July 04, 2016 – KERR MARKET SUMMARY – Volume 5, Number 13

While nervously watching for indications of the Fed’s next move, markets have essentially been moving sideways for the last few months. The U.S. Fed is keen to raise rates and is waiting for that that perfect moment of calm. Now certainly doesn’t seem like the opportune time, given the market’s reaction to the outcome of the Brexit vote. Global fragility and investor nervousness were on full display this month in both the lead-up and denouement of the U.K.’s Brexit vote – the leave camp unexpectedly winning the outcome with 52% of the ballots. If that wasn’t enough, the Kingdom immediately had its triple-A credit rating reduced a notch as an “unintended consequence” of the result. To top it all off, as dictated by Sod’s law, England’s Euro 2016 soccer team suffered an infamous defeat at the hands (or feet) of Iceland. Fortunately, the latter event had no impact on investor portfolios.

While there were other headline events, rumination over the June 24th “Brexit” vote in the UK drove much of the market sentiment in the first half of the month. Markets waxed and waned as early polls showing increased support for the “leave” camp were met with the backlash from the tragic murder of a pro-EU member of parliament – heightening the prospects for the “remain” vote. In the U.S., the Fed’s policy meeting met investor expectations as they kept rates steady and suggested a slower pace of rate hikes than previously indicated. Japanese stocks continued to disappoint as the yen climbed to a two-year high when the BoJ decided not to take any additional stimulus action. Investors are losing faith in Abenomics and its safe haven currency status which make Japan’s export orientated equities less appealing. For the first-half of the month, Canadian and U.S. equities were down at -1% and -1.2% respectively. EAFE markets were down 4.4% along with Japanese equites at-4%.

Going into the month’s second half, markets became increasingly skittish on anticipation of the UK referendum. Investors ultimately headed for the hills as Britons unexpectedly voted to leave the EU. While the latest polls were neck-and-neck, sentiment was brazenly “risk-on” up until the voting booths closed – as pundits counted on the undecided vote to carry the “stay” camp. While voter turnout was strong at 72%, participation in the “remain” regions of London, Scotland, and Northern Ireland were weaker than average. In the immediate aftermath, the British pound declined against the U.S. dollar and Japanese yen, falling 8.3% and 12.5% respectively. The euro also fell 2% against the greenback. Equity markets plummeted the day after the vote with US, European and Japanese stock indices down 3%, 7.5%, and 8% respectively. Fixed income yields reflected the flight to safety with US 10-year treasury yields down 17 bps, trading at a yield of 1.57%. After the initial Brexit selloff, a semblance of stability returned to financial markets towards the end of the month – the VIX fear index declining from its peak of 27 to 16, and both the dollar and yen inflows diminishing. Global equities also staged a rally, recovering most of the Brexit-induced losses. Oil prices recovered by 6%, reflecting the upbeat investor sentiment as the UK’s FTSE 100 hit a year-to-date high helped by a decline in the value of the pound. Even the broader domestic-focused FTSE 250 recovered half of its Brexit sell-off losses. For the second-half of the month, after an initial drop of 1% to 3%, Canadian and U.S. equities returned 1.3% and 1% respectively. EAFE markets initially dropped 5% but finished even and Japanese equites gained 1.6%.

Going into the month’s second half, markets became increasingly skittish on anticipation of the UK referendum. Investors ultimately headed for the hills as Britons unexpectedly voted to leave the EU. While the latest polls were neck-and-neck, sentiment was brazenly “risk-on” up until the voting booths closed – as pundits counted on the undecided vote to carry the “stay” camp. While voter turnout was strong at 72%, participation in the “remain” regions of London, Scotland, and Northern Ireland were weaker than average. In the immediate aftermath, the British pound declined against the U.S. dollar and Japanese yen, falling 8.3% and 12.5% respectively. The euro also fell 2% against the greenback. Equity markets plummeted the day after the vote with US, European and Japanese stock indices down 3%, 7.5%, and 8% respectively. Fixed income yields reflected the flight to safety with US 10-year treasury yields down 17 bps, trading at a yield of 1.57%. After the initial Brexit selloff, a semblance of stability returned to financial markets towards the end of the month – the VIX fear index declining from its peak of 27 to 16, and both the dollar and yen inflows diminishing. Global equities also staged a rally, recovering most of the Brexit-induced losses. Oil prices recovered by 6%, reflecting the upbeat investor sentiment as the UK’s FTSE 100 hit a year-to-date high helped by a decline in the value of the pound. Even the broader domestic-focused FTSE 250 recovered half of its Brexit sell-off losses. For the second-half of the month, after an initial drop of 1% to 3%, Canadian and U.S. equities returned 1.3% and 1% respectively. EAFE markets initially dropped 5% but finished even and Japanese equites gained 1.6%.

