September 02, 2020 – KERR MARKET SUMMARY

To say it’s been an unusual summer would be an understatement. The effects of COVID-19 continue to provide challenges on the health, economic and social fronts. However, post-lockdown, these challenges haven’t stopped the world from turning and the markets from rising. While many are relieved to see markets recover after a tumultuous start of the year, we are reminded that these are unusual times with fluid and evolving circumstances. We continue to receive uplifting news from the FDA on developments ranging from efficient virus testing applications to progress of various vaccine trials.

On the economic front, the Federal Reserve continues to dominate headlines as market watchers expected an update on its long-standing 2% inflation target. Federal Reserve Chair Jerome Powell announced that the Fed will aim for a 2% long-term average, allowing for periods of higher inflation to make up for periods of lower inflation, and will give more weight to supporting the labor market and the broader economy. The bottom line is that accommodative monetary policies will likely remain in place for the foreseeable future. In Canada, the release of second quarter GDP reflected a contraction at an annualized rate of 38.7%, echoing the economic impact of the pandemic. On a monthly perspective, the view is more encouraging, the Canadian economy grew 6.5% in June, beating expectations and hinting at a recovery. The Bank of Canada is focusing on building trust with the public in an age of unconventional monetary policy and fiscal stimulus and will also likely adopt an average inflation rate target. On the world stage, Japanese Prime Minister Shinzo Abe’s announced his resignation. Many are now questioning whether his three-pillar mix of monetary easing, fiscal stimulus and structural reforms, “Abenomics”, will live on.

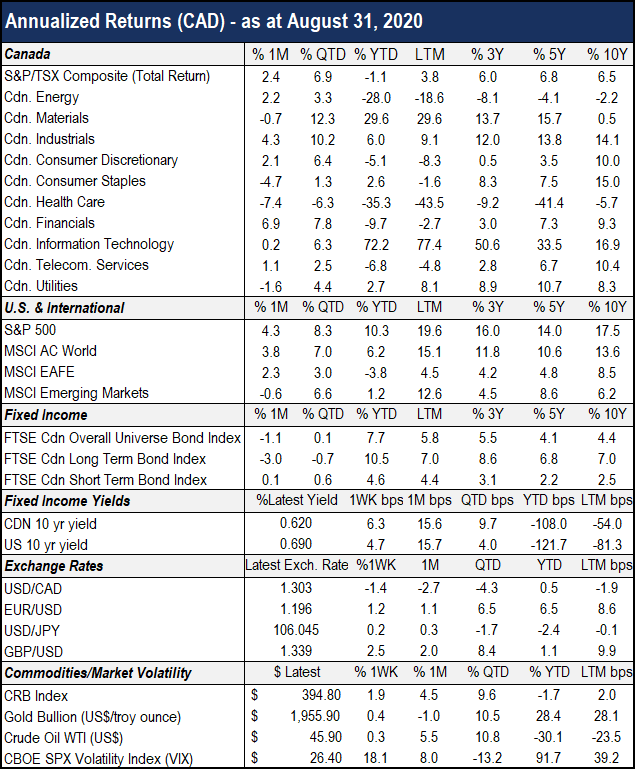

In the fixed income world, US Treasury yields rose at the end of the month capping a mild selloff in fixed income markets in August. Similarly, the Canadian Bond Universe fell 1.1%, in August, though still managing a healthy 7.7% return for the year. Adding to the Fed’s inflation target announcement earlier this month, Vice Chair Richard Clarida confirmed that yield curve control with yield caps was not warranted at this time but left the option open, should circumstances change. Yields rose following the Fed’s announcement, though no commitment was made to purchase additional longer-term Treasury debt as part of its inflation strategy. The Fed’s announcement indicated a higher tolerance for a steeper yield curve. Mid-month, the yield-curve inverted when the 10-year yield fell below the 2-year yield, this inversion is typically feared as it often precedes recessionary periods. A steeper yield curve would also trickle into the value of the dollar; the attractive higher longer-term yields would create foreign demand for US dollars, which have been declining in value throughout the pandemic.

The low rate environment has been a tailwind for equities, with the S&P 500 posting a 7% gain and the S&P/TSX advancing 2.3% this month. The now familiar trend favoring technology stocks continues to dominate market action. The strength in share prices has led tech giants like Apple and Tesla to announce stock splits to make shares more accessible to a broader base of investors. Symbolic of the growing influence of technology, the Dow Jones Index announced an adjustment with the replacement of Exxon Mobil, Pfizer and Raytheon with Salesforce, biotech company Amgen and Honeywell respectively. While developed international equity markets participated in the stock price rally posting a 2.3% gain for the month, emerging markets took a step back falling 0.6% in August.

While we remain optimistic on the strides made in finding solutions to deal with the health crisis, we recognize the global economy is not operating near capacity levels. We hope that economic activity can continue to resume in a growing number of different sectors without the need to enforce restrictions to contain the spread of the virus. Although the accommodative policies of central banks and governments have been quite supportive for markets, we acknowledge that valuation levels have increased significantly. As such, the investment managers on our platform remain vigilant in their security selection process to ensure that holdings in our portfolios are positioned to realize sustainable gains over the long-term.

Sources: National Bank Financial Markets, Morningstar Direct, Globe Investor, Capital Economics