Economic Overview

The global economy showed mounting strain in the third quarter of 2025. World trade rebounded, and AI investment lifted U.S. capital spending. Still, labor markets softened across advanced economies, services inflation remained stubborn, and tariffs disrupted trade flows, muddying the inflation outlook. Manufacturing remained in contraction across the U.S., euro area, and China. With growth faltering and inflation distorted by tariffs, central banks face the delicate task of weighing slowdown risks against reigniting inflation.

In the U.S., Q3 GDP is tracking near 3%, underpinned by consumer spending and business investment. AI-related investment remains strong, though productivity gains are concentrated in a few sectors. Revisions cut 2024–25 payroll growth by 900,000, and average monthly job gains have slowed to 27,000. Unemployment climbed to 4.3%, and wage growth cooled to 3.6% from over 5% in 2022. While inflation is easing, services prices remain sticky, driven by wages, rents, and tariffs. Manufacturing is weak but showing signs of tentative stabilization.

The Federal Reserve cut rates by 25bp to 4.00%–4.25% in September while signaling more easing ahead. But rising fiscal deficits—now near 7% of GDP—are increasing the risk of higher long-term yields, complicating the Fed’s efforts.

Canada’s slowdown is intensifying. Q3 growth is tracking around 0.6% annualized. Unemployment rose to 7.1% after back-to-back job losses. Inflation increased to 1.9%, up from 1.7% the month prior. The Bank of Canada cut the policy rate by 25bp to 2.5% in September, below neutral to support growth. Policymakers flagged trade uncertainty and weakening demand as key risks.

In the Euro area, stagnation persists. Manufacturing is in contraction, and services have slowed. Inflation is drifting lower, nearing 2%. As the ECB enters wait-and-see mode, policymakers hope lower rates may stabilize sentiment into year-end.

China’s recovery remains fragile. U.S. tariffs have hit exports, though some flows are being rerouted. Domestic demand remains under pressure from property weakness. Stimulus is cushioning the downturn.

The current trajectory points to a modest slowdown, though the risk of something deeper is rising. Labour markets across advanced economies are softening, with unemployment drifting toward recessionary thresholds. Monetary policy is no longer moving in sync: the Fed is balancing inflation against weakening jobs, the Bank of Canada has begun easing, and the ECB is likely to follow

Equity Markets

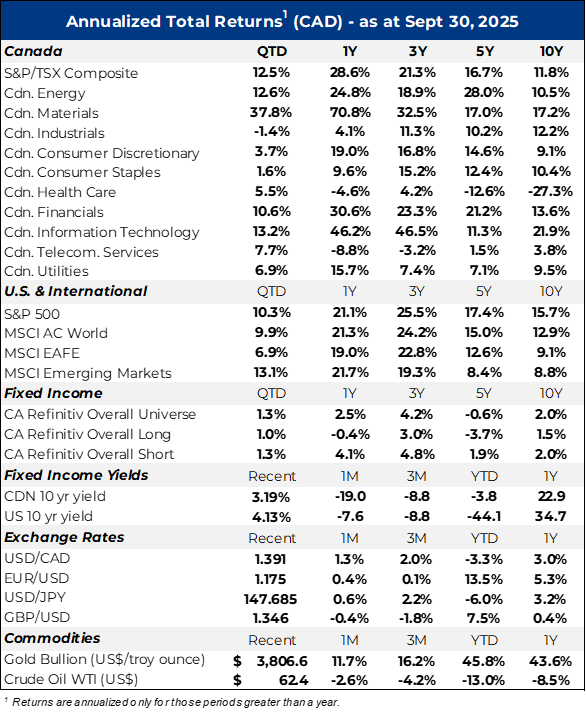

Global equities advanced in Q3, navigating slowing growth, sticky services inflation, and renewed trade frictions. After a turbulent Q2, volatility subsided as markets priced in eventual Fed easing. The September rate cut confirmed the shift, compressing risk premiums and supporting multiples. Leadership stayed concentrated in AI-linked and large-cap growth names, with defensives and energy providing balance.

In the United States, the S&P 500 returned 7.8% (USD). Information technology (+13.0%) and communication services (+11.8%) led gains, with consumer discretionary (+9.4%) also contributing. Defensives offered ballast, as utilities rose 6.8% and health care 3.3%. Crowding remained a concern: the top 10 companies now represent nearly 40% of the index and trade at ~29.9x forward earnings versus 19.5x for the rest. With the S&P 500 at ~22.8x forward earnings—about 34% above its 30-year average—the market remains vulnerable to policy missteps or inflation surprises.

Canadian equities posted a strong quarter, with the S&P/TSX Composite gaining 11.8% (CAD). Materials were the standout, rising 37.4% as gold surged 16.2% to over US$3,800/oz, lifting the S&P/TSX Global Gold Index by 45.2%. Financials advanced 9.7%, energy rose 11.4%, while technology (+13.2%) also contributed. The TSX story was cyclical beta amplified by gold leverage.

