July 04, 2017 – KERR MARKET SUMMARY – Volume 7, Number 13

Markets pulled back this month after a fairly strong “spring surge”. Recent investor pessimism is blamed on softening economic data in the U.S. which has seen consumer and business confidence levels come down a few notches from recent highs. In addition still-low inflation and growth readings, have resulted in declining long-term yields as well as rising short-term rates on account of the Fed’s hawkish tone. The end result is the potential for an inverted yield curve –a harbinger of recession. In Washington, the “Comey affair” continues to distract the Trump administration – possibly impeding his promised tax cuts and fiscal spending. Overseas, the U.K.’s “dumbest hour” continues to bemuse as their recent election outcome created even more political uncertainty for the pending Brexit negotiations.

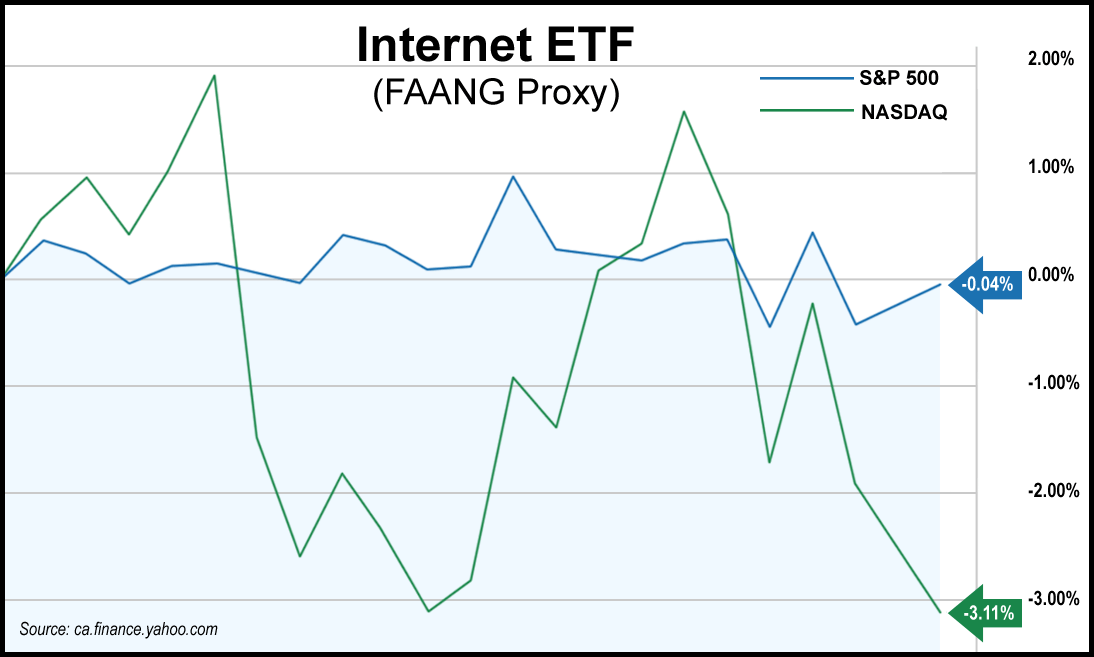

The month’s first half saw, amidst light trading volumes, a transition in market leadership as the FAANG stocks (Facebook, Amazon, Apple, Netflix, and Alphabet’s Google) representing $2 trillion in market cap, sold off, while small and mid-cap benchmarks outperformed. One exception was Amazon, which enjoyed resurgence on the surprise Whole Foods acquisition of over $13 billion. Long bond investors benefited from a fall in yield for 10-year Treasury note, on news of lower-than-expected inflation. Retail sales also disappointed. Despite the waning economic data, the Fed raised rates and suggested there could be one more hike in 2017. In addition, the Fed plans to unwind its $4.5 trillion balance sheet – to reverse its nine-year unprecedented purchases of Treasury bonds and mortgage-backed securities. Overseas, the UK electorate delivered another surprise electoral result, requiring Prime Minister May to seek out a collation with a Northern Irish fringe party. Interestingly enough, Britain’s FTSE 100 rose on the news as it is thought a weaker majority could lead to a “soft” Brexit. For the first half of June the S&P 500 Index retreated 0.4% while Canada’s TSX finished down 4.9% – following oil’s 7% drop during the fortnight. European investors took some of their profits off the table – resulting in a 1.9% drop to the Eurostoxx 50 index.

During the month’s second half, despite the oil-induced setback for energy shares, the S&P 500 Index managed to achieve new highs early on before retreating. Oil prices were officially in bear market territory (a fall of 20% from recent highs) falling to a 10 month low of $44/bbl. Analysts point to a secular downward trend precipitated by OPEC’s inability to enforce quotas and the rapid on-lining of U.S. shale production when prices rise. Tech stocks, such as the FAANG members, recovered somewhat after industry leaders met with President Trump; however, a subsequently sharp sell-off was caused, in part, to news that the European Union was fining Google parent Alphabet $2.7 billion for antitrust violations. Overall market volatility was exasperated by a bond market sell-off as central bankers in the Eurozone and the UK have indicated that recent economic gains now warrant the removal of accommodative monetary policy measures. European bond yields rose by 25 basis points. At the same time, comments by Fed Chair Janet Yellen indicated that the Fed is concerned with stock markets valuations, causing some aversion to U.S. equity markets. One relative winner was the Canadian loonie as hawkish remarks by Governor Poloz signalled that the BoC will soon hike rates. For the last two trading weeks of the month, Canadian equities were down 0.14% while U.S. and European equities both declined by 0.5%.

