Economic Overview

In the first half of 2023, the global economy shrugged off rising interest rates to produce economic growth that defied expectations. However economic tailwinds seemed to turn into headwinds in the third quarter, prompting economists to lower growth projections.

Weakness became evident in survey indicators. Quarter-end manufacturing PMI indicators fell below the 50 level – below 50 usually represents economic contraction, above 50 represents growth. Services PMI indicators finished the quarter at 50.1 and have been on a steady decline from the mid-50s in recent months.

Consumer confidence in developed economies also began to deteriorate last quarter. The U.S. index hit a four-month low in September, while Canada’s index dropped to its second lowest point since 2002. Sentiment declined particularly in the E.U., as September marked one of the lowest points in German history. Germany’s elevated pessimism stems from an economy on the verge of recession and an industrial sector struggling with lower demand from China, compounded by higher borrowing and energy costs.

Rising interest rates also caused bank lending to slow last quarter. While loan and credit card delinquency rates in developed economies did not reach risky levels, they have been steadily increasing. Even if policy rates remain unchanged, their impact will continue to be felt as existing mortgages and corporate loans are rolled over.

Higher rates are, of course, the main tool to combat higher inflation. While headline inflation is well off its mid-2022 peak, it remains above central bank targets. Core inflation has been less susceptible to change. Goods price inflation has fallen convincingly, but services inflation remains stubborn, likely due to the significant role of labor as an input, which responds more slowly to market shifts as seen in ongoing labor strikes in the United States.

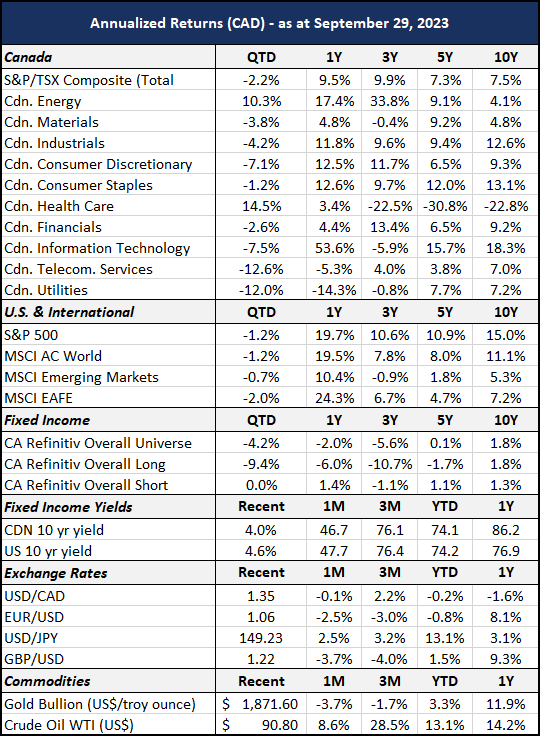

The labor market remains tight in advanced economies, but falling vacancy rates and lower quits levels are signs that pressure is easing, along with a reduction in the pace of wage gains. Job openings are down in both the U.S. and Canada, with the unemployment rate having begun to move up. Despite these trends, job openings still exceed available workers. While positive for job seekers, the overall strength of the labor market coupled with persistent inflation could pose challenges for central banks as they contemplate future rate hikes. A more explicit risk to high inflation is the price of oil. The broader decline in inflation of the last 12 months was in large part due to declining oil prices. This drop reversed course in Q3 with WTI up 28.5% on the quarter, hitting a high of $95 as OPEC restricted supply, while inventories in the U.S. dwindled to levels last seen in the 80s.

In the face of slowing global growth, economic resilience in the first half of the year was unlikely to continue at the same pace indefinitely. Consumers are feeling strained from reduced savings plus higher borrowing and energy costs, while Europe is on the verge of recession and the Chinese economy continues to struggle with over-indebtedness. Growth remains resilient however, especially in the labor market, and companies continue to deploy capital expenditures. Whether record fiscal and monetary stimulus amounts have been muted by the equally impressive amount of central bank tightening remains a legitimate debate. Central bankers remind us that they may not have done enough, while investors remind us that they may have gone too far.

Equity Markets

The third quarter of 2023 offered a reality check to equity markets. Investors entered the quarter optimistic that central banks would pull off an economic soft landing, and that the era of high interest rates was ending. That enthusiasm waned in August and September as the prospect of higher for longer became viewed as increasingly likely. Fiscal sustainability was another area of concern, causing a selloff in U.S. Treasuries (forcing yields up), which also placed pressure on risk assets as investors reassessed the value of both long duration and dividend stocks.

The MSCI AC World index fell -1.2%, taking year-to-date returns down to a still strong 10.3% (both in CAD). Value stocks proved more resilient than their expensive counterparts, with the MSCI World Value Index returning -1.7% in Q3 in comparison to -4.9% for the MSCI World Growth Index. The gap between the two styles remains wide year-to-date, with the growth index outperforming by more than 18% since the beginning of 2023.

