March 03, 2020 – KERR MARKET SUMMARY

It is remarkable how quickly things can change. As recently as mid-February, investors were enjoying one of the longest bull markets and economic expansions in history. Then, COVID-19 cases began proliferating worldwide, and market selloffs swiftly ensued as investors began assessing the economic impact of the outbreak. The sudden onset of this market shift is unlike any that has come before it. The same can be said for its source: a global pandemic and its quickly evolving, predominantly self-imposed consequences on global demand and earnings. The world has never experienced such widespread closures, sweeping unemployment levels, social distancing orders, and government directives regarding which businesses are essential enough to remain open. Confronted with so many unknowns, most asset classes were understandably volatile as they declined in value last month.

In economic news, global health concerns and the nascent price war in crude oil markets negatively impacted consumer spending, industrial production, business confidence and employment. Central banks around the world have undertaken significant measures to support the economy, slashing interest rates and providing liquidity to markets through various instruments and programs. Governments have also introduced unprecedented fiscal stimulus measures in an effort to limit the human and economic toll of COVID-19. Immediate consequences on the global economy are becoming increasingly apparent and point to a sharp fall in output worldwide. Effects over the longer term are less certain. Eventually containment measures will be lifted and the global economy will recover. What remains unclear is how long this will take, as well as how quickly demand and consumer confidence levels will bounce back once the curve flattens.

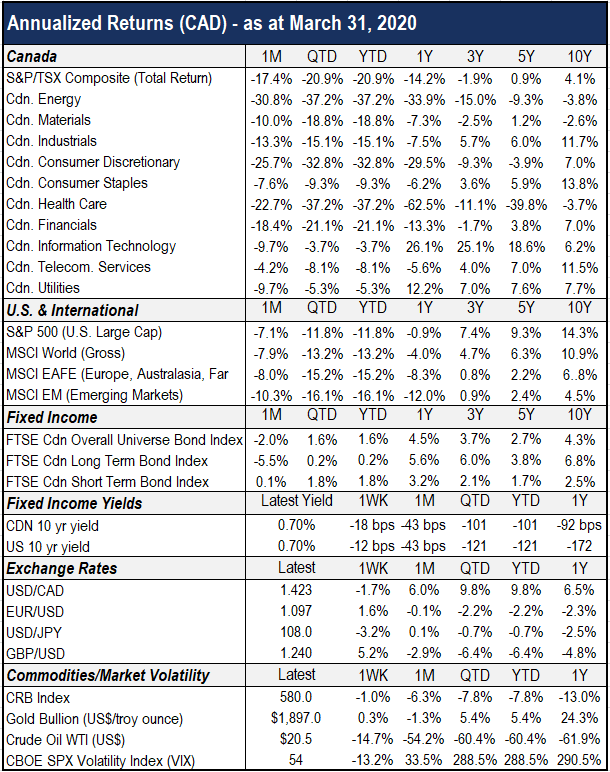

Fixed income markets, typically a safe haven when equities are challenged, faced difficulties in March, with the Canadian bond universe retreating 2.0% and the corporate bond index down 5%. As many investors looked to raise cash, liquidity became increasingly difficult to find – even in high-quality, shorter-duration corporate bonds. Central banks responded by pushing monetary policy to the limits, both in terms of the sheer figures employed to purchase assets, as well as the numerous market facilities launched. The U.S. Federal Reserve, Bank of Canada and various central banks around the globe have dropped interest rates to near zero, as well as announced liquidity-boosting packages to prevent credit markets from seizing up. These measures have allowed bond markets to function more smoothly over the last week and we expect central banks, particularly the Fed, to remain in “whatever it takes” mode. Last month saw short-term bonds significantly outperform their long-term counterparts, as fixed income investors flocked to the safety of lower-duration instruments. Similarly, the powerful risk-off sentiment caused government bonds to fare far better than their corporate equivalents.

It is often said that stock markets detest uncertainty, and last month was no exception, with global equities reacting sharply to the escalation of COVID-19 and collapsing oil prices. As we have highlighted before, stocks were richly valued at the start of the year, which exacerbated the downside as investors de-risked last month. The selloff was indiscriminate, which is not necessarily unusual in the beginning of a correction, where liquidity is of main concern and the baby can get thrown out with the bath water so to speak. Nevertheless, the last few trading days of March saw stock prices reverse course somewhat, as investors reacted positively to the U.S.’s $2 trillion stimulus package announcement. For the month of March, Canadian and U.S. stock markets returned -17.4% and -7.1% respectively. As well, international and emerging markets declined -8.0% and -10.3%.

Looking forward, we anticipate market volatility to continue in the short-term, as policymakers roll out further actions to fight the slowdown, and markets vote in real time on whether these programs are “good enough”. Markets will likely move sideways, with both selloff and rally attempts, until evidence emerges that COVID-19 containment efforts have proven effective. In time this will all prove to be temporary, and an end to this chapter will come, we just do not know when. History demonstrates that markets tend to swing too far in either direction, and once the outbreak is brought under control, we expect markets to respond with enthusiasm. Our defensive positioning in client portfolios has been helpful in preserving capital through these unsettling times. Our experienced selection of investment managers continue to focus on balance sheet strength within their portfolios, as well as the ability of their underlying companies to hold on through this challenging economic environment. The recent market weakness has also given our sub-managers the opportunity to selectively add to high-quality businesses at attractive safety margins. While the ride will be bumpy in the short-term as we manage the downside risks, it is crucial to remember that having a proper asset mix and investment plan in place, such as the ones we build at Kerr, is akin to wearing your seat belt. The bumps may be uncomfortable, but you can still keep going.

Sources: Morningstar Direct, Capital Economics, Globe Investor, National Bank Financial Markets