Economic Overview

Despite solid headline GDP growth in Q2, the global economy showed mounting strain. Momentum slowed across key sectors, inflation risks lingered, and geopolitical and trade tensions escalated. Manufacturing and trade volumes contracted under rising tariffs, while consumer demand showed mixed signals – resilient in some areas but pressured by high prices. Central banks faced growing constraints, caught between slowing growth and renewed inflation – pressures intensified after Israeli strikes on Iranian nuclear and military sites in mid-June, which jolted commodity markets.

The U.S. showed headline growth, but underlying indicators weakened. The Federal Reserve cut its 2025 GDP forecast from 1.7% to 1.4%, citing softer consumer activity and slower investment. Real consumer spending declined 0.3% in April as retail sales and auto demand fell – reversing earlier gains tied to inventory front-loading. The labor market remains tight but rising jobless claims suggest cooling demand. The ISM Services Index edged up to 50.8, barely signaling expansion, while manufacturing remained in contraction at 49.0. Core PCE inflation is projected at 3.1% – above target – driven by tariff pass-through and energy costs. In June, the Fed held rates steady at 4.25%–4.50% and signaled just one rate cut before year-end, balancing inflation control with growth concerns.

Canada’s economic momentum continued to fade in Q2. The Bank of Canada expects GDP growth below 1% for 2025, citing weak manufacturing sales, soft investment, and housing weakness. May’s trade deficit remained wide at $5.9 billion. While exports rose, the gain was due to one-off gold shipments to the UK; excluding these, exports fell 1.2%. Volumes dropped 9.1% in April as pre-tariff shipments to the U.S. faded. Inflation is resurfacing as CPI rose to 1.7% in May and is expected to climb further. The Bank of Canada held its rate at 2.75% in June, citing risks on both inflation and growth fronts.

The Eurozone showed tentative stabilization. The composite PMI rose to 50.5, signaling modest expansion, though Germany and France continued to struggle. Headline inflation increased to 2.6%, with services inflation near 4%, fueled by wage growth and energy costs. The ECB cut its deposit rate to 2.00% in June but signaled a pause on further easing. GDP growth remains weak, projected at 1.0% for 2025.

China posted 1.1% quarterly and 4.8% annual GDP growth in Q2, but underlying data remains soft. The Caixin Manufacturing PMI dropped to 48.3 in May – its lowest since 2022 – and the official PMI remained below 50. Property investment fell 9.3% year-over-year. Inflation remained subdued: CPI rose just 0.5% in May, and producer prices fell 2.7%, pointing to weak domestic demand and external pressures.

Geopolitical tensions spiked after Israeli strikes on Iran, sparking fears of broader conflict. Oil prices jumped and gold neared record highs amid safe-haven demand. Yet U.S. Treasuries and the dollar barely reacted, raising questions about the role of traditional hedges in a shifting macro landscape. This may reflect confidence in containment—or investor uncertainty over risk protection.

Equity Markets

Global equities rebounded in Q2 after a volatile start. Markets sold off early in the quarter on renewed trade tensions and slowing U.S. growth. In April, the Trump administration introduced sweeping “Liberation Day” tariffs—a 10% baseline levy on nearly all imports. Recession fears pushed the S&P 500 down nearly 20% from its February high. The NASDAQ fell about 25%, weighed by pressure on mega-cap tech stocks.

Markets recovered after a 90-day suspension of the tariffs and the resumption of U.S.-China trade talks. Sentiment improved in May and June, helped by strong Q1 earnings and supportive EU fiscal moves. Equities rotated back into large-cap growth names – particularly in tech and AI – while value, cyclicals, and small caps lagged amid continued macro uncertainty.

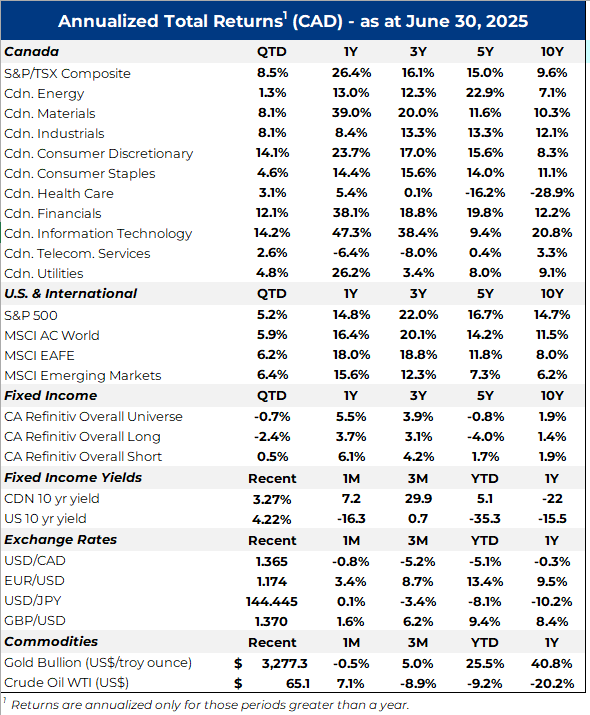

The S&P 500 ended the quarter up 10.6% (USD), led by information technology (+23.5%) and communication services (+18.2%). Industrials (+12.6%), financials (+5.1%), and gold miners (+20.7%) also saw renewed interest. Q1 earnings added momentum: 78% of S&P 500 companies beat estimates, and 9 of 11 sectors exceeded expectations.