Closing off the month, Canada’s TSX eked out a gain of 0.3% helped by Materials (+13%), Metals/Mining (+15%) and Gold (+21%). In local currency terms, the S&P 500 was also barely positive at 0.3% while the EAFE and Japanese indices declined by 3% and 2.4% respectively. Despite the flight to the U.S. dollar, the loonie also appreciated 0.7% for the month – possibly due to attractive bond yield differentials and a contained Brexit impact on Canada. While market volatility has subsided for now, the “leave” vote has unleashed a great deal of political and economic uncertainty. Whatever the lasting effects, the distraction will certainly impact Eurozone and UK growth with collateral damage to investor sentiment.

NEWS FOR THE FIRST HALF OF JUNE 2016

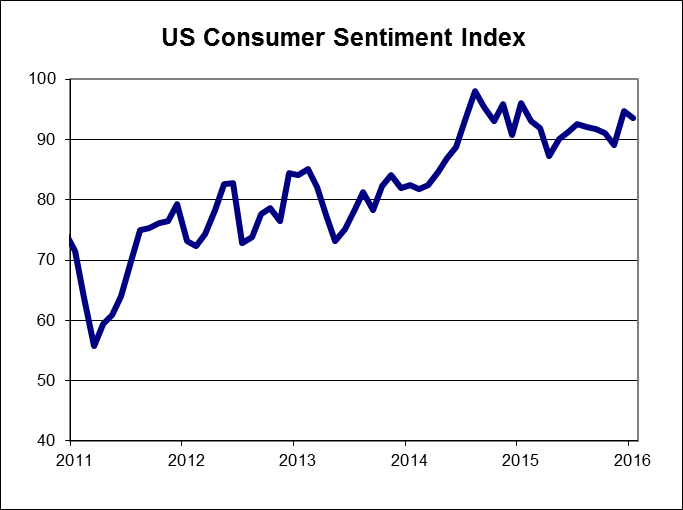

The Thomson Reuters/University of Michigan consumer sentiment index dropped to 93.5 in June from 94.7 in May. Consumers were less optimistic about economic conditions, expecting slower growth in the months ahead.

The latest Realty Trac foreclosure report showed foreclosure filings were reported on 100,932 properties in April, down 7% from the previous month, and down 20% from a year ago, the ninth consecutive year-over-year decrease.

The S&P/Case-Shiller home price index for 20 US cities rose by 5.4%, year-over-year in April, which was in line with expectations.

The ISM manufacturing index rose to 53.2 in June up from 51.3 for May, as new orders accelerated and employment expanded for the first time since November.

OTHER ECONOMIC NEWS

US housing starts fell slightly in May to 1.164 million units, beating expectations. Building permits rose marginally. US existing homes sales rose by 1.8% to 5.53 million annualized units in May. US new home sales dropped by 6.0% to 551,000 annualized units in May. April’s number, though revised downward, was still the highest since February 2008. US durable goods orders decreased by 2.2% in May. Orders for non-defence capital goods, excluding aircraft, a closely watched indicator of business spending, fell by 0.7%. The third and final estimate of first quarter US GDP showed annualized growth of 1.1%, an increase from the second estimate of 0.8% last month. Stronger net exports and business investment offset an unexpected downward revision to consumer spending. US consumer prices rose by 0.2% in May, with the annual inflation rate dipping to 1.0%, from 1.1% in April.

CANADIAN ECONOMIC NEWS

Canada’s GDP rose by 0.1% in April, following two months of declines. Canadian retail sales rose by 0.9% in April with a slight upward revision to the previous month’s number. The annual inflation rate in Canada fell to 1.5% in May from 1.7% in April.

