October 02, 2017 – KERR MARKET SUMMARY – Volume 7, Number 19

After a modest uptick in market turbulence last month triggered by concerns over geopolitical jostling, markets reverted back to the low volatility pattern that has been a dominant force over the last 18 months. Central banks had center stage again this month, as markets focused on future rate hikes and the reduction in monetary stimulus programs.

On the economic front, the theme of a global synchronized expansion cycle remained intact. The economic data released this month in Canada reflects ongoing job gains, rising consumer spending and a manufacturing sector that is on the mend. In the U.S, the active hurricane season has dampened economic activity temporarily. However, strong employment levels and trade activity remain supportive of the U.S economy. The ongoing debate revolves around the slow pace of inflation, with y/y core inflation at 1.7% in July well below the U.S Federal Reserve target of 2%.

The sustainable economic gains were noted by both the U.S Fed and the Bank of Canada, that both raised interest rates by 0.25% in September. The U.S Fed has not deviated from the path to increasing rates this year and next, and reducing monetary stimulus measures starting in October as they believe the U.S and the global economy are both on firmer ground.

The sustainable economic gains were noted by both the U.S Fed and the Bank of Canada, that both raised interest rates by 0.25% in September. The U.S Fed has not deviated from the path to increasing rates this year and next, and reducing monetary stimulus measures starting in October as they believe the U.S and the global economy are both on firmer ground.

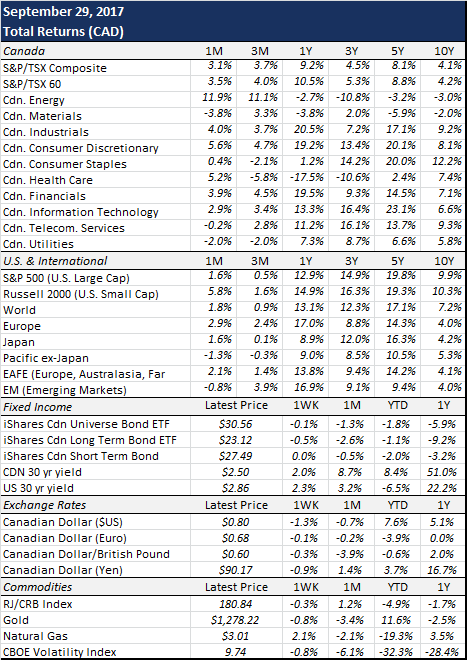

Fixed income markets had a difficult month as investors reacted to news from central banks signaling further rate increases and a reduction in the bond buying programs. In Canada, the September interest rate hike and prospect of further increases caused the FTSE Canada Bond Universe index to decline 1.3% in September. The downward pressure on fixed income assets was felt globally, as bond yields rose during the month and the Barclays Global Aggregate Bond index fell by 1%. In Canada, there was some refuge for bond investors as the corporate bond issues declined less in value relative to federal and provincial bonds.

The steady economic gains and the positive outlook for corporate profits overshadowed any concerns derived from rising interest rates for equity markets. The MSCI World Index rose 2.3% in US dollar terms in September. The rebound in energy prices supported the Canadian market as the TSX/S&P rose 3.1% for the month. While U.S equity markets continued to hit all-time highs in September and the S&P 500 rose 2.1% for the month, emerging markets were down 0.4% for the month, however developing markets have delivered among the strongest equity returns to date in 2017 advancing by 27% at the end of September.

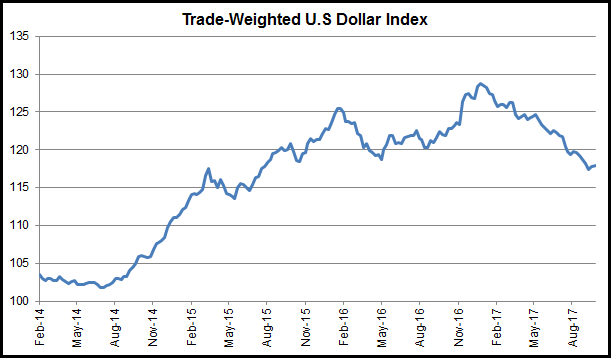

In currency markets, the trade-weighted U.S dollar index began the month on the decline as it has for since early 2017, but the prospects of rising rates triggered a recovery of the losses by the end of the month. The U.S dollar has given back a portion of the gains realized since 2014, as it has declined 7% relative to the Canadian loonie and 11% versus the Euro to date in 2017. There may be some support for the U.S dollar with global investment flows moving back to the U.S as interest yields widen relative to those in Europe and Japan.

Crude oil prices rallied 12% during the month, and WTI crude prices moved above the US$50/bbl level for the first time since May. The gains in crude helped the Goldman Sachs Commodity Index rise 3% for the month. While the relief rally in crude was welcomed by producers, the likelihood of similar gains in future months is unlikely given the current oil supply is outstripping demand. Gold prices took a step back and fell 3% this month, likely due to abating fears of escalating geopolitical tensions with North Korea.

Sources: TD Economics, Bloomberg