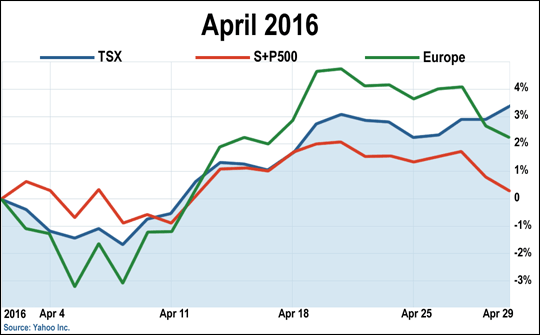

April’s market performance tentatively continued the upward trajectory that launched in late February. This month’s trading saw equity markets experience both a wobbly start and wobbly finish due to volatile trading swings over uncertainty about monetary policy, corporate profitability and commodity prices. After a brief market rally interruption, many benchmarks touched on multi-month highs before pulling back as investors processed a mixed bag of global economic news. Despite the dearth of options in fixed income markets and the psychological scars from the recent high-yield debt scare, investors remain skittish on equities in light of the recent weak earnings results and insufficient global growth. While monetary conditions remain accommodative and the risk of a policy misstep is diminishing, it will take more evidence of either an increase in global growth or signs of a corporate earnings rebound before investors unreservedly embrace risk assets again.

During the month’s second half, market sentiment initially proved substantive. News of a possible Saudi-Russian coordinated oil supply cut saw energy stocks rise to year-to-date high and led the one of the largest volume trading days in a month. While the accord failed, markets shrugged off the news and oil gained another 1%. Corporate profitability vexed investors with two-thirds of S&P 500 index constituents reporting its fourth string of quarterly earnings declines (-7.6% year-over-year) – the worst since the market crisis. While markets reacted negatively, sentiment was partially bolstered by a sustained oil rally, weakening greenback, and further dovish assurance from the Fed. European equites sold off sharply on downbeat corporate earnings (-7% year-over-year.) Japanese equities sold off due to disappointment over the BoJ’s decision to pause on additional stimulus measures. A rapid rise of the yen did not help matters either. The BoJ prefers to wait and see how its previous measures are working – present results not stellar as they also reduced their inflation forecast (actual inflation currently -0.1%) and GDP growth forecast from 1.5% to 1.2%. For the second half of the month, Canadian and U.S. equities returned 1.7% and -0.7% respectively. EAFE markets returned 0.9% and Japanese equites lost 0.8%.

Closing off the month, Canada’s TSX continued its recent leadership of the developed world indices with a gain of 3.7% – the usual commodity suspects like Energy (+8%), Gold (+25%) and Materials (+20%) contributing the most. In local currency terms, the S&P 500 paused at 0.4% while the EAFE and Japanese indices increased by 3% and 4.7% respectively. Along with a 15% rise in the price of oil, the loonie appreciated 3.7% for the month – tempering the S&P 500, EAFE and Japan indices down to -2.9%, -0.3%, and +1.2% respectively, in Canadian dollar terms.