March 02, 2018 – KERR MARKET SUMMARY – Volume 8, Number 4

Since the Great Recession, investors have been on the lookout for indicators that could spell the end of the bull market. Rising bond yields and an ascent in core inflation had recently been stoking the unease. After years of near-zero interest rates and virtually no volatility, financial markets have at long last been impacted by the broadly-based global growth that has pushed both bond yields and inflationary pressures higher. Unsurprisingly, February’s sharp market correction in the first week of trading was precipitated by these two trends. Many observers postulate that the pullback was a mean reversion to a more sustainable trend. And while most equities have since recovered ground, investors remain wary of the direction in which interest rates, volatility and inflation are headed.

On the economic front, Canadian Finance Minister Bill Morneau did not present any major tax or spending measures in the 2018 Federal Budget – despite sizeable U.S. corporate tax cuts, uncertainties over NAFTA’s going concern and a slowing housing market. It is expected that the Bank of Canada will err on the side of caution by keeping interest rates on hold in the near-term. South of the border, Fed Chair Jerome Powell’s first congressional testimony struck a hawkish chord, noting mounting inflation, pledging to prevent economic overheating, and portending the near-certainty of a March rate hike. Both the FOMC and Bank of Canada left interest rates unchanged in February.

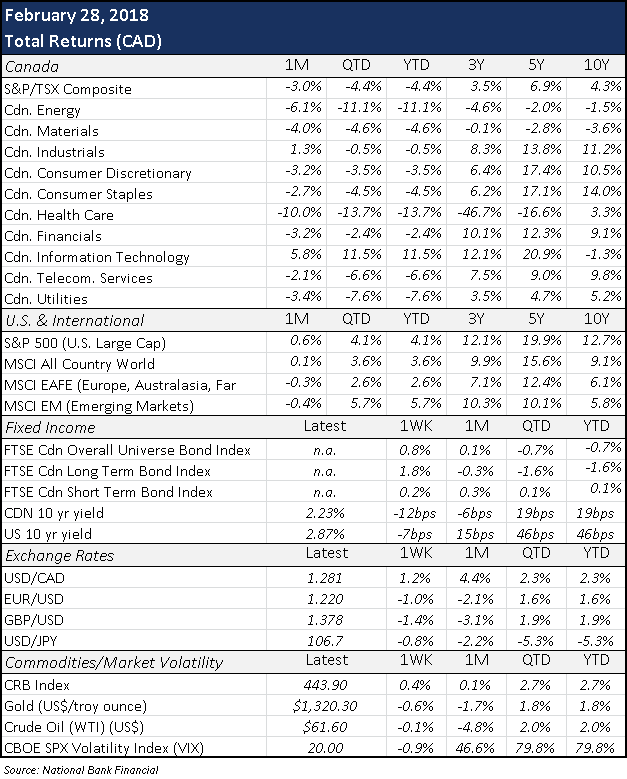

Fixed income markets experienced a wild ride in early February yet stabilized toward the end of the month. Changes in interest rates and credit spreads – the difference between government and corporate bonds – were muted. Yet the shape of the yield curve has shifted considerably in recent months, with short-term yields rising and the longer portion of the curve flattening. And while the curve has historically possessed some prognostication powers, this has largely been confined to when it inverts. Until then, the notion that a flat curve is a harbinger of market and economic weakness appears incorrect. The FTSE Canada Bond Universe Index ended 0.1% higher in February.

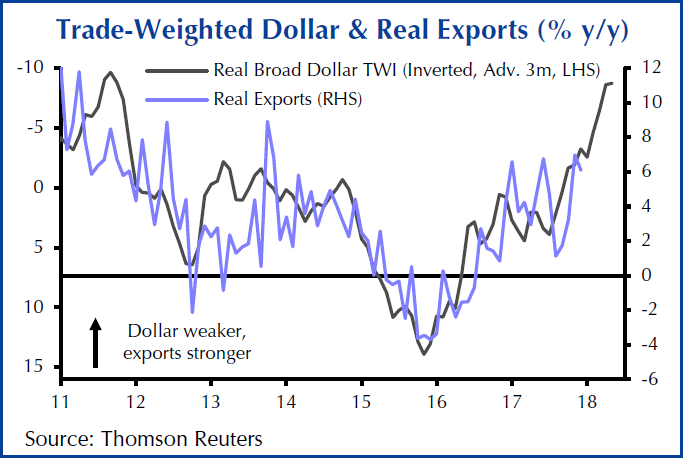

In currency markets, the loonie closed the month at a nearly ten-week low against its U.S. counterpart, trading at 78 cents USD. Loonie weakness is good news for exporters but not for Canadians spending Spring Break south of the border, with suddenly a little less purchasing power. Meanwhile, the greenback rose to six-week highs against a basket of currencies, its newfound strength weighing on emerging markets at a time when they were benefiting from foreign exchange.

Preserving the February narrative, oil prices kept in line with equity asset volatility last month. Benchmark crude oil settled 4.8% lower, at $61.60 USD a barrel, after data revealed a build in U.S. inventories. Having risen 20% since mid-2016, mounting U.S. production is keeping a lid on oil prices year-to-date, even as OPEC complies with supply cuts.

Sources: Capital Economics, Globe Investor, National Bank Financial