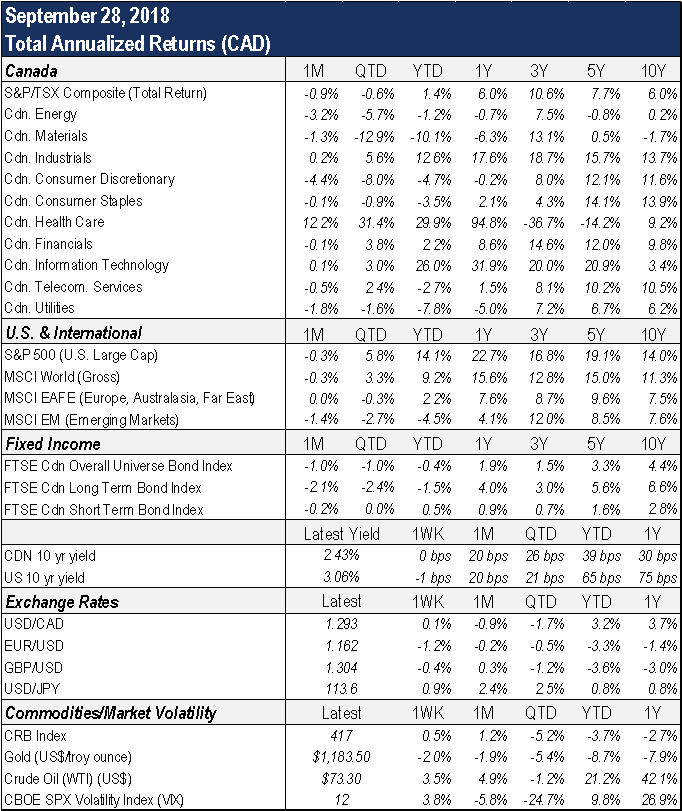

Economic Overview

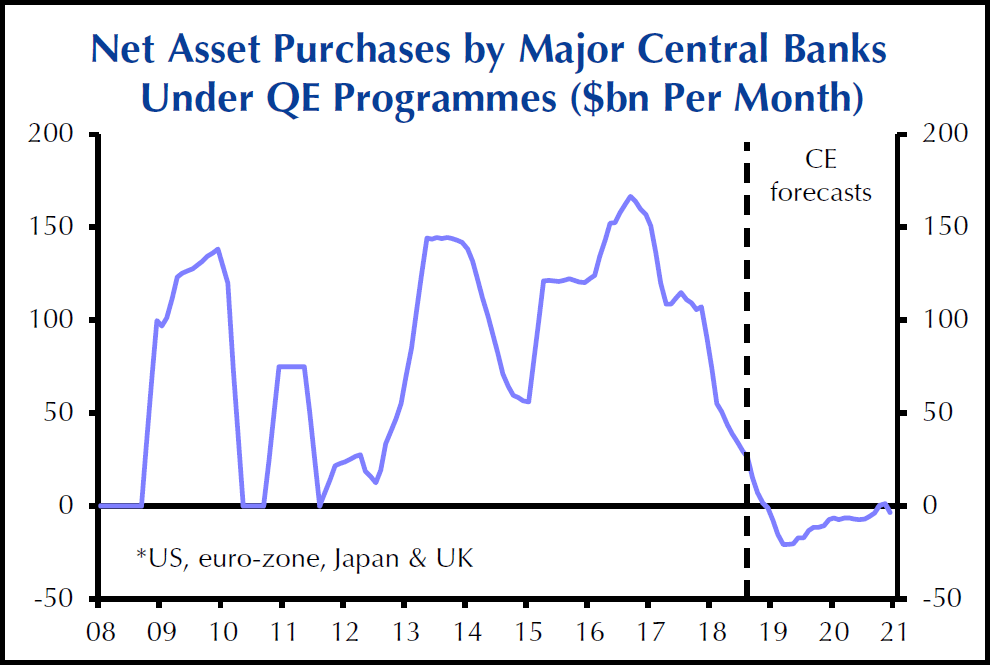

For investors, the summer months of 2018 saw a continuation of situations encountered year-to-date: encouraging global economic trends, upward revisions to corporate earnings, no shortage of geopolitical or trade-related announcements, central bank commitments to gradually withdraw stimulus in the face of inflationary pressures – to name a few. With the ECB and Bank of Japan set to end quantitative easing policies in December and January, respectively, global QE should diverge into quantitative tightening by early 2019, (Chart 1). Yet while the U.S. economy maintained its upward march this quarter, growth figures for the rest of the world were less buoyant.

