Economic Overview

Unprecedented seems to be the key word to describe current times. Financial markets along with the entire world were thrown off kilter with the arrival of a new force last quarter, COVID-19. As cases began spreading around the globe, market selloffs quickly followed as investors started assessing the economic impact of the outbreak. The sudden onset of this market shift is unlike any that has come before it. The same can be said of its source: a global pandemic and its rapidly evolving, self-imposed economic consequences. The world has never experienced such widespread closures, sweeping unemployment levels, social distancing orders, and government directives regarding which businesses are essential enough to remain open. Faced with so many unknowns, most asset classes were understandably volatile as investors rushed to the exits last quarter.

Central banks around the world have undertaken significant measures to support the economy, slashing their administered interest rates and providing liquidity to markets through various instruments and programs. Governments have also introduced unprecedented fiscal stimulus measures in an effort to limit the human and economic toll of COVID-19.

Immediate repercussions on the global economy are becoming increasingly apparent and point to a sharp fall in output worldwide. Consequences over the longer term are less clear. Eventually containment measures will be lifted and the global economy will recover. However, what remains uncertain is how long this will take, as well as how quickly demand and consumer confidence levels will normalize once the curve flattens.

With global demand contracting, financial markets were further burdened last quarter due to an oil price war between Saudi Arabia and Russia. After failing to agree on managing oil supplies, Saudi Arabia announced unexpected price discounts to customers in Europe, Asia and the United States. The news triggered a free fall in oil prices and added further fuel to the COVID-19-led equity market selloffs.

Though it is undeniable that the world is experiencing a significant economic shock, many economists expect that once containment measures are lifted, demand will slowly ramp up and financial markets will stabilize. Economic activity is expected to rebound in the second half of the year, and continue to recover in 2021.

Fixed Income Markets

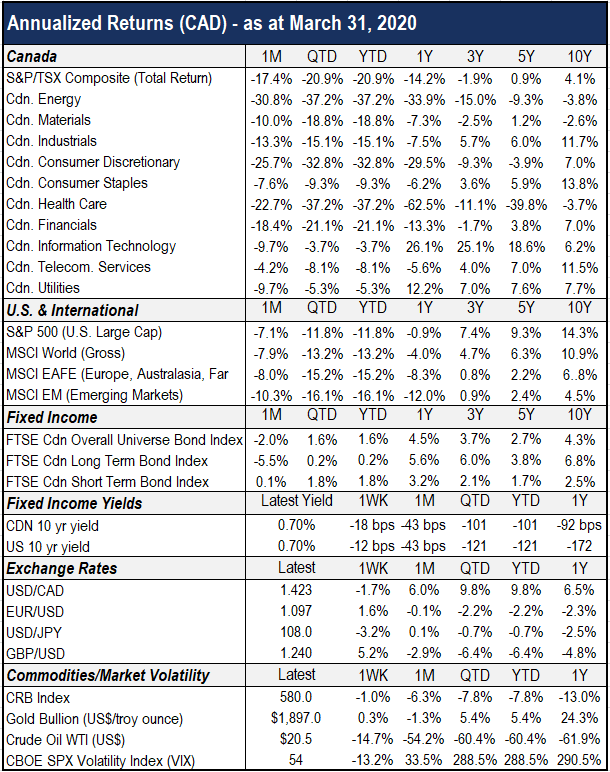

The Canadian bond universe closed the first quarter of 2020 in positive territory, posting a return of 1.6%. Short-term bonds significantly outperformed their long-term counterparts, as fixed income investors flocked to the safety of lower-duration instruments. Similarly, the COVID-19-led risk-off sentiment caused government bonds to protect capital far better than their corporate equivalents.

Fixed income markets, typically a safe haven when equities are under pressure, faced unprecedented difficulties in the first quarter. As investors looked to raise cash, liquidity became increasingly difficult to find, even in high-quality, shorter-duration corporate bonds. Central banks responded by pushing monetary policy to the limits, both in terms of the sheer figures employed to purchase assets, as well as the numerous market facilities launched in order to offset deteriorating financial conditions caused by COVID-19.

The Bank of Canada and U.S. Federal Reserve both cut interest rates by 150 bps last quarter, their steepest cuts since the 2008 Great Recession. Central banks around the globe followed suit and dropped interest rates to near zero as well. Numerous quantitative easing actions, large-scale asset purchases, and liquidity-boosting packages have also been announced, in an effort to prevent credit markets from seizing up.