Sources: US Bureau of Labor Department, US Department of Commerce, RealtyTrac, US National Federation of Independent Business, and Statistics Canada, Teranet/National Bank of Canada.

| June 30, 2016

Total Returns in CDN$ |

1M | 3M | 1Y | 3Y | 5Y | 10Y |

| Canada | ||||||

| S&P/TSX Composite | 0.34% | 5.07% | -0.20% | 8.27% | 4.21% | 4.94% |

| S&P/TSX 60 | -0.05% | 4.24% | -0.39% | 8.78% | 4.48% | 5.14% |

| Cdn. Energy | 0.15% | 10.35% | -4.97% | -5.04% | -6.90% | -3.01% |

| Cdn. Materials | 13.02% | 26.88% | 19.31% | 6.27% | -7.32% | 2.70% |

| Cdn. Industrials | -0.69% | 3.89% | 0.73% | 10.24% | 10.18% | 9.23% |

| Cdn. Consumer Discretionary | -4.59% | -2.87% | -8.55% | 14.20% | 13.67% | 7.45% |

| Cdn. Consumer Staples | -2.88% | -4.01% | 13.37% | 22.94% | 21.69% | 12.73% |

| Cdn. Health Care | 10.76% | -7.01% | 37.27% | 4.43% | 10.12% | 8.52% |

| Cdn. Financials | -2.91% | 0.97% | 2.75% | 11.08% | 8.96% | 6.98% |

| Cdn. Information Technology | -6.65% | -5.38% | 5.80% | 19.13% | 10.91% | 8.18% |

| Cdn. Telecom. Services | 2.54% | 5.85% | 21.09% | 16.13% | 13.77% | 12.14% |

| Cdn. Utilities | 4.17% | 7.03% | 18.44% | 9.48% | 6.41% | 7.22% |

| U.S. & International ($CDN) | 1M | 3M | 1Y | 3Y | 5Y | 10Y | |||||

| S&P 500 (LargeCap) | -0.4% | 2.8% | 8.5% | 19.9% | 19.0% | 9.1% | |||||

| Russell 2000 | -0.8% | 4.1% | -2.7% | 15.0% | 15.0% | 7.8% | |||||

| World | -1.8% | 1.5% | 2.0% | 15.5% | 13.9% | 6.7% | |||||

| Europe | -5.1% | -2.0% | -6.8% | 10.1% | 7.9% | 3.7% | |||||

| Japan | -3.1% | 1.3% | -4.7% | 10.6% | 10.9% | 1.9% | |||||

| Pacific ex-Japan | 0.2% | 1.0% | -2.6% | 8.7% | 7.2% | 7.4% | |||||

| EAFE (Europe, Aus, Far East) | -4.0% | -0.9% | -5.8% | 10.1% | 8.4% | 3.6% | |||||

| EM (Emerging Markets) | 3.4% | 1.1% | -7.9% | 6.1% | 2.5% | 5.5% | |||||

| Fixed Income | Latest Price | Week | Month | YTD | 1-Year |

| iShares Cdn Universe Bond ETF | $32.29 | 0.91% | 1.4% | 2.0% | 1.8% |

| iShares Cdn Long Term Bond ETF | $25.08 | 1.92% | 3.1% | 5.6% | 5.0% |

| iShares Cdn Short Term Bond | $28.45 | 0.21% | 0.2% | -0.2% | -1.1% |

| CDN 30 yr yield | $1.77 | -5.66% | -11.0% | -17.8% | -23.2% |

| US 30 yr yield | $2.28 | -8.62% | -14.0% | -24.3% | -26.5% |

| Exchange Rates | Latest Price | Week | Month | YTD | 1-Year |

| Canadian Dollar ($US) | $0.77 | -1.05% | 0.5% | 6.7% | -3.7% |

| Canadian Dollar (Euro) | $0.70 | 0.73% | 0.6% | 4.3% | -3.3% |

| Canadian Dollar/British Pound | $0.58 | 8.92% | 9.5% | 17.8% | 12.8% |

| Canadian Dollar (Yen) | $79.33 | -2.62% | -6.4% | -8.8% | -19.2% |

| Commodities | Latest Price | Week | Month | YTD | 1-Year |

| RJ/CRB Index | 193.56 | 1.48% | 4.6% | 9.9% | -14.3% |

| Bloomberg Livestock | $30.58 | -0.35% | -0.1% | -1.1% | -9.7% |

| Gold | $1,321.20 | 4.48% | 9.3% | 25.2% | 13.2% |

| Natural Gas | $2.86 | 6.95% | 32.0% | 29.3% | 1.1% |

| Light Sweet Crude Oil | $48.88 | 1.53% | 1.1% | 34.7% | -16.1% |

| CBOE Volatility Index | 15.52 | -21.4% | 26.8% | -8.6% | -8.7% |