Underpinned by tax stimulus, consumer confidence as well as household spending growth, the U.S. economy’s hot streak persisted throughout the third quarter. In fact, with consumer confidence levels recently extending to 18-year highs, some pundits postulate there is cause for concern. Historically, elevated confidence levels have preceded periods of interest rate tightening and recession. Despite the enthusiasm espoused by President Trump over unemployment rates dropping to half-century lows and corporate earnings growth in double-digit territory, scepticism over the “longest bull run in history” is, at the very least, justified. The boost from fiscal stimulus may very well sustain growth trends for now, yet once it fades, higher borrowing costs are likely to exert greater pressure on consumption and investment.

After over a year of negotiations, member countries finally struck a deal on NAFTA 2.0. From Canada’s perspective, the newly inked USMCA does not materially differ from its predecessor. What is material, however, is that it is a reasonable outcome for Canada. While U.S. tariffs on steel and aluminum remain in place for now, the guarantee that Canada (and Mexico) will be exempt from U.S. auto tariffs is a win. The possibility of damaging auto tariffs had formed a dark cloud over Canadian financial markets – and while a similar truce with China is improbable, at least Canadian and Mexican market participants have one less item to worry about.

Fixed Income Markets

The third quarter of 2018 was not a great one for fixed income investors although no one should truly be surprised by the resulting returns in the bond market when interest rates trend higher.

While we continued to see the bond market bounce around from month-to-month, the trend for the quarter was a net increase in interest rates across the yield curve with technical factors influencing economic fundamentals at the longer end of the curve. New U.S. bond supply was arguably the biggest technical factor affecting 10- and 30-year bond yields this quarter, as the market must absorb more net new supply at the same time as the Federal Reserve reduces the Treasuries held on its balance sheet, thus further increasing the supply of Treasuries the market must absorb. As far as fundamentals go, economic data in both the U.S. and Canada remained supportive of continued interest rate normalization, with each central bank increasing its target policy rate by 25 bps during the quarter, although the Bank of Canada held off increasing again at its September meeting due to NAFTA uncertainties.

One of the brighter spots in the Canadian bond market was corporate bonds, whose spread tightening dampened the negative impact of higher interest rates. While strong Canadian economic fundamentals remained supportive of credit spreads, the key driver of tightening spreads over the quarter was supply vs. demand. For the quarter, the Canadian bond market (FTSE Canada Universe Bond Index) fell 1.0%, with the long-term bond market down 2.4% and the short-term bond market flat. The Canadian Corporate Bond Universe slipped 0.5%.

With the resolution of NAFTA, the Bank of Canada is expected to increase rates at its meeting in late October. While the U.S. and Canadian economies are showing limited signs of slowing, we expect that continued global trade uncertainty, including the impact of tariffs on economic growth and consumer prices, will result in ongoing volatility within the Canadian bond market. Consequently, we continue to believe that active management is key to navigating the current fixed income environment. Our underlying managers remain concentrated in shorter-duration, high-quality bonds to preserve capital while being mindful of the need to provide protection should equity markets consolidate. We are also investigating additional fixed income strategies that are positioned to benefit from rising interest rates.

Equity Markets

In contrast to the bond market’s response to rising rates, the reaction from equity markets has been more muted. Healthy corporate earnings growth may have distracted investor attention from the risks associated with rising inflationary pressures. Admittedly, it is difficult to be overly pessimistic when the consensus among analysts is for global corporate earnings to increase by 16% in 2018 and by another 10% next year.

Domestically, despite cannabis stocks pushing the healthcare sector up a remarkable 31.4% in Q3, the TSX delivered a negative performance in August and July, returning -0.6% over the quarter. The energy sector failed to benefit from crude oil’s new highs, as production in Western Canada remained landlocked. With uncertainty over trade and infrastructure outcomes characterizing much of the quarter (and year), Canadian equities have underperformed their counterparts south of the border.