The bold moves made by central bankers and policymakers around the world allowed bond markets to operate more smoothly toward the end of the quarter. We expect these measures will indeed assist in stabilizing financial markets as well as supporting the economy during this difficult chapter. We also expect central banks, particularly the U.S. Fed, to remain in “whatever it takes” mode. However, what remains to be seen are the longer-term effects of such interventionism, as no one really knows what they will look like.

There is certainly a global effort to protect economies from the effects of the COVID-19 outbreak. Many central banks in both developed and developing nations have adopted accommodative monetary and fiscal policies, and are collaborating in order to maintain liquidity in their regions, keep dollar lending costs low, and ensure that banks maintain their ability to operate.

Equity Markets

It is remarkable how quickly the investment environment can change. As recently as February 19, equity investors were enjoying one of the longest bull markets in history. Then, COVID-19 cases began proliferating worldwide, and stock market selloffs swiftly ensued. The simultaneous oil price plunge added further fuel to the flames.

It is often said that stock markets detest uncertainty, and the first quarter of 2020 was no exception. As we have highlighted in the past, equities were becoming richly valued at the start of the year, which exacerbated the downside as investors hurried to the exits. The stock market selloff was indiscriminate, which is not necessarily unusual at the start of a downturn, where liquidity is of main concern, and the baby can get thrown out with the bath water so to speak. Confronted with so many unknowns, stock markets were understandably volatile as they sold off last quarter.

Canadian stocks bore the brunt of the decline. As if a rapidly evolving global pandemic was not enough of a headwind, the nascent price war in oil markets sent the resource-heavy Canadian economy and equity market into a free fall. Nevertheless, the last few trading days of Q1 saw Canadian stock prices reverse course somewhat, as investors reacted positively to massive central bank intervention and stimulus measures. Canadian stocks (S&P/TSX) returned -20.9% last quarter, with the energy, healthcare and consumer discretionary sectors experiencing the most weakness. Meanwhile, consumer staples, technology and telecom were the strongest sectors on a relative basis.

South of the border, U.S. equity investors also rushed to de-risk, as the broad market selloff that began in late February continued throughout March. Similar to Canada, numerous monetary and fiscal policy measures – particularly President Trump’s announcement of a $2 trillion stimulus package – appeared to calm investors toward quarter-end. The S&P 500 returned -11.8% for the first quarter of 2020. Overseas, international and emerging markets returned -15.2% and -16.1%, respectively.

The start of earnings season will provide investors with a glimpse of the impact that COVID-19 closures are having on corporate profits. It will also be a unique earnings season, as only a handful of businesses have managed to sail through the virus outbreak unscathed. Therefore “beating” or “missing” expectations will no longer be the focus, and a new set of questions will emerge. What is the scope of the damage? What measures are management teams taking to cushion the fallout? How might extended containment measures impact future earnings? Needless to say we will be monitoring corporate earnings season very closely.

Portfolio Positioning

Looking forward, we anticipate continued market volatility in the short-term. Assets prices will likely move sideways, with both selloff and rally attempts, until COVID-19 containment efforts prove effective. In time we will look back on this period as temporary, we just do not know when the end will come. History demonstrates that markets tend to swing to extreme levels in either direction, and once the outbreak is contained, we expect markets to respond with enthusiasm.

Our defensive portfolio positioning has been helpful in preserving capital during these unsettling times. Given the market risks, our portfolios are increasingly in favour of superior quality and valuation characteristics. Our experienced set of investment managers continue to focus on balance sheet strength, as well as the ability of their underlying portfolio companies to survive this challenging period. The recent market volatility has also given our sub-managers the opportunity to selectively add to high-quality businesses at attractive safety margins.

For our clients with adequate investment horizons, we continue to believe that long-term return prospects favour equities over fixed income and cash. For our clients with shorter horizons and/or liquidity needs, we continue to emphasize a balanced portfolio with larger fixed income and cash allocations. While the ride will be bumpy in the short-term as we manage the downside risks, it is crucial to remember that having a proper asset mix and investment plan in place is akin to wearing your seat belt. The bumps may be uncomfortable, but you can still keep going.