At the end of the month, Canada’s TSX slipped by 0.75%, greatly affected by the usual suspects: Energy (-6.5%); and Materials (-3.9%). The S&P 500 was up 0.6% while European indices retreated by 1%. Foreign equities were tempered by the headwind of a surprising 4% gain to the loonie, bringing U.S. and European indices to -3.2% and -4.9% respectively. Of interest, the FAANG stock proxy (PowerShares NASDAQ Internet ETF: PNQI) was down 3% for the month. Over the past five years, the PNQI has risen 171% vs. the S&P 500’s 79%. The FAANG stocks now account for 11.9% of the S&P 500’s market capitalization (compared to 5.8% at the start of 2013) and collectively, over the same period, have contributed $1.6 trillion of the $6.9 trillion increase in the S&P 500.

NEWS FOR THE SECOND HALF OF JUNE 2017

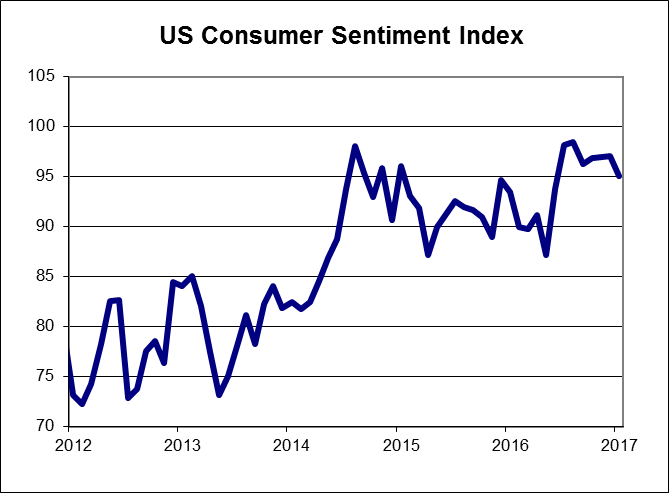

The Thomson Reuters/University of Michigan consumer sentiment index fell by 2.0 to 95.1 in June. Sentiment about current conditions rose modestly, but was more than offset by the decline in the barometer of future economic expectations.

Personal income rose by 0.4% in May, up from 0.3% in April, but personal spending did not keep pace, rising only 0.1% after increasing 0.4% the previous two months.

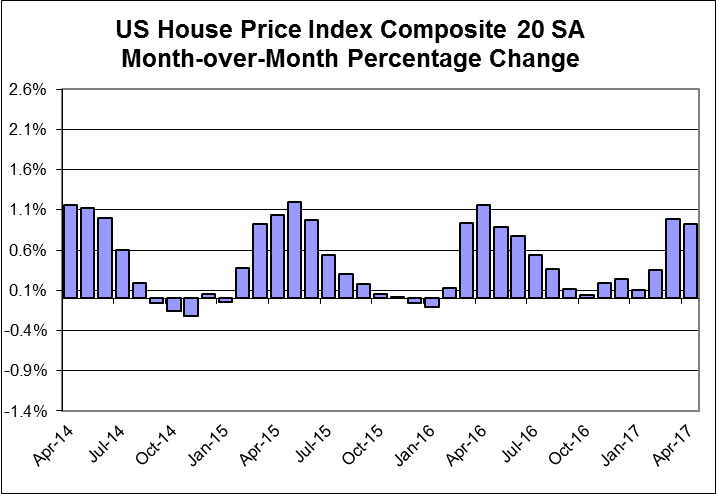

Home prices, as measured by the S&P Case Shiller home price index, rose by 0.3% in April and were up by 5.7%, year-over-year.

The ISM Manufacturing index for June rose to 54.9 from 57.8, the fastest rate in three years as new orders, production and employment surged.

OTHER ECONOMIC NEWS

US housing starts dropped by 5.5% in May to 1.09 million, annualized, the lowest level since September 2016. Building permits fell by 4.9% to 1.17 million, the lowest level since April 2016. New home sales in the U.S. rose by 2.9% in May to a seasonally adjusted annual rate of 610,000 units. Existing home sales in the U.S. rose by 1.1% to a seasonally-adjusted annual rate of 5.62 million units in May. Orders for U.S. durable goods fell by 1.1% in May. Orders for non-defence capital goods, excluding aircraft, a close proxy for business investment, fell by 0.2%. The final estimate of US first quarter GDP came in at 1.4%, annualized, up from last month’s estimate of 1.2%.

CANADIAN ECONOMIC NEWS

Canadian retail sales for April rose by 0.8%, despite a 1.0% drop in vehicle and auto part sales. The Canadian inflation rate for May fell to 1.3% from 1.6% in April. Canadian GDP rose by 0.2% in April, building on March’s 0.5% increase. Growth was broadly based as 14 of 20 subsectors showed positive growth for the month. Canadian manufacturing sales rose by 1.1% in April.