After a strong start to 2023, the S&P 500 was down -1.2% (CAD) last quarter, bringing its year-to-date gain down to 12.8%. Conversely, the TSX finished the quarter down -2.2% (CAD), eroding most year-to-date gains, which were 3.4% at quarter-end. At the sector level, energy was the standout last quarter due to rising oil prices. Energy stocks were up 8.9% (CAD) on the TSX and 11.3% (USD) on the S&P 500. Within the TSX and S&P 500, the only other sectors to post positive results last quarter were healthcare and communication services.

While communication services, technology, and consumer discretionary businesses have been strong year to date, performance moderated last quarter as the AI-driven rally faded, higher interest rates weighed on valuation, and corporate guidance moderated expectations. The S&P 500’s performance continues to be dominated by the “Magnificent Seven” mega-caps. Year-to-date, these seven companies account for 11% of the index’s 11.7% return (both in USD).

Every other major exchange except India finished the quarter down. The MSCI China index returned -3.0% as the country’s property sector continued to show signs of stress. Chinese investors also seem doubtful of Beijing’s willingness to deliver necessary policy measures. The MSCI India gained 3.7%, contributing to a year-to-date return of 7.5%. This compares to MSCI China’s year-to-date return of -8.2%. India’s strong performance is attributed to strong cyclical momentum, global supply chain diversification, and increased investor engagement.

Fixed Income Markets

Despite rising oil prices, year-on-year core inflation measures eased last quarter. This trend prompted many central banks to pause further rate hikes. In July, the U.S. Federal Reserve (Fed), Bank of Canada (BoC) and European Central Bank (ECB) raised rates by 0.25%, with only the latter continuing to hike in September. The ECB suggested this rate hike might be sufficient to guide inflation back to target. Even though the Fed and BoC held rates steady in September, the market continued to anticipate an extended period of elevated rates, which drove yields higher.

Led by the U.S., global bond yields peaked in September before slightly retreating at quarter-end. The U.S. 10-year Treasury yield increased from 3.81% to 4.57% on the quarter, while the Canadian 10-year government bond yield increased from 3.27% to 4.03%. The rise in yields was due to a more resilient U.S. economy led by a strong labor market in conjunction with supply and demand imbalances in the U.S. Treasury market.

The economy’s resilience has pushed back expectations of a recession. With the impact of aggressive rate hikes being delayed and inflation proving sticky, investors began realizing that rates may need to remain higher for longer. Supply and demand dynamics of the U.S. Treasury market have also pressured yields higher. The U.S. Treasury surprised markets when it announced the need to issue more debt to fund the government’s growing budget deficit. This additional supply came at a time when demand had been falling due to quantitative tightening and more attractive yields on global bonds relative to Treasuries.

Corporate bonds outperformed government counterparts, with spreads narrowing across investment-grade and high-yield instruments. The FTSE Canada All Corporate Bond Index returned -2.2% in Q3, compared to the FTSE Canada Universe Bond Index’s -3.9%. Shorter duration outperformed long duration, with the FTSE Canada Short Term Overall Bond Index returning -1.2% in Q3, while the FTSE Canada Long Term Overall Bond Index’s returned -9.5%. Relative performance in duration caused the inverted yield curve to pull back from Q2’s extreme values, contracting by over 50bps.

Although worrying for investors, the higher-for-longer interest rate scenario may be necessary to control inflation pressures. As a result, rate volatility will likely persist as central banks pursue the 2% target. Given monetary policy’s long and variable lags, the greatest risk is that rates are raised and/or maintained at levels that lead to undue financial turmoil.

Outlook & Portfolio Positioning

Looking forward to 2024, we anticipate slower economic growth, but uncertainty remains over whether we will see a manageable deceleration, recession, or if stagflation will come into play.

As investors, it is crucial to maintain a steadfast approach amid market volatility, placing a strong emphasis on high quality assets. While cash might seem appealing, the anticipation of rate cuts aimed at countering the economic slowdown suggests that locking in bonds at presently attractive levels may be a wiser choice.

With valuations in key markets like mega-tech remaining elevated, value investments present attractive opportunities. Diversification remains an important component of any portfolio, not just to mitigate risk, but to broaden opportunity sets. Lastly, while the buy-and-hold strategy was ideal in an era of declining rates, the shifting landscape calls for more active management to navigate volatility.

When considering the long-term and the expectation of higher rates persisting, fixed income and associated yields should become increasingly attractive. It is also wise to be open to new technology, particularly within the AI and semiconductor companies, while remaining vigilant about valuations. Opportunities also lie in the shift from traditional energy to green energy, recognizing this will require time, fiscal support, and an astute evaluation of genuine prospects in this sector. Finally, we must prepare for the possibility that heightened volatility is the new norm and maintain investment policies and strategies that align with risk profiles.