Financial markets seem bound in a trading range, perhaps waiting to see how a number of near-term risks unfold. The increasingly strong U.S. dollar is causing further anxiety coincident with the market’s interpretation of an imminent December Fed rate hike. The U.S. economy appears to have reached full employment, while other developed world economies require further stimulus. While developed world equity markets have reacted calmly to increased geopolitical risks – tighter border controls and other security restrictions could further stall the Eurozone recovery.

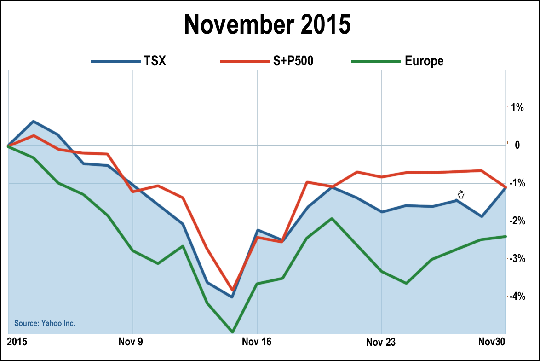

Despite the terrorist attacks in Paris punctuating the mid-point of the month, global equity markets proved resilient. U.S. stocks rose as market sentiment was supported with signs that the Fed would cautiously raise interest rates before Christmas – their meeting notes confirming that conditions for a rate rise may “well be met”. The Fed also specified that its path of policy normalization would be very gradual. Firming inflation data further supported a rate hike as core consumer prices increased to 1.9%, close to the Fed’s 2% target. Meanwhile, the labour market continued to stabilize, with initial claims for unemployment benefits in in mid-November falling to 271,000 from 276,000 in the previous week. European indices were surprisingly calm in the wake of the Paris terrorist attacks. Perhaps investors are confident that a coordinated international coalition will be sufficient to eliminate further ISIS threats. What’s more, investors have been encouraged by the ECB’s signaling of further measures to tackle that region’s deflationary problems. In a speech at the end of the week, ECB president Mario Draghi stated that ECB policymakers would “do what they must to raise inflation as quickly as possible”. Draghi’s speech was interpreted by investors as a harbinger for additional monetary stimulus measures at the ECB’s next board meeting. Over the last two weeks of the month, markets partially recovered their first-half losses: the U.S. and Europe both finished up 1.3%, Canada’s TSX was up 1%.

At the end of the month, Canada’s TSX slipped by 0.23% with the Health Care sector over contributing at 22%, buffering the drag from metals and mining (-18%). The S&P 500 was slightly positive at 0.3% while the EAFE indices declined 1.5%. North American bond indices initially dipped 1% in anticipation of a rate hike, only to recover as much on heightened geopolitical risks. The almost certain Fed rate hike caused Emerging Markets to sell off by 3.9% A 2% monthly loss to the loonie bolstered foreign equity returns to investors holding globally diversified portfolios, bringing the MCSI World Index up 1.4% in Canadian dollar terms.