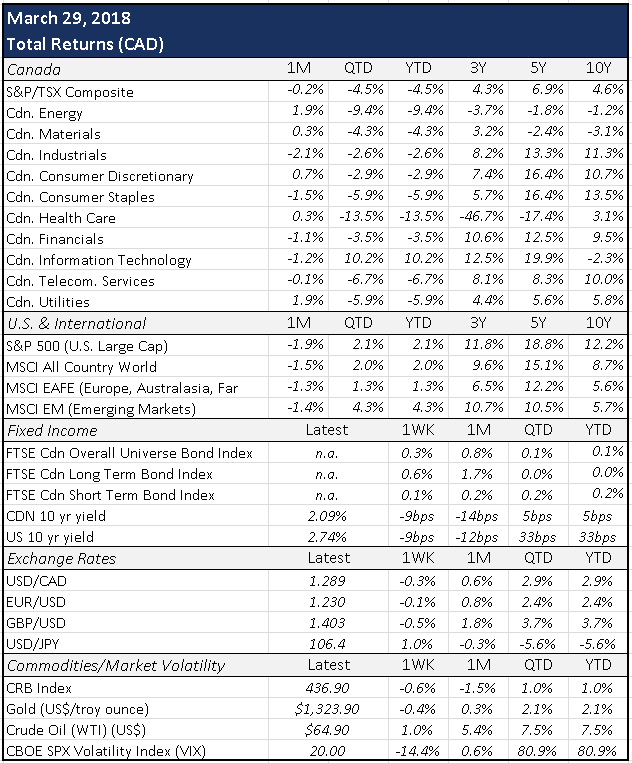

The Canadian fixed income began the year on weak footing, with yields increasing across the entire curve in January due to mounting inflationary pressures and robust economic data, both of which were cited in the Bank of Canada’s decision to increase the overnight target rate by 0.25% in January. However solid economic growth and favourable corporate earnings positively impacted credit spreads, with spreads tightening and corporate bonds outperforming in January. In February, the bond market reversed some of January’s poor performance. Rates declined across the yield curve late in the month, but more so at the short- and mid-term parts of the yield curve, as economic data indicated some slowing in the housing market and consumer spending. The weaker economic data and equity market turmoil were not positive for credit spreads, which widened in February, particularly at the long end of the yield curve. By the end of March, January’s poor bond market performance had been entirely erased. The Canadian bond market (FTSE TMX Canada Universe Bond Index) returned 0.1% this quarter, with the long-term bond market ending flat and the short-term bond market up 0.2%.

While we have begun to see some softer economic data in Canada, inflationary pressures continue to mount. The Bank of Canada indicated in its last statement that it was in no rush to increase interest rates due to trade-related and housing market uncertainties. Despite the statement, it remains widely expected that rate-raising has not ended and will resume when uncertainties subside, assuming economic growth doesn’t slow dramatically. In our fixed income allocations, we continue to focus on shorter-duration, high-quality bonds to preserve capital, while also being mindful of the need to provide protection in the event of an equity market correction.

Equity Markets

After a remarkable 15-month run of world stocks posting gains amid virtually no volatility, the bullish narrative finally succumbed to several headwinds this quarter. January’s strong equity market performance – the S&P 500 had already returned over 7% USD by the 26th – was wiped out by sell-offs that ensued in February and in March, as investor attention shifted to inflationary pressures, global trade tensions and tech sector mea culpas. While the majority of global markets retreated over the quarter, the Canadian dollar’s depreciation against most currencies bolstered loonie-denominated returns, dampening the shock for Canadian investors of foreign equity funds. This quarter the TSX, S&P 500 and MSCI World Indexes respectively returned -4.5%, 2.1% and 2.2% (CAD).

Yet as the market regime shifted, corporate profit outlooks continued to advance. This earnings season has been highly anticipated as it marks the first since the GOP tax overhaul, which passed in December. The combination of greenback softness, robust economic growth and recent tax reform is underpinning expectations for S&P 500 earnings to rise 18% in 2018, the strongest annual increase since 2010. This should provide tailwind for equity valuations since higher earnings will either be reinvested in capital expenditures or returned to shareholders via dividends and share buybacks.

In times like these it is also crucial to remember that long-term investment success requires the relentless disentanglement of the material from the immaterial. For instance, despite recent cracks in the mighty tech sector edifice due to consumer privacy concerns, the odds of major regulatory and/or legal risk disrupting enterprises over the long-term remain reasonably low.

Nevertheless, monetary policy tightening is likely to exert upward pressure on equity market volatility going forward. Between the 2016 U.S. presidential election and early February 2018, the CBOE Volatility Index (VIX) hovered around record lows of below 10%, rarely surpassing 15%. Since the first week of February, it has dropped beneath 15% only once. While not downright alarming, this environment noticeably differs from the one investors had become accustomed to. The implication is that the years of smooth upward trajectory – particularly for highly-valued growth and tech stocks – may be in the rearview mirror, and equity investors will likely contend with a protracted period of uncertainty. Nonetheless, we are encouraged by the fact that global macro fundamentals remain solid even as market turbulence has rematerialized.

Portfolio Positioning

Despite the resurgence of market volatility this quarter, we continue to maintain a cautiously optimistic outlook on financial markets. A broad range of economic indicators highlight that the global economy remains in expansion mode. In addition, corporate earnings growth is gaining momentum in both developed and emerging markets. We are however mindful of risks related to the withdrawal of monetary stimulus, rising inflation, and historically elevated asset valuations. Our sub-advisors have proactively shifted their strategies over the last year in order to manage these risks, with emphasis on capital preservation.

Our portfolios continue to favour high-quality equities over cash and bonds. Our fixed income mandates hold shorter duration bonds to minimize interest rate risk, as well as higher credit quality so as to reduce credit risk. Within our equity portfolios, the objective is to remain globally diversified in order to benefit from the growth resurgence in developed and emerging markets. We continue favouring well-established dividend-paying companies with a track record of thriving through market cycles.