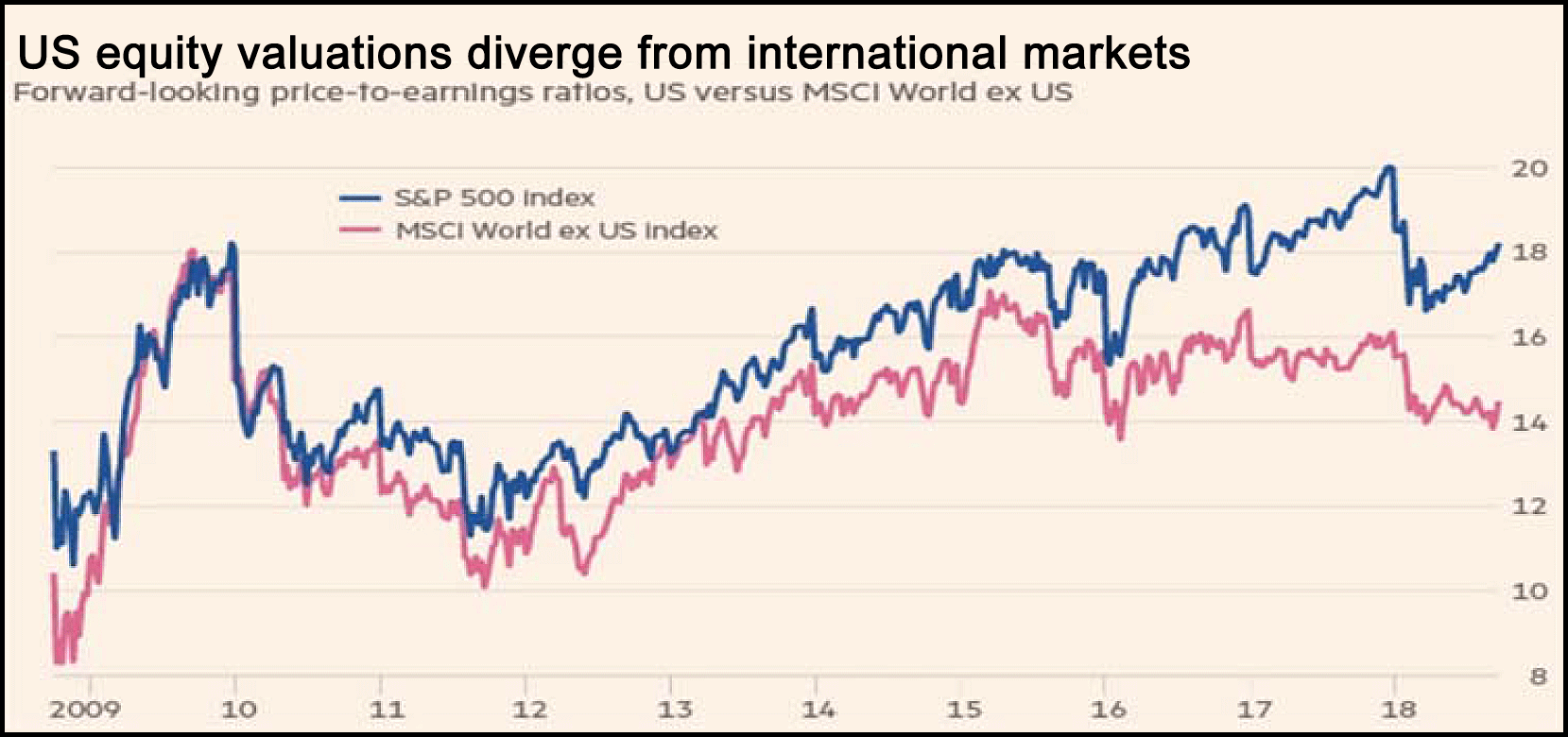

U.S. equities, meanwhile, traded at all-tim e premiums this quarter, with the S&P 500 posting a 5.8% return. The chart below depicts the U.S. stock market’s decoupling from world markets in recent years, underpinned by investor confidence in the U.S. economy outgrowing its global peers. Historically, correlation has been relatively prominent among equities, with divergence of this magnitude being rare. While U.S. equities remain an important constituent of a diversified portfolio, we recognize the mounting list of cost pressures that could become headwinds going forward.

e premiums this quarter, with the S&P 500 posting a 5.8% return. The chart below depicts the U.S. stock market’s decoupling from world markets in recent years, underpinned by investor confidence in the U.S. economy outgrowing its global peers. Historically, correlation has been relatively prominent among equities, with divergence of this magnitude being rare. While U.S. equities remain an important constituent of a diversified portfolio, we recognize the mounting list of cost pressures that could become headwinds going forward.

While U.S. valuations continued echoing strong economic trends, international equity valuations increasingly reflected trade tensions and negative policy outcomes. The MSCI EAFE, which represents developed markets outside Canada and the U.S., retreated 0.3% in Q3, while Emerging Markets declined 2.7%. As the numbers illustrate, performance can vary significantly from one region to the next, which highlights the importance of geographic diversification in optimizing risk-adjusted returns.

Portfolio Positioning

For the upcoming year, we do not envision the global economy deviating from its expansionary trend. However, slower growth would not surprise us as the impact of rising interest rates works through the system. We are, however, increasingly concerned with investors’ bold willingness to assume higher risks to generate returns, as this is unsustainable. This growing appetite for risk is prevalent across all asset classes. While we did not materially change asset allocations this quarter, we note that our portfolios are conservatively positioned, as we are mindful of credit and interest rate risks within fixed income holdings, as well as high earnings growth expectations embedded in equity positions. Our sub-advisors continue to proactively manage these risks, with an emphasis on capital preservation.

Our portfolios continue to favour high-quality equities over cash and bonds within the context of each client’s target asset mix. For clients with equity allocations at the higher end of their target range, we have proactively reduced exposure where appropriate, particularly with respect to U.S. equities. For clients with regular cash requirements, we have proactively been raising funds in order to meet their need for liquidity.