Economic Overview

It was another strong quarter across economic markets, with global growth continuing on its path of positive synchronization. Europe displayed particular strength while December jobs reports in both Canada and the U.S. underpinned a stellar year for the North American labour market. And as growth advanced, inflation remained tame, permitting the preservation of broadly supportive monetary policies amid the normalization.

Domestically, jobs reports surpassed expectations with ample gains this quarter. In November, employment surged by 80k, steering expectations toward a December pullback. Yet employment jumped another 79k last month, guiding Q4 to the strongest quarterly gain since 2010. The upbeat news is an indicator that Canadian economic growth ended the year on strong footing. Furthermore, improvements in business sentiment over the quarter, most notably via a marked rebound in investment intentions, suggest that NAFTA uncertainties are unlikely to restrain economic growth this year. For the Bank of Canada, an environment of labour market strength, improving business sentiment and rising core inflation likely seals the deal for an imminent interest rate hike – even if Q4 GDP growth falls short of the bank’s estimate – so long as NAFTA, housing market and minimum wage hike headwinds do not disrupt growth or prompt the Bank to reverse course.

South of the border, as investors celebrated tax reform, the FOMC discussed the pace of monetary policy normalization, which could increase in order to offset potential inflationary pressures that materialize from tax cuts. December’s strong jobs report capped the end of a stellar year for the U.S. labour market – the unemployment rate at a 17-year low for the third consecutive month. With tax reform offering further ammunition for wage upgrades, pundits deem it a matter of time before U.S. inflation finally edges above target. The Fed will likely continue normalizing rates this year, assuming inflation builds steadily.

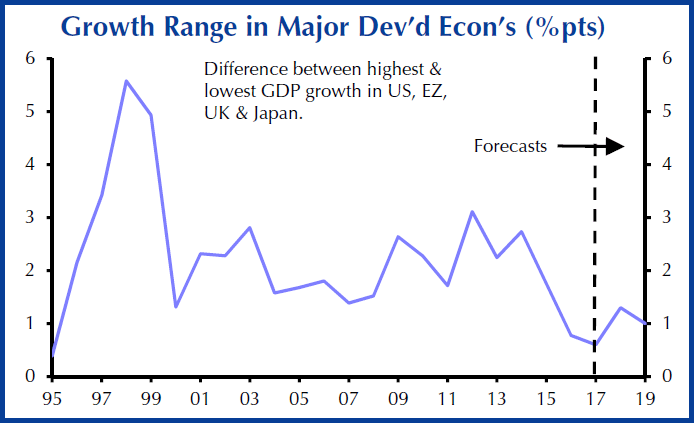

A key characteristic of the world economy in recent quarters has been the broad-based and synchronized expansion of its major economies. As Chart 1 illustrates, growth rate divergence among the U.S., Eurozone, U.K. and Japan in 2017 was at its narrowest since 1995. Emerging market growth rates, primarily those of China, Brazil and Russia, underpinned a global economy with a GDP that is expanding at its fastest rate since 2011. This leads us to the possibility of a slowdown and/or desynchronization in 2018. China indicators suggest growth is already slowing in the wake of faded policy stimulus. In the U.S., while tax reform and a strong finish to 2017 provide momentum for growth in 2018, a slowdown could arise towards year-end in response to tighter monetary policy. Meanwhile, the spare capacity and corresponding lack of policy tightening pressure in the Eurozone point to its recovery maintaining momentum.

A key characteristic of the world economy in recent quarters has been the broad-based and synchronized expansion of its major economies. As Chart 1 illustrates, growth rate divergence among the U.S., Eurozone, U.K. and Japan in 2017 was at its narrowest since 1995. Emerging market growth rates, primarily those of China, Brazil and Russia, underpinned a global economy with a GDP that is expanding at its fastest rate since 2011. This leads us to the possibility of a slowdown and/or desynchronization in 2018. China indicators suggest growth is already slowing in the wake of faded policy stimulus. In the U.S., while tax reform and a strong finish to 2017 provide momentum for growth in 2018, a slowdown could arise towards year-end in response to tighter monetary policy. Meanwhile, the spare capacity and corresponding lack of policy tightening pressure in the Eurozone point to its recovery maintaining momentum.

Fixed Income Markets

The Canadian bond market experienced bouts of volatility during the final quarter of the year, but ended the quarter in positive territory, with longer-term bonds outperforming their short-term counterparts and spread products outperforming federal government bonds. The first two months of the quarter saw bonds react favourably to slower third-quarter economic growth, as well as the dovish tone in the Bank of Canada’s October and December decisions to keep the overnight target rate unchanged at 1%. While the BoC noted that both the Canadian and global economies were evolving as projected and that inflation continued to edge higher, they indicated that the global outlook remains subject to considerable uncertainty, notably with respect to geopolitical developments and trade policies (specifically NAFTA renegotiations). During the month of December, however, the robust economic data, including strong November inflation numbers, pushed short rates back above early-October levels, while longer rates moved up only marginally. The net decline in long-term interest rates combined with the longer duration of these bonds resulted in long-term bonds performing particularly well over the quarter, with the long-term bond index returning 5.2% compared to 0.3% for the short-term bond index. Credit spreads continued to tighten over the quarter, particularly amongst provincial and municipal bonds, as investors continued their search for yield and economic data remained supportive. Overall, the Canadian bond market (FTSE TMX Canada Universe Bond Index) returned 2.0% in the fourth quarter and 2.5% for the calendar year. While the path taken by U.S. interest rates during the quarter was quite different to that in Canada, net interest rate movements in the U.S. over the quarter were not that dissimilar to those in Canada, although U.S. shorter-term rates rose much more than in Canada and long-term rates moved slightly higher.

