July 03, 2020 – KERR MARKET SUMMARY

The past month proved to provide some positive progress as governments around the globe introduced measures to re-open economies While this development has been encouraging, it’s been offset by the fact that a number of nations continue to struggle to contain the spread of the coronavirus, raising fears that more drastic measures need to be taken. Despite the trials and tribulations, global markets closed the quarter on a positive note based on optimism of an incipient global economic recovery. Government programs for both individuals and businesses have supplied vital support to our global economy providing quick access to income to many. Likewise, for global markets, policy support uplifted investor sentiment but are not a long-term solution to the present challenges.

The economic recovery is proceeding, albeit rather cautiously as many hurdles still exist. Following the release of this year’s “stress tests” for the largest American banks, the Federal Reserve directed the major banks to suspend share buybacks and halt dividend payout until the end of the third quarter. Equally vigilant, the International Monetary Fund (IMF) downgraded its economic forecasts based on expectations of a more severe global recession, deeper economic damage and slower recovery than it anticipated at the beginning of Q2. Durable good orders and new home sales beat expectations hinting at an improving economic landscape and increasing the potential of the highly desired “V-shaped” recovery. On the other hand, jobless claims remain high, suggesting that the return to business isn’t as substantial as many hoped. We remain in contraction territory even though Purchasing managers’ indices (PMIs) showed strong advances in Europe and the US. Similarly, in Canada, real GDP data indicates that the measures adopted to limit the pandemic had a profound impact, so far, the total output decline is 18.2% since the onset of the crisis.

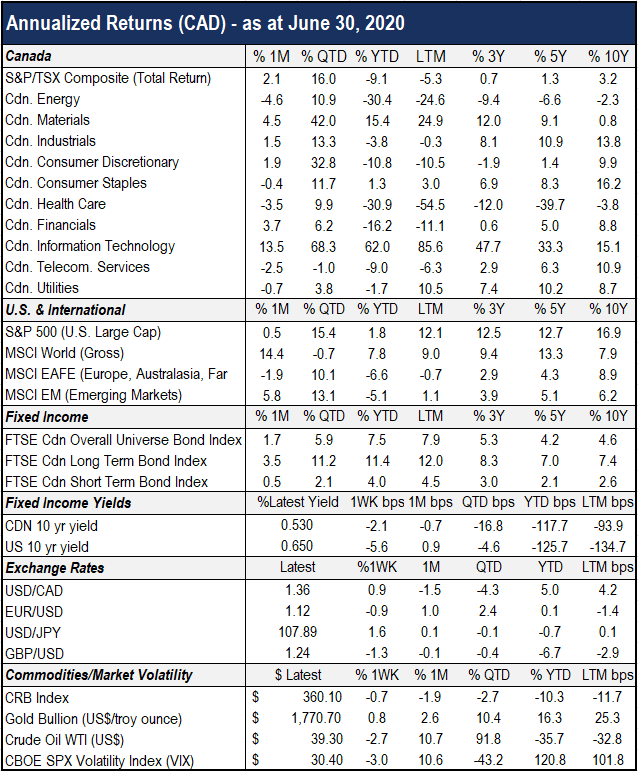

The Canadian bond universe returned 1.7% last month, and its 7.4% rate of return to date in 2020 is well ahead remains of various stock market benchmarks. The risk-on sentiment allowed corporate bonds to outperform their government counterparts in June. In fixed income news, Treasury yields rose on the closing of Q2, yet the Fed chair Jerome Powell’s outlook remains “extremely uncertain”. With the objective to improve market stability The Federal Reserve began investing in household bonds in June with its $428 million bond purchase in Walmart, AT&T, Gilead Sciences, and Ford Motors, to name a few. Given the highly uncertain environment, the Fed is following the trend of other central banks such as the European Central Bank and the Bank of Japan who developed individual corporate bond purchase programs. With such purchases, central banks help ensure that companies can continue to raise capital in an environment that would be otherwise very challenging for most companies to do so. Lastly, Fitch Ratings downgraded Canada’s credit rating from AAA to AA+ as our government finances suffered as result of adopted infection control measures.

In equities, we witnessed a tremendous rebound with the MSCI World Index rising by 18% in Q2, marking its biggest quarterly gain since Q2 2009. The momentum carried through North American equity markets with the S&P 500 rebounding with a 20% gain in Q2, the highest quarterly return since 1998. Although equity markets rallied higher during the quarter, the financial results from corporations operating through the pandemic are mixed. While technology, healthcare and consumer companies are operating with relative ease and reporting strong results, companies in the energy, industrial and consumer discretionary sectors are struggling because of the drop in demand. As a result companies of all sizes are having to restructure in order to survive Some companies have successfully raised capital such as Boeing’s massive $25 billion debt issue, while others like Chesapeake Energy, the gas pioneer that contributed to making the US a global energy giant filed for bankruptcy. Despite the challenging fundamentals there has been a furor of interest from new investors in segments of the equity market. Many millennials are taking this opportunity to play their hand at the market, using their emergency government assistance cheques to invest airlines, cruise operators and other stocks with hope of realizing massive gains. These have become known as Robinhood traders, partly due to a favored trading platform. Though their typical order size is minuscule, the volume of combined Robinhood traders is causing an impact and may influence the tipping of price scales.

As we move into the summer months, the cautiously positive sentiment is fueled by high recovery hopes. Though economies are gradually reopening the U.S and other countries are seeking to extend stimulus funding recognizing that we continue to operate from a vulnerable position While we remain hopeful that a vaccine and other measures will prove effective in dealing with the coronavirus, we expect to encounter numerous fits and starts before we gain confidence that the global economy and markets are on solid footing. As such, the investment managers on our platform remain vigilant in their security selection process to ensure that holdings in our portfolios are positioned to realize sustainable gains over the long-term.

Sources: Capital Economics, National Bank Financial Markets, Financial Post