June 01, 2017 – KERR MARKET SUMMARY – Volume 7, Number 11

Markets advanced cautiously amidst a global macroeconomic landscape depicting slowly accelerating growth and stable but low inflation. At the same time, lower-than-expected U.S. GDP growth and political instability in Washington stalled the trajectory of U.S. equity gains and hurt the value of the U.S. dollar. Fortunately, the potential for a policy misstep by the Fed is low as evidenced by the recent caution exhibited in its decision to hold rates steady. This month’s results suggest that market leadership may be changing. While the corporate earnings recovery is supportive of valuations, U.S. equities are priced for perfection. In contrast, European equities and some emerging markets exhibit an attractive valuation gap that can no longer go unnoticed.

The month’s first half saw global markets continue their climb amidst an initial environment of investor complacency – the Chicago Board of Exchange’s Volatility Index (VIX) at a record low. U.S. economic data supported the view that the recently disappointing 0.7% Q1 GDP growth rate is not indicative of America’s future prospects. The job market improved as payrolls advanced 211k jobs in April and the unemployment rate fell to 4.4% – the lowest level since 2007. Broader measures of the labor market also improved, such as a lower number of discouraged workers and less involuntary part-time workers. Wages were up 2.5% over a year ago, a positive for consumer spending for the rest of the year. On the political front, the Trump administration had a small win in its stumbling steps towards repealing Obamacare. The revised American Health Care Act passed narrowly in the House, but with an uncertain future in the Senate. Passing healthcare reform is expected to generate some of the savings to make budgetary room for the proposed changes to the tax code. As expected, the Fed kept interest rates unchanged, noting below-expectation inflation numbers. European equity indexes rallied on the back of strong corporate earnings, more clarity from the French presidential election outcome, and signs of improving economic growth and employment. The election of pro-EU Emmanuel Macron as President of France augers well for European markets that have been dogged by protectionist and nationalistic rhetoric over the last few years. The German blue chip DAX 30 index climbed to an all-time high and France’s CAC rose to its highest level in nearly a decade. For the first half of May the S&P 500 Index increased 0.4% while Canada’s TSX finished down 0.2%. European stocks led the way with a rapid gain of 3% – hitting a 20-month high.

During the month’s second half, political shenanigans in Washington finally awakened the ire of investors, sparking a surge in market volatility. Major U.S indices had their biggest sell-off since last September following allegations that President Trump had requested ex-FBI Director James Comey to drop his investigation into possible ties with Russian government officials. After reaching a 20 year low at the start of the month, the VIX spiked 46% on the breaking news. Global markets were not immune and suffered broad-based declines. The U.S. dollar dropped 2% relative to the Euro, while the price of gold rose sharply by 3.8%. The ensuing speculation about impeachment is considered an impediment to the Trump administration’s efforts on tax reform and other campaign promises. Markets soon got over the “Comey Affair”, recovering somewhat along with the VIX reverting to its normal-of-late calm. For now markets have looked past the recent goings-on in Washington; however, these matters have the potential to spiral out of control and affect investor sentiment. One need only look to Brazil’s bribery and corruption scandal that emerged this month to see the carnage it can have on investor confidence – Brazil’s Bovespa declining 16% mid-month (finishing down 5%). For the last two trading weeks of the month, Canadian equities were down 0.8% while U.S. and European equities both advanced 1.1%.

At the end of the month, Canada’s TSX slipped by 1.3% – its fate tied to Energy (-5.5%), Materials (-2.2%) and Financials (-1.9%). The S&P 500 was up 1.4% while European indices surged for the third consecutive month at +5%. Foreign equities were tempered by the headwind of a 1% gain to the loonie, bringing U.S. and European indices to +0.2% and +3.8% respectively. The U.S broad-based bond index rallied 0.9% for the month, suggesting some investor trepidation over the prospects for Trump and for the long-term efficacy of the Trump administration’s economic policies.