While inflation remains below target and the risks highlighted by the Bank of Canada remain, it is widely expected that rate-raising will resume as economic data is robust and inflationary pressures continue to mount. In our fixed income allocations, we continue to focus on shorter-duration, high-quality bonds to preserve capital, while also being mindful of the need to provide protection in the event of an equity market correction.

Equity Markets

Global equity markets (in local currency terms) continued on their upward trajectory in the last quarter of 2017, with seemingly little capable of stopping the trend. A combination of robust global economic data, continuously strong corporate earnings and accommodative financial conditions provided equity markets with the ideal backdrop to fight off any jitters from geopolitical or global indebtedness concerns.

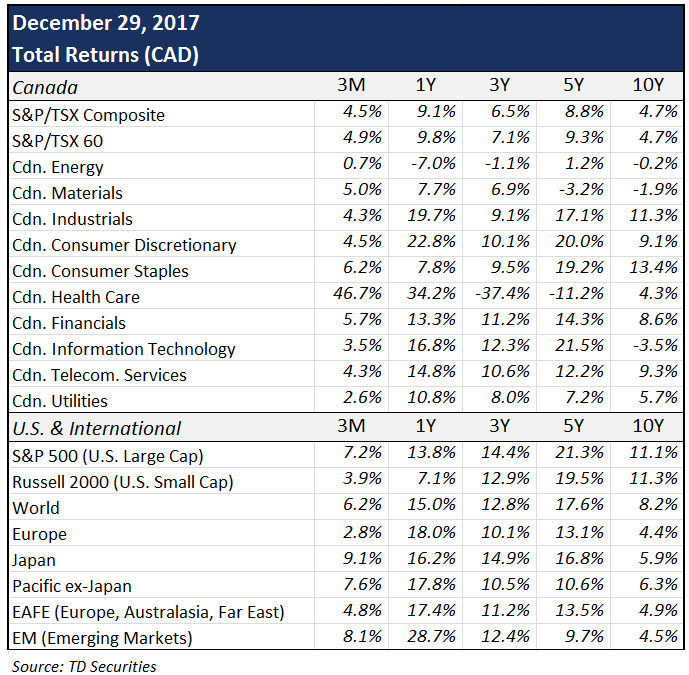

The MSCI World Index registered its 10-year high on the second-to-last trading day of 2017, resulting in a total return of 5.6% in USD (6.2% CAD), with every major regional equity market once again posting gains during the quarter. The U.S. market remained one of the best performers, posting a 10-year high on December 18, but it was Japan that took the top spot in Q4, advancing 8.5% USD, with emerging markets a close second. For Canadian investors, the appreciation of global equities was further supported by a modest 0.5% depreciation in the loonie relative to the greenback.

In the fourth quarter, the S&P 500 gained 6.6% USD (7.2% CAD), with gains fuelled by continuously better-than-expected profits, as well as the announced U.S. tax cuts. Almost all sectors contributed to performance apart from utilities and health care. Although energy had been a drag for most of 2017, the sector rebounded in the fourth quarter on the back of a strong increase in oil prices.

The S&P/TSX continued gaining momentum in Q4, ending the year at a 10-year high with a 4.5% return. The strong performance was supported by a rebound in consumer staples, as well as robust gains in all other sectors except for energy and utilities. Energy and materials, however, provided a strong boost at year-end as commodity prices experienced a healthy surge.

While the developed global equity market (MSCI World Index) posted its best performance in four years in 2017, it was Emerging Markets that blew past the rest of the world with the MSCI Emerging Markets Index returning a whopping 37.8% in USD (28.7% in CAD).

A defining characteristic of 2017’s global equity rally has been the fact that it was not fuelled by P/E expansion but rather by strong underlying fundamentals, namely broad-based synchronized economic growth and healthy corporate profits. Accommodative financial conditions also provided support to global equity markets. While a number of central banks have already begun monetary policy normalization and are expected to continue on this path provided economic conditions remain positive, a notable risk to equity markets is if central banks withdraw stimulus by more than currently expected. This would impact not only economic growth and corporate profits, but also P/E multiples (i.e. we could see a contraction).

Portfolio Positioning

The currently favourable global economic environment and accommodative financial conditions continue to provide support to corporate earnings and global equity markets. As such, we continue to favour equities over cash and bonds, but remain mindful of the risks inherent in the equity market. In terms of equity allocation, we continue to maintain a globally diversified approach, but with reduced exposure to markets that are fully valued. We expect central banks to carry on with gradually withdrawing stimulus and for interest rates to move higher. As such, we continue to position client portfolios in higher-quality, shorter-duration bonds in order to preserve capital. Should we witness a correction in the markets this year, our active managers have the ability to act defensively and select which investments to be in, when compared to passive management.

Given the starting point for both bonds and equities at the beginning of 2018 – continually low interest rates and stretched valuations in a number of equity markets – we expect both bond and equity returns to be lower going forward.