August 02, 2019 – KERR MARKET SUMMARY

July was another month for the optimist. The month ended with the FOMC meeting where the Federal Reserve announced an interest rate cut of 25bp, to a new range of 2%-2.25%. This event marks the first rate cut since battling the 2008 financial crisis, and President Trump remained unsatisfied. The Fed released the news with notes of caution, underlining that this “was not the beginning of a long series of rate cuts”. Though a number of investors were counting on this rate cut, some reacted with mixed feelings, questioning what exactly justified the rate cut and whether it accomplished a positive outcome for the markets.

What motivated the Fed’s move? Some fear that the Fed is reacting to political pressure. In reality, according to the Fed’s statements, the rate cut represents an accommodative stance to continue stimulating the economy and dampen recession potentials. Another chief aim is to prolong our current expansionary phase, which is at times threatened by slowing global growth and shifting trade wars. Some perceive this to be an insurance policy. What does this mean for us, Canadians? Many question whether the Bank of Canada will follow suit and lower our rates as well. This does not seem likely. Though we are closely related, the BoC affirms its own stance and sees no reason to lower our rate, which currently sitting at 1.75%, is already lower than our neighbors south of the border. Economic indicators support this as we have witnessed three consecutive months of GDP growth in Canada, fueled by increases in manufacturing and construction. This indeed translates to the BoC opting to not follow its international counterparties in their easing policy. Nonetheless, the U.S. rate cut may benefit Canadians through an increase in foreign demand.

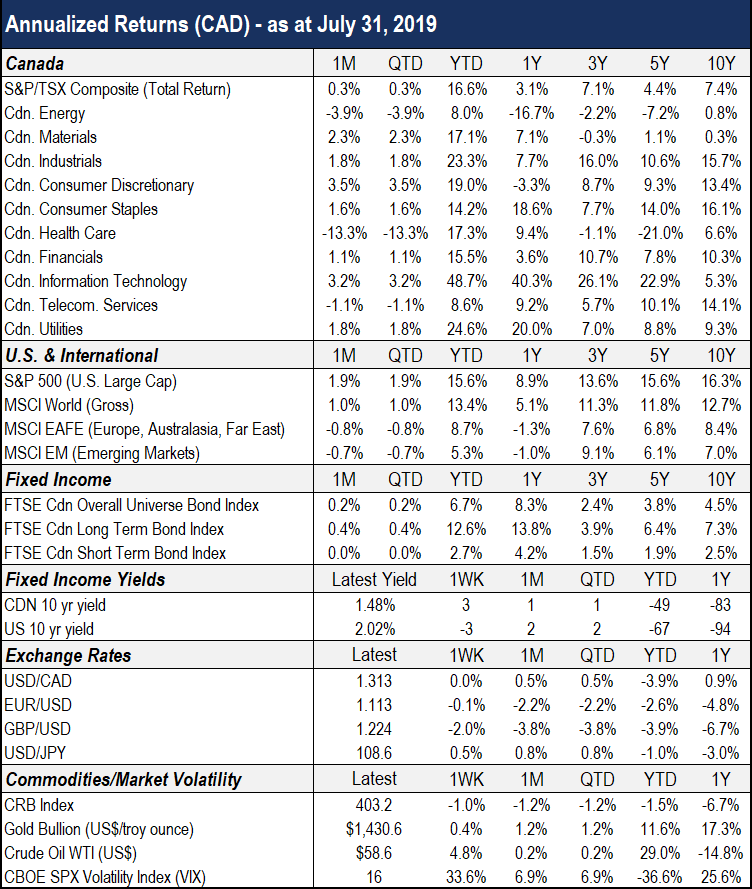

Despite the lower interest rates, the yield curve, depicting the margin between short- and long-term U.S. Treasury yields, did not shift very much, settling at -5.5bps. The concern that many share is the recent witness of an inverted curve, as historically this has preceded most U.S. recessions. The reaction in fixed income markets was positive, with an overall drop in yields, with the Canadian short-term bond market benefitting the least returning only 0.1% in July. Bond prices and interest rates are inversely related, meaning when interest rates decrease, bond prices increase, which also translates into a reduced yield to maturity. Other parts of the world, however, seem to be inspired by Fed chair Jerome Powell’s initiative. The president of the European Central Bank, Mario Draghi, uplifted the European market through the month with comments that they are prepared to loosen monetary policy to stimulate the European economy. This rippled to a number of other countries such as Brazil and Australia.

In equity markets, although stocks opened lower in July, they rallied over rate cut expectations throughout the month with the S&P 500 reaching record highs, followed by the DJIA and NASDAQ comp reaching for YTD peaks. Once the Fed rate cut news was officially released, U.S. stock prices dipped. Gold prices also rallied in July surpassing $1,450 for the first time in six years. A number of geo-political events equally impacted the markets. Namely, a decrease in trade tensions between the U.S. and China for the time being and further tariffs averted on Mexican imports, save steel. However, these events were offset by shipping disruptions in the Gulf of Oman mid-month, creating once again tensions with the Middle East.

Although we cannot predict the future, we remain biased towards equity markets. This remains accompanied by caution as to when a correction will occur. Our focus, as always, remains on investing in quality positions and minimizing risk to ensure your financial well-being.

Sources: Capital Economics, National Bank Financial Markets