International developed markets posted mixed results. The MSCI EAFE Index gained 6.9% (CAD). Japan gained 9.6% (JPY), supported by governance reforms and a weaker yen. Valuations in Europe and Japan remain more compelling than in the U.S., but country-specific risks are increasingly shaping performance.

Emerging markets outpaced developed peers, with the MSCI EM Index up 12.8% (CAD). China and Hong Kong extended gains on policy support and AI optimism, though the rally appeared liquidity-driven with economic activity continuing to contract. India’s equity market delivered –7.3% on the quarter, as foreign investors turned sellers amid tariff concerns and high multiples.

Q3 underscored both resilience and fragility: easier policy and liquidity supported gains, yet stretched valuations, narrow leadership, and crowding left markets highly sensitive to shocks. With volatility compressed to multi-year lows, complacency has grown, leaving indices vulnerable to abrupt reversals. Policy expectations have become central, but dependence on easier policy raises vulnerability if growth re-accelerates or fiscal risks escalate.

Fixed Income

Global fixed income markets advanced in Q3 as central banks shifted into easing mode. Softer U.S. data and cooling inflation gave the Federal Reserve scope for its first rate cut, while the Bank of Canada followed with additional reductions. Yields declined, curves steepened, and spreads compressed, producing decent returns across sovereign and corporate markets.

In the U.S., the Federal Reserve cut its target range by 25 bps in September to 4.00–4.25%. The decision followed weaker payrolls, higher unemployment, and a sharper drop in August inflation. Treasury yields declined sharply, with the 2-year falling 89 bps to 4.13% and the 10-year lower by 44 bps to 4.05%. The Bloomberg U.S. Aggregate Bond Index returned 2.55% (USD). Credit spreads narrowed, with corporates tightening from 0.91% to 0.76% and high yield from 3.25% to 2.80%. Investment grade produced returns of about 3%, while high yield gained 2%.

Canada followed a similar trajectory. The Bank of Canada cut rates twice by 25 bps each to 2.25%. The 10-year yield declined from 3.28% to 3.19%, while the 2-year fell from 3.41% to 2.87%. The FTSE Canada Universe Bond Index gained 1.5%, with long bonds leading. Corporates outperformed governments, returning 4.1%, aided by spread compression.

In Europe, yields diverged as fiscal and political concerns re-emerged. French and German curves steepened, with investors demanding higher risk premia. In France, the government’s collapse in September amplified concerns over fiscal sustainability, pushing the 30-year OAT yield to multi-year highs. In the U.K., the 30-year gilt yield climbed above 4.70%, the highest since the late 1990s.

Broad flows into fixed income remained robust, with bond funds attracting heavy inflows. Despite record U.S. supply, spreads held firm, underscoring strong technical demand. Globally, spreads compressed across most sectors, though valuations now appear rich. Overall, Q3 was characterized by rate cuts, falling yields, and tighter credit spreads. Looking forward, central banks remain focused on balancing disinflation with labor-market weakness. Fiscal slippage and inflation trends remain risks, but policy support continues to underpin the outlook for global bond markets.

Looking Forward

As Q4 begins, markets are navigating a delicate balance between policy support and underlying fragility. The Fed’s September rate cut marked the start of an easing cycle, and the Bank of Canada has followed. Yet the path ahead is complicated: labour markets are softening, trade frictions remain unresolved, and fiscal deficits are widening. While headline inflation has drifted closer to 2%, tariffs and sticky services prices keep risks two-sided.

Equities enter the quarter with strong momentum but uneven foundations. AI-linked mega-caps and defensives continue to dominate U.S. returns, leaving indices concentrated and valuations stretched. Europe and Japan offer more compelling entry points, though politics in France remain a headwind. Emerging markets are mixed: China’s recovery is fragile, supported more by liquidity than durable demand, while India faces tariff-related challenges and high valuations. Overall, breadth remains narrow, and the potential for abrupt reversals is high.

Fixed income has enjoyed strong performance due to falling yields and tighter spreads. With central banks now pivoting, the income profile of government and investment-grade bonds looks more attractive. Still, fiscal slippage and heavy issuance temper the case for extending duration. Credit valuations are also increasingly tight.

Risks into year-end remain multidimensional. Trade tensions could re-ignite inflation pressure just as central banks ease. Fiscal strain raises the risk of higher long-end yields. Geopolitical uncertainty continues to hang over commodities and risk sentiment. At the same time, complacency has crept into markets: volatility is at multi-year lows, and confidence in policy support is high.

In this environment, portfolio strategy should emphasize quality, diversification, and liquidity. A modest equity overweight remains reasonable, but it should be balanced with exposure to regions where valuations offer a wider margin of safety. Fixed income has regained its role as a stabilizer, concentrated at the shorter end of the curve. Real assets such as gold continue to provide ballast against fiscal and geopolitical risks. Above all, discipline matters: the path forward still favours risk assets, but diversified, flexible, and liquid positioning will determine resilience if the cycle takes a sharper turn.