Canadian equities also rallied. The S&P/TSX Composite rose 8.5% (CAD), supported by attractive valuations and global capital flows. Financials gained 12.1% on strong earnings from loan growth and healthy margins. Technology rose 14.2%, and materials and industrials each gained 8.1%, reflecting interest in cyclicals. Energy underperformed, up 1.3%, after a surprise production increase from OPEC+. The group cited “healthy market fundamentals,” but the move added to bearish sentiment. The Israel–Iran conflict introduced volatility, but with Iran’s infrastructure intact, rising supply weighed more on energy markets.

International equities advanced, helped by a softer U.S. dollar and improving trade sentiment. The MSCI EAFE Index gained 6.2% (CAD), lifted by strength in European industrials, real estate, and financials. Japanese markets also performed well, supported by improved corporate governance and increased shareholder returns.

Emerging markets outperformed developed markets modestly. The MSCI EM Index rose 6.4% (CAD), aided by dollar weakness and renewed trade optimism. Latin America and Southeast Asia attracted inflows on improving export prospects and easing political risk. India underperformed, rising 3.8% (CAD), as stretched valuations weighed on sentiment. Chinese equities declined –1.5% (CAD), held back by structural issues and inconsistent policy support.

Fixed Income

Q2 brought a recalibration for global fixed income as investors reacted to tariff shocks, persistent inflation, and shifting central bank messaging. Recession fears spiked in April after the U.S. unveiled 10% tariffs on all imports, prompting bond selloffs. Yields rose, credit spreads widened, and inflation expectations increased. Markets steadied in May after a 90-day tariff pause created space for talks.

Central banks turned more cautious and data-dependent. In June, the Fed held rates at 4.25–4.50% and projected one rate cut this year, down from earlier expectations of two or more. Chair Powell emphasized flexibility, noting persistent inflation in tariff-sensitive goods and energy, and rising geopolitical risks. Internal divisions within the FOMC became more visible, with some members pointing to softening labor markets and others stressing inflation risks.

The Bank of Canada also held rates at 2.75%, adopting a neutral tone after earlier dovish signals. Governor Macklem cited weak exports, wide trade deficits, and escalating U.S. actions as downside risks. Domestic demand remains soft, but the Bank warned that tariffs could lift headline inflation – warranting close data monitoring.

The ECB became the first major developed central bank to resume easing. Following a 25 bp cut in April, it lowered rates again in June to 2.00%. Policymakers noted ongoing disinflation in goods and wages but acknowledged sticky services inflation. Back-to-back cuts signaled a shift toward accommodation.

Fixed income performance reflected these shifts. In the U.S., short-term Treasuries gained 0.9% as investors sought safety. Long-duration Treasuries fell –2.0%, dragged down by inflation concerns and debt sustainability fears, worsened by Moody’s downgrade of the sovereign rating to Aa1.

Canadian bonds followed suit. The CA Refinitiv Overall Long Bond Index dropped –2.4%, while short bonds rose 0.5% as investors favored lower duration amid higher yields. Credit spreads held steady, supported by light issuance, healthy corporate earnings, and stable institutional demand.

Q2 highlighted how trade, inflation, and policy volatility continue to shape bond strategy. Bonds remain vital for diversification, but navigating this environment required active duration management, selective credit exposure, and cross-market awareness.

Looking Forward

As H2 begins, three forces continue to define the investment landscape: persistent trade frictions, geopolitical volatility, and the lagged effects of fiscal and monetary shifts.

In fixed income, investors face elevated policy rates, rising term premiums, and limited fiscal capacity. The newly passed U.S. budget reconciliation bill pushes the deficit to 7–8% of GDP over the next decade – despite higher tariff revenues – deepening debt concerns. While the Fed held steady in Q2, guidance remains fluid. Markets price in one to three cuts by year-end, depending on inflation and labor data. With core PCE still above 3%, risks run both ways. Most managers remain cautious, favoring shorter maturities and a balanced mix of government and corporate bonds, while watching for opportunities in steepening curves.

Equity leadership is starting to broaden. Mega-cap tech still leads – driven by AI and operating leverage – but industrials, financials, and select cyclicals are gaining ground on strong earnings, infrastructure demand, and tariff-driven domestic substitution. Q1 earnings brought upside surprises and stronger margins, contributing to a more balanced equity profile. Valuations remain elevated in some areas, but modest Q2 expectations could support further upside.

Globally, attractive relative valuations and coordinated Eurozone fiscal efforts are renewing investor interest, especially in value-oriented sectors. In China, industrial softness and deflation are headwinds, but long-term investment themes like automation and clean energy continue to attract capital. A weakening U.S. dollar and narrowing rate differentials are supporting flows into emerging markets, particularly where real yields are high and policy easing is underway.

Portfolio strategy in Q3 should balance defensiveness with selective offense. With risks – from fragile ceasefires to tariff uncertainty – likely to persist, liquidity is essential. The Israel–Iran ceasefire is holding for now, but risks to oil flows and inflation remain. The expiry of tariff suspensions and threat of retaliation add complexity to global supply chains. In this context, diversification across regions, sectors, and styles – especially value and quality – can enhance resilience. We continue to emphasize high-quality core holdings, supplemented by tactical exposure to undervalued global opportunities. While the rebound from April’s lows has been strong, unresolved risks demand careful, disciplined positioning.