NEWS FOR THE SECOND HALF OF MAY 2017

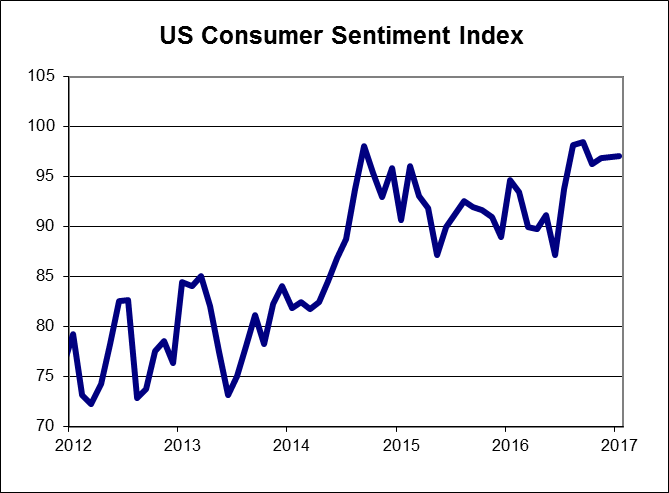

The Thomson Reuters/University of Michigan consumer sentiment index rose by 0.1 to 97.1 in May. The divide among party lines remained unchanged with Democrats expecting a recession and Republicans optimistic about more robust growth.

Personal income and spending both rose by 0.4% in April, both in line with consensus estimates.

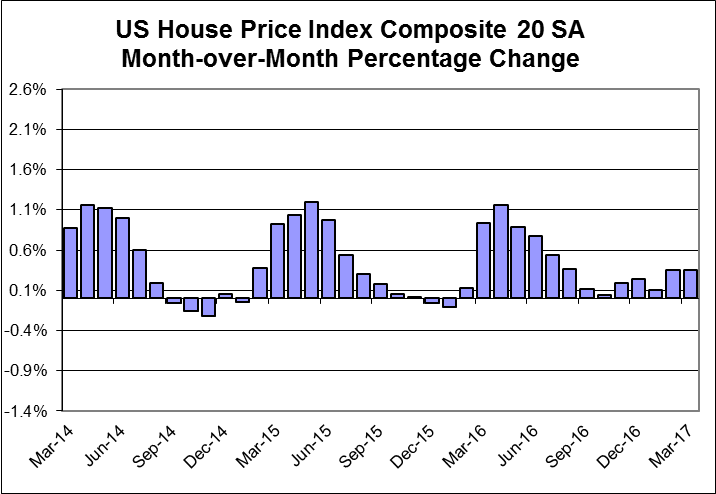

Home prices, as measured by the S&P Case Shiller home price index, rose by 0.9% in March and were up by 5.8%, year-over-year.

The ISM Manufacturing index for May rose by 0.1 to 54.9, as half of the components rose and half fell.

OTHER ECONOMIC NEWS

US housing starts and building permits both started the second quarter with subpar readings. Housing starts fell to 1.172 million units in April from a downwardly revised 1.203 million units in March. Building permits also fell short of expectations. Existing home sales in the US fell by 2.3% for April, which was below expectations. US new home sales declined by 11.4% in April, to 569,000 units, on an annualized basis, with March’s figure being revised upward. Orders for US durable goods for April decreased by 0.7%. Orders for non-defence capital goods, excluding aircraft, a close proxy for business investment, were unchanged for a second straight month. The second estimate of US first quarter GDP came in at 1.2%, annualized, up from last month’s estimate of 0.7%. The increase was attributed to increased business investment and consumer spending.

CANADIAN ECONOMIC NEWS

Canadian retail sales bounced back in March, up by 0.7%, after declining in February. The increase was driven by sales of durable goods, i.e., autos, appliances and electronics. The Canadian inflation rate remained unchanged in April, at 1.6%. Canadian GDP for the first quarter came in at 3.7%, annualized on the strength of consumer spending, business investment and housing activity. Despite the strong gain, the reading was slightly below expectations. Canadian manufacturing sales rose by 1.0% in March, missing expectations, with the February